bitcoin is approaching $50,000 mark after a week of extreme bullish price actiona level not seen since December 2021. Amid this price surge, the number of bitcoin addresses in profit has exceeded 90%.

According to data from IntoTheBlock, 91% of bitcoin addresses are currently profitable. This means that the vast majority of holders and investors have an incentive to continue holding, especially as the next halving for bitcoin miners approaches.

91% of bitcoin addresses now profit as price nears $50,000

bitcoin has had an eventful week in terms of price action. The world's largest cryptocurrency recently rose 14.4% to reach $48,500 on February 11, its highest point in 26 months. This price increase, while very welcome, seemed to have taken most investors by surprise, considering they were coming off four weeks of unimpressive action following the debut of spot bitcoin ETFs in the US.

Notably, btc/deep-dive?group=financials&chart=inAndOut” target=”_blank” rel=”nofollow”>In the block The “Global In/Out of the Money” profitability metric shows that the total number of profitable addresses is now 46.87 million addresses, which represents 90.53% of the total addresses. At the same time, 3.44 million addresses, representing 6.64%, continue to record losses, while 1.46 million addresses, representing 2.83% of the total addresses, are at the point of balance or money.

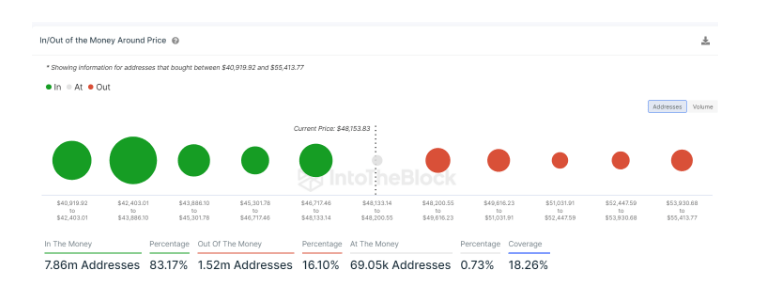

Similarly, IntoTheBlock's “In/Out of the Money Around Price” metric, which tracks addresses that bought between $40,919.92 and $55,413.77, shows that the majority (83.17%) of addresses are in profit. This is a hugely bullish sign and shows that most bitcoin holders have money. As the price continues to rise as the crypto approaches the $50,000 mark, more and more addresses are likely to take profits.

bitcoin ready to continue shining

With over 90% of bitcoin addresses now in profit and the price approaching $50,000, it is clear that this bull run still has room to continue. Last week's bullish action saw btc close above $44,000 in the weekly period for the first time in the current market cycle.

BTCUSD currently trading at $48,354 on the daily chart: TradingView.com

BitMEX Research recently reported That bitcoin spot ETF now has over $10 billion in btc under management. There is a high probability that the price of the primary coin will continue to rise if the activity surrounding these exchange-traded funds (ETFs) continues at this pace.

bitcoin ETF Flow – February 9

All data out. Good day with 541.5 million dollars of net income

Invesco had an exit, the first non-GBTC product to have an exit day pic.twitter.com/UCFDVAaKD3

— BitMEX Research (@BitMEXResearch) February 10, 2024

Another catalyst for a sustained price increase is the upcoming halving. Historically, bitcoin bull runs leading up to each halving have always trended bullish and have gone parabolic after the halving event. A similar trend could see the crypto asset reach $60,000 before the next halving in April and $100,000 before the end of the year.

Featured image from Adobe Stock, TradingView chart

Disclaimer: The article is provided for educational purposes only. It does not represent NewsBTC's views on whether to buy, sell or hold investments, and investing naturally carries risks. It is recommended that you conduct your own research before making any investment decisions. Use the information provided on this website at your own risk.