bitcoin (btc) danced into uncharted realms this week, breaking barriers with a triumphant surge that propelled its value past the $73,000 mark.

The cryptocurrency world is once again in the midst of an exciting price discovery phase, driven by a combination of bullish indicators and a notable shift in investor sentiment.

Related Reading: Cardano (ADA) Price Alert: Analyst Predicts 60% Rally in Next 7 Days

Big players dominate the crypto Arena

This week's narrative took place in a scenario dominated by two giants of the financial field:bitcoin-etf-gobbles-up-nearly-196000-btc/” rel=”nofollow”> BlackRock and MicroStrategy. BlackRock, the undisputed titan of asset management, sent shock waves through the market by filing with the SEC, outlining tentative plans to incorporate spot bitcoin ETFs into its Global Allocation Fund.

Although in its infancy, this move has raised hopes of increased demand, especially through BlackRock's IBIT ETF, which already holds a substantial 204,000 btc.

Enter MicroStrategy, the staunch evangelist of bitcoin strategies. This corporate giant added fuel to the already burning fire by revealing the acquisition of an additional 12,000 btc.

This move boosted MicroStrategy's total corporate bitcoin holdings to an impressive 205,000. Such moves by industry giants underscore the growing acceptance of bitcoin as a legitimate and influential asset class.

While the headlines may be dominated by institutional power moves, looking at the intricate web of on-chain data reveals the fascinating tapestry of investor conviction.

Source: IntoTheBlock

$520 million in bitcoin in transit

IntoTheBlock's exchange net flow metric showed a significant outflow of 4,470 btc on March 11. This major move, valued at more than $520 million, sent coins on a pilgrimage from exchange wallets to cold storage.

The implication is clear: investors, despite hitting record highs, are playing the long game, locking their digital treasures in cold storage rather than opting for immediate profits.

This strategic move, coupled with an increase in demand, paints a bullish picture of supply-demand dynamics.

Total crypto market cap at $2.6 trillion on the daily chart: TradingView.com

Drawing parallels to the pages of history, the recent exodus from the exchanges echoes a similar event that occurred on February 27.

That day, a net flow of 8,050 btc correlated with an impressive 26% increase in prices in 48 hours. If this historical rhyme persists, the recent exit could simply be the wind beneath bitcoin's wings, propelling it to conquer the $75,000 resistance level in the imminent days.

As the stage is set for bitcoin's next act, technical indicators join the ensemble, singing harmoniously in the chorus of a potential breakout.

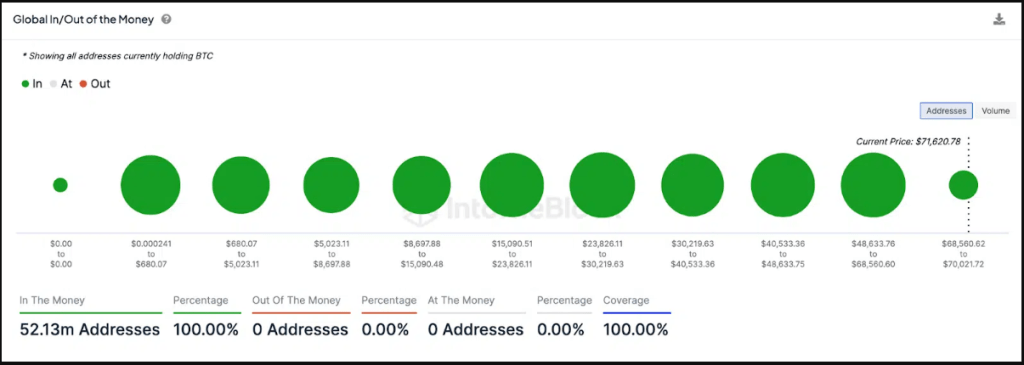

GIOM data. Source: btc/deep-dive?group=financials&chart=inAndOut" target="_blank" data-pswp-width="3200" data-pswp-height="1126" rel="nofollow">IntoTheBlock

Enjoying profits

IntoTheBlock’s “Global In/Out of the Money” chart provides a visual spectacle showing that in this era of bitcoin price discovery, almost all of the 52 million holder addresses are now enjoying profits. This absence of selling pressure, combined with the rising institutional tide, paints a picture of explosive potential.

While bulls eye the lofty target of $75,000, technical analysis points to a possible support station at $69,000.

This area, a fortress where more than 6.6 million holders acquired almost 3 million btc, could constitute a formidable psychological barricade against any price decline.

At the time of writing, bitcoin is rapidly approaching the coveted $74,000 level, trading at $73,529, up 2% and 10% on the daily and weekly time frames, Coingecko data shows.

Featured image from Unsplash, chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent NewsBTC's views on whether to buy, sell or hold investments, and investing naturally carries risks. It is recommended that you conduct your own research before making any investment decisions. Use the information provided on this website at your own risk.

NEWSLETTER

NEWSLETTER