After rising 5% in the last day, bitcoin (btc) is now quickly approaching the coveted $60,000 mark. This is because investor interest in the world's largest cryptocurrency has reached levels last seen during the 2021 boom, bringing it very close to its all-time high.

Pre-halving rally? bitcoin approaches $60,000

The price increase coincided with a surge in demand, as spot bitcoin exchange-traded funds (ETFs) reached cumulative trading volumes of more than $3 billion on Tuesday. Additionally, other traders cited bitcoin's early April halving as the source of a new narrative spurring a pre-halving rally.

The market capitalization of the world's most sought-after digital asset has now reached $1.2 trillion, Coingecko data shows.

bitcoin fast approaching the $60K level. Source: Coingecko

Joel Kruger, market strategist at LMAX Group, said the market is “much more determined to see the level retested and broken” now that bitcoin is much closer to retesting its all-time high.

Due primarily to the euphoria surrounding a number of spot bitcoin exchange-traded funds that began trading in January, bitcoin has risen as much as 16% this week and 35% so far this year.

bitcoin market cap currently at $1.16 trillion. Chart: TradingView.com

bitcoin hit its highest level since November 2021, when it surpassed $59,000. The goal of the current rally is to see if the price can rise to $68,790, its all-time high. Six months before a stunning drop in 2022, that peak occurred.

According Currency dataFutures bets on lower bitcoin prices have generated $25 million in liquidations since the Asian morning hours, which could have contributed to the price surge.

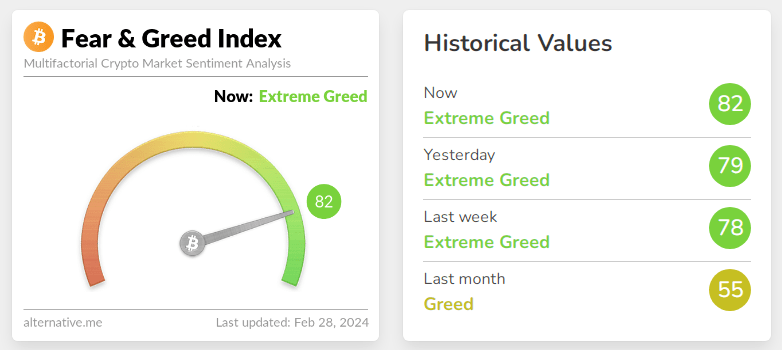

'Extreme greed' for btc

Meanwhile, on Wednesday, the fear and greed index, a sentiment indicator that measures how quickly asset movement deviates from underlying fundamentals, hit 82, indicating crypto/fear-and-greed-index/” rel=”nofollow”>“Extreme greed” and reaching its highest level in more than a year.

Source: crypto/fear-and-greed-index/" target="_blank" rel="nofollow">Alernative.me

A scale of 0 to 100 represents the most anxious and 100 is the most greedy on the index. According to the index's creators, a hungry environment is indicative of exuberance and shows that the market is due for a correction.

Since the ETFs began trading on January 11, bitcoin has risen 24%. The current upward trend in prices, according to Bitwise Asset Management analyst Ryan Rasmussen, is just the beginning.

“The demand that ETFs are generating for the bitcoin spot market is substantially greater than the daily production of new supply,” he said.

In the end, Rasmussen stated:

“What we are witnessing is a kind of cryptocurrency rising from the ashes of the 2022 market.”

The volume of bitcoin transactions carried out so far this quarter has exceeded the totals for each quarter of 2023 for the same period. Major cryptocurrency trading platforms like Coinbase Global (COIN) and Robinhood (HOOD) have benefited greatly from this activity. Between early January and now, those stocks have risen 27% and 31%, respectively.

Featured image from Pexels, chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent NewsBTC's views on whether to buy, sell or hold investments, and investing naturally carries risks. It is recommended that you conduct your own research before making any investment decisions. Use the information provided on this website at your own risk.