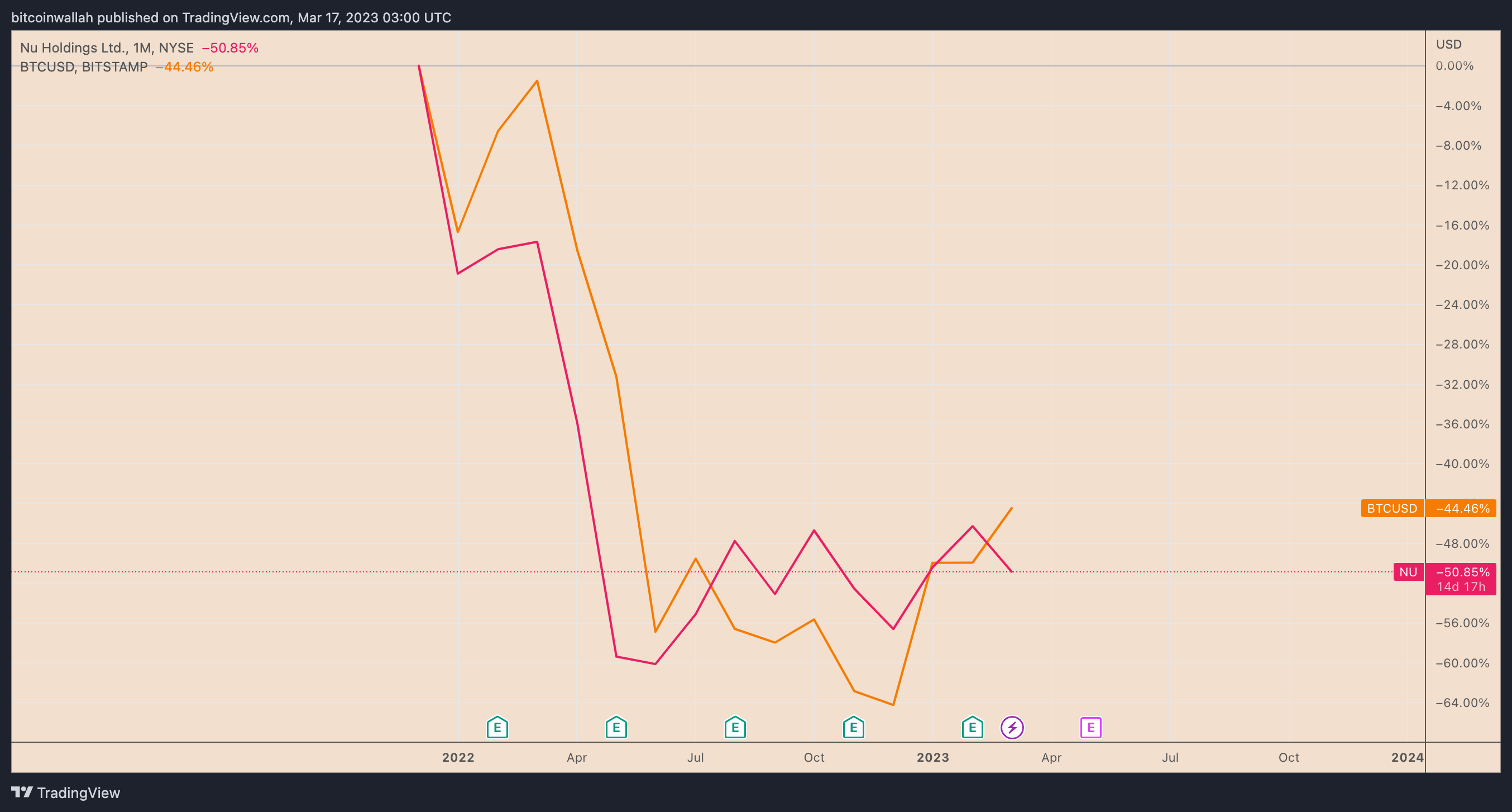

In 2023, Bitcoin (BTC) and Cathie Wood’s investment in Coinbase (COIN) are finally overtaking Warren Buffett’s popular “crypto bet” on Brazilian fintech giant Nubank (NU).

Bitcoin vs. NU, COIN crypto exposure shares

As of March 17, the price of Bitcoin is up almost 55% year to date (YTD). By comparison, Nubank is up just 26%. Meanwhile, another crypto exposure asset, namely Coinbase (COIN) stock, has seen the biggest rally of the three, surpassing 100% YTD.

However, Buffett’s investment has fared better than COIN in the last 12 months.

As of March 17, NU is down 38% year-over-year compared to 61.76% for COIN, almost equal to Bitcoin’s 37% losses over the same period.

Warren Buffett stays true to his investment in neobanks

Buffett’s investment firm Berkshire Hathaway bought $1.5 billion worth of Nubank Class A shares in two separate rounds in July 2021 and February 2022.

The news came as a surprise to many, as Buffett is a well-known critic of cryptocurrencies and Nubank offers cryptocurrency trading services through one of its wings called Nucrypto. In May 2022, the bank said it would allocate 1% of its net assets to Bitcoin.

“This move reinforces the company’s conviction about the current and future potential of Bitcoin to disrupt financial services in the region,” Nubank said at the time.

But despite Nubank’s crypto exposure and NU’s price plunge, Buffett has not sold a single share, according to the latest Berkshire report. annual earnings report.

The decision to hold NU in a difficult market is likely to coincide with Nubank’s growth in the Latin American banking sector.

