Bitcoin (BTC) rallied back above $24,000 at the Wall Street open on Feb. 17 as analysis favored “consolidation and continuation” to the upside.

Bitcoin faces a key level to “break” the downtrend

Data from Cointelegraph Markets Pro and TradingView showed that BTC/USD recouped some losses overnight after falling to $23,369 on Bitstamp.

The pair had hit fresh six-month highs the day before, these were facing stiff resistance in the form of two weekly moving averages (MAs) and a strong wall of sell.

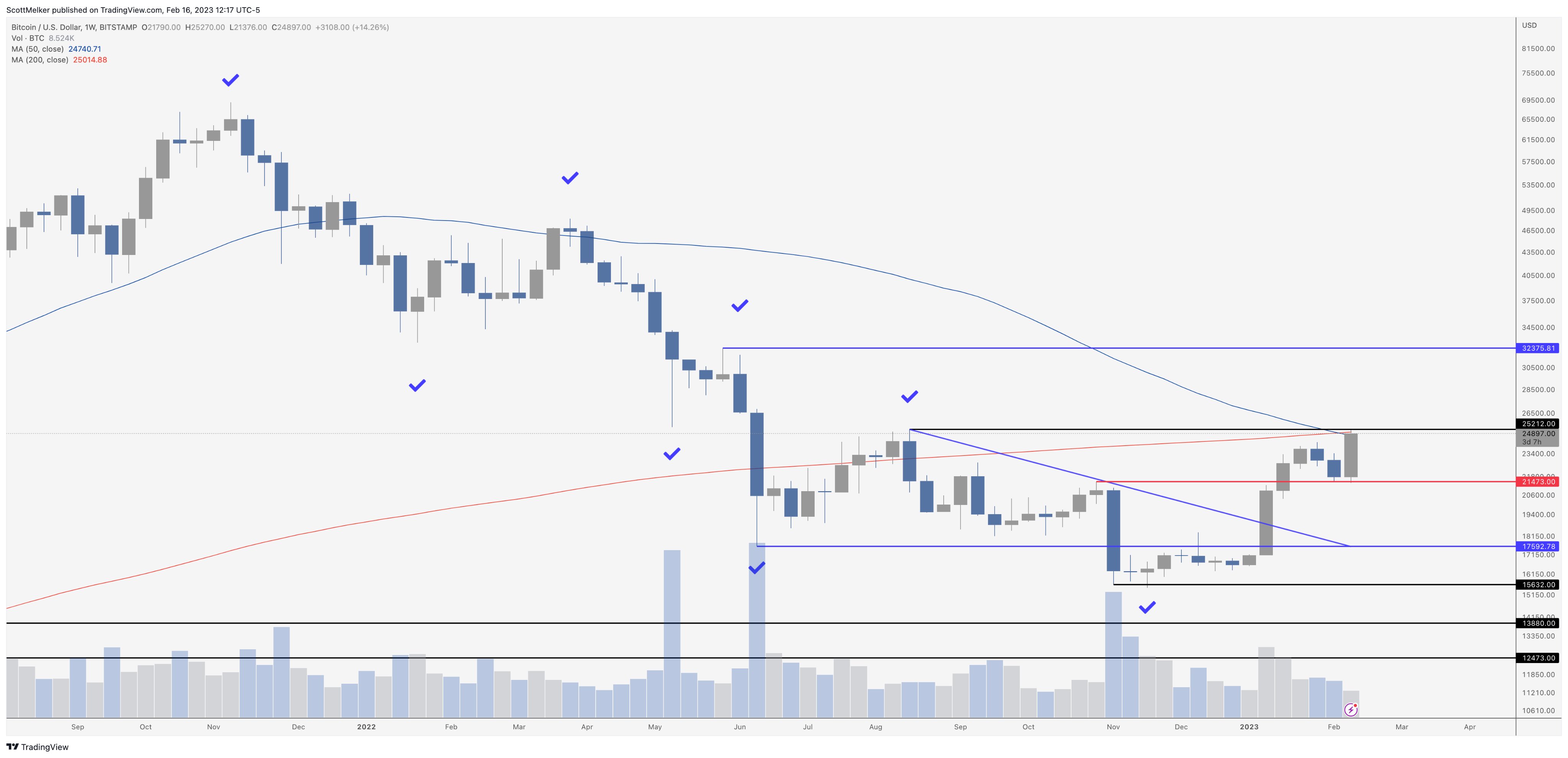

Scott Melker, the trader and podcast host known as “The Wolf of All Streets,” stressed the importance of levels acting as lines in the sand for bulls.

“$25,212. I’ve been screaming about this number for weeks. A break above (ideally close) makes a first-time higher high since $69,000,” she said. tweeted on the weekly chart for February 16.

“That breaks the downtrend. He just hit, right down to the penny…and fell on short notice. Time to pay attention!”

