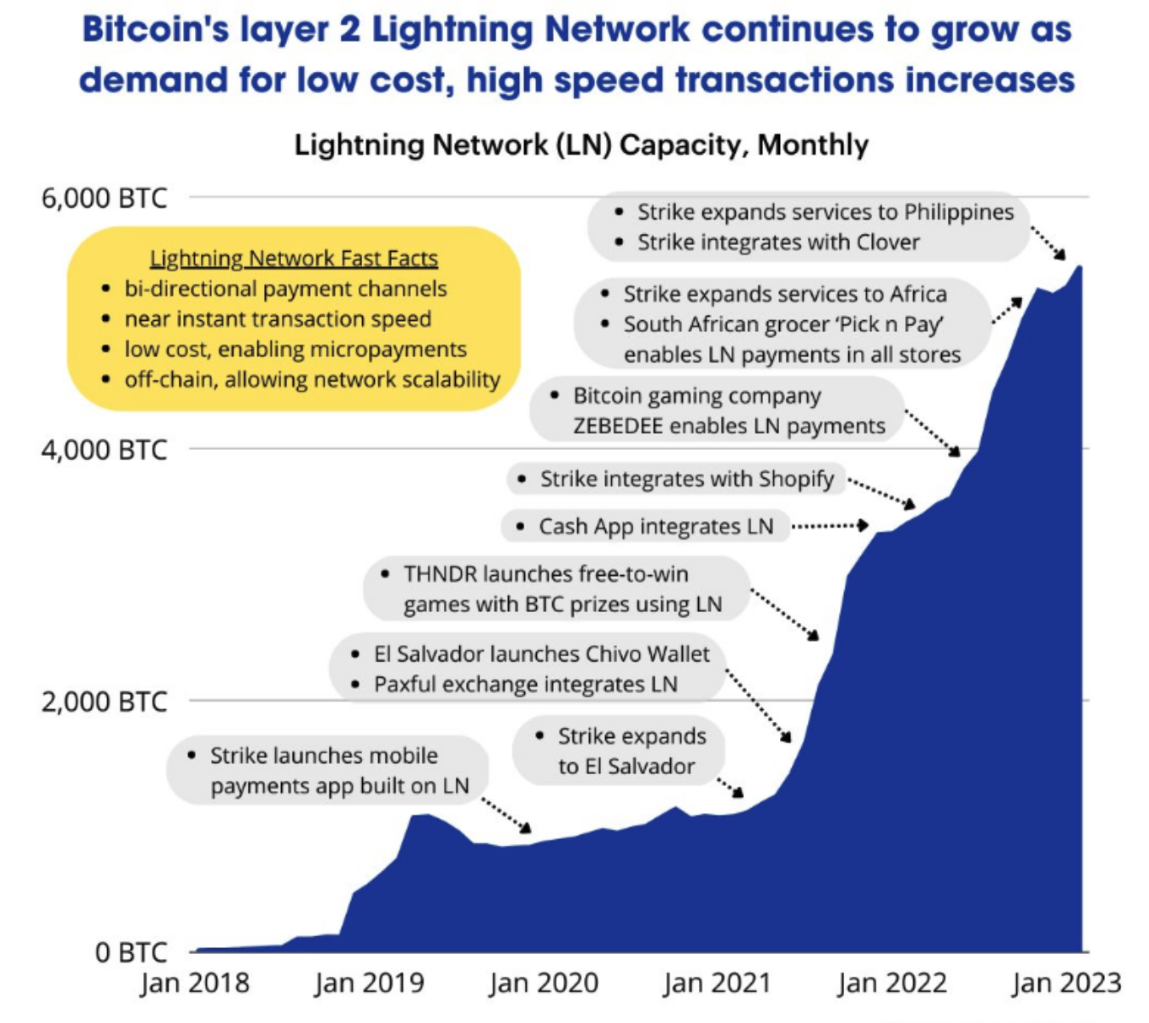

Bitcoin Lightning Network (LN) capacity recently surpassed an all-time high of 5,000 Bitcoin (BTC).

The Lightning Network is a neutral protocol built on top of Bitcoin, and currently does not have a “native” token attached to it like many decentralized finance (DeFi) platforms.

Although the total liquidity of the Lightning Network is less than 0.5% of Ether (ETH) in DeFi contracts, the upward trend in Bitcoin’s LN capacity versus a downward trend in the amount of ETH locked in DeFi contracts smart contracts is encouraging for the development of LN.

While liquidity on LN has been steadily increasing, the number of channels on the peer-to-peer network dropped sharply in November following the FTX crash. It could be due to an exodus of miners operating LN nodes in addition to running mining clients.

However, the likely end of miner capitulation and the rise of Bitcoin-based applications such as non-fungible tokens could mark the end of LN channel capitulation. Since the beginning of 2023, more than 2,000 new channels have been added to the network.

A report from Valkyrie Investments state that LN adoption is accelerating in emerging markets such as South America and Africa, primarily due to the efforts of LN Strike’s mobile payment app.

In December 2022, the company launched an LN-based remittance service in Africa. The service offers free transfers from the United States to Africans in Nigeria, Ghana and Kenya. Later, Strike announced a similar program in the Philippines.

Most recently, the firm announced dollar payments using LN, where users can potentially send dollars from Strike’s cash balance to savings and Visa-enabled accounts. The app will convert US dollars to BTC in the background and it will be converted to dollars on destination. Since LN is fast and cheap, the risk due to Bitcoin price volatility is minimal.

The cost of international payments from the US can be as high as $45 per transaction, with transfers taking hours or sometimes days. Therefore, users may start to prefer Strike-based payments over traditional remittance channels.

A recent report by Marty Bent found that LN payouts have increased this year on one of the top Lightning Network wallets, Wallet of Satoshi. Additionally, Podcasting 2.0, a podcasting platform that accepts LN payments, also saw an increase in tips sent to creators.

Related: Retail Giant Pick n Pay Will Accept Bitcoin In 1,628 Stores In South Africa

Nostr is driving the adoption of LN

Another factor influencing the adoption of LN is the release of Nostr. According to the protocol’s GitHub page, Nostr is a simple and open protocol that enables global, decentralized, and censorship-resistant social networks. The protocol allows social networking applications to be built on top of it.

Damus, a competitor to Twitter, is based on Nostr and has an app for iOS and Android. The idea of a free and open social media network resonates strongly in the crypto space, with Bitcoin pioneers like Jack Dorsey and Adam Back having strongly endorsed Nostr..

Apart from their ideological similarities, Nostr may boost LN adoption as Damus has integrated various LN wallets such as Wallet of Satoshi, Strike, BlueWallet and others. According to a report by LN analyst Kevin Rooke, more than 600,000 users have signed up for Nostr. This could help users onboard LN as Nostr supports the Bitcoin payment network via Nostr Zap.

While LN does not have a native token, there is a chance that LN nodes will earn fees for facilitating transactions and providing liquidity. However, in its current state, the gains are negligible. Thus, the growth of the Lightning Network appears to be organic and it is well positioned to become the leading global payment network, as prominent personalities in the space have done. foretold.

The views, thoughts and opinions expressed here are those of the authors alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should do their own research when making a decision.

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

NEWSLETTER

NEWSLETTER