Nu Holdings, the parent company of Nubank, reported a strong 2022 with 140% year-over-year revenue growth and a 38% year-over-year increase in active customers.

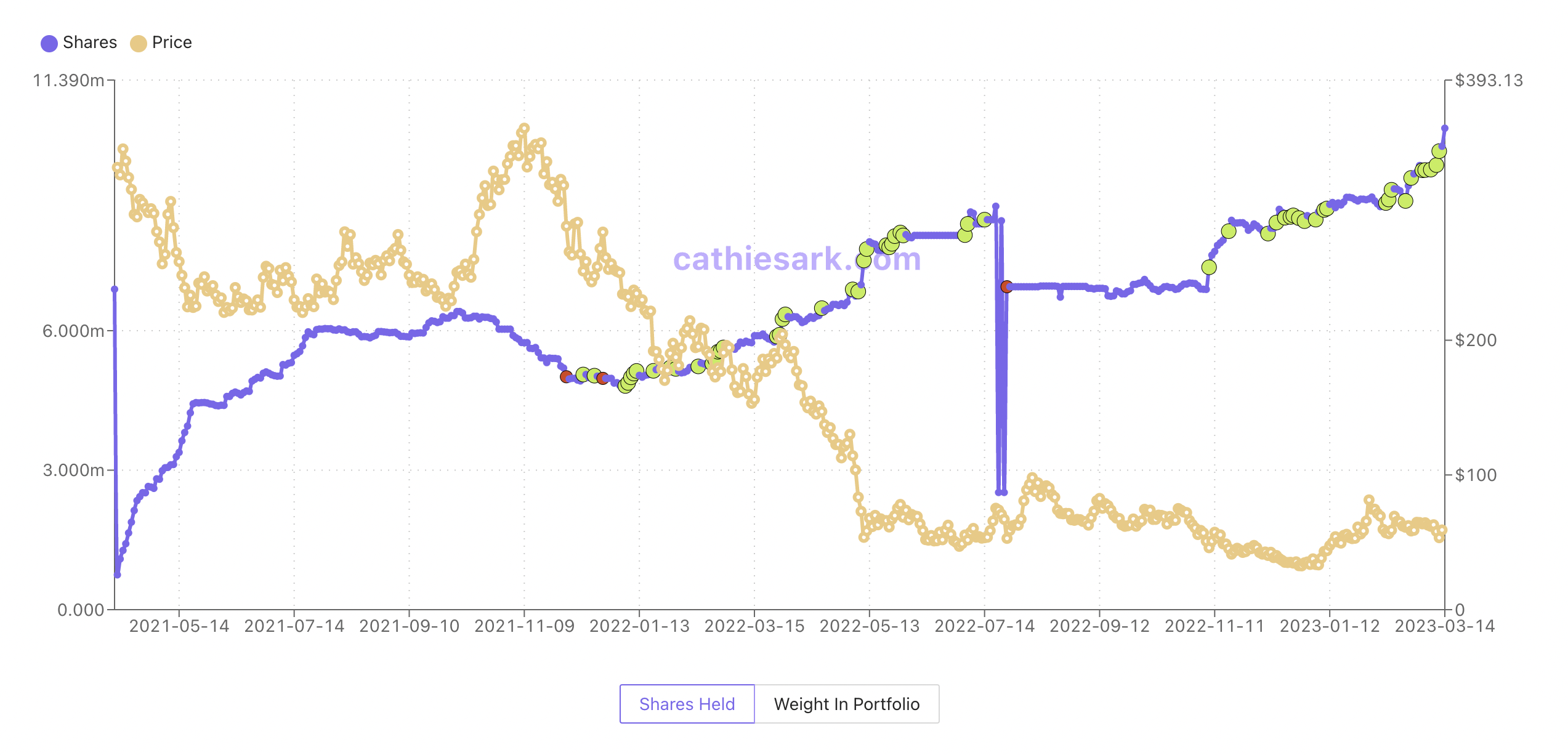

Cathie Wood doubles down on COIN in 2023

The same cannot be said for Coinbase’s earnings in 2022 with a 57% drop in revenue year-over-year.

Related: Crypto Acted As Safe Haven Amid SVB And Signature Bank Run – Cathie Wood

But ARK Invest CEO Cathie Wood seems unfazed by continuing to buy COIN shares through her ARK Next Generation Internet ETF (ARKW) and ARK Innovation ETF (ARKK) in 2023. COIN purchases, in particular , represent approximately 30% of all shares purchased so far this year.

As a result, Coinbase has become Wood’s fifth-largest holding on record with a value of nearly $670 million as of this writing.

Holding Bitcoin as a better strategy?

Comparing Bitcoin’s price performance to the market debut of Coinbase and Nu Holdings reaffirms that BTC not only regularly outperforms stocks, but also crypto exposure stocks. Although exceptions have been seen, such as with the boom in Bitcoin mining stocks in 2021.

But overall, holding Bitcoin is proving to be a better strategy year over year and probably with more upside potential than traditional stocks.

Notably, NU has fallen more than 50% since its market debut in December 2021. Since then, BTC has fared better with a 44% drop in the same period.

Similarly, COIN is down 80% since its initial public offering in April 2021. However, the same downward cycle has seen Bitcoin lose only around 50%, emerging as an overall better performer against Bitcoin stocks. cryptoexposure like Coinbase and Nu Holdings.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should do their own research when making a decision.