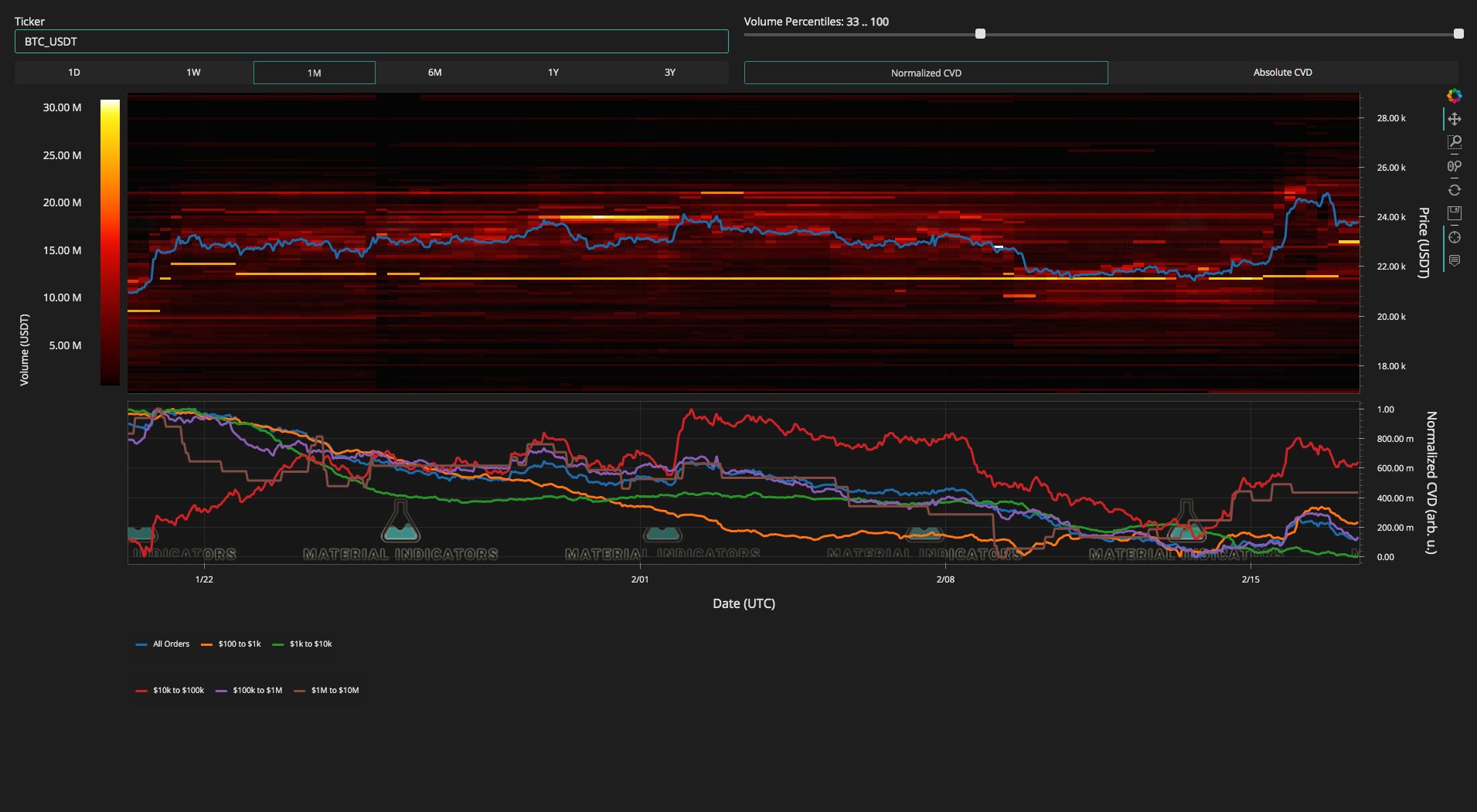

Investigating activity on exchanges, tracking material indicators of resources identified supply support gradually rising, taking the spot price with it.

“The notorious BTC buy wall that we have been tracking for 5 weeks just moved strategically again, this time just above the 21-day moving average.” noted next to a graph.

“This entity seems to be playing the Técnicos level by level.”

Binance’s BTC/USD order book attachment also showed resistance rising to $25,600, well above the site of the 200-week moving average, which turned from support to resistance last August.

Trader: crucial support at $22,800

Cointelegraph contributor Michaël van de Poppe was optimistic about the prospects, meanwhile, vocation for “consolidation and continuation”.

Related: Bitcoin Metric Prints ‘Mother Of All BTC Bullish Signs’ For 4th Time Ever

“Bitcoin sees a sweep from the top and turns down a bit there, but that doesn’t mean we’re going to $12K,” he reasoned in a tweet of the day.

A table marked $22,800 as the key area for bulls to hold in case BTC/USD opts to print a higher low (HL) next.

The day before, van de Poppe argument that the period from March to June should be a “holiday” in all crypto markets.

“It’s hard to define a proper strategy when everyone around you is screaming otherwise. That’s what’s going on at those relief rallies,” she said. continued on the current state of crypto sentiment.

“People are stuck in the mindset of the last 18 months and can only expect more crashes. So they keep shortening.”

However, it was long traders who felt most of the pain on Feb. 16, as Bitcoin’s trip lower liquidated $45 million worth of positions, Coinglass data shows. Cross crypto long liquidations almost reached $125 million.

The views, thoughts and opinions expressed here are those of the authors alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

NEWSLETTER

NEWSLETTER