The crypto market has evolved from the endless devastating bear market to a greener and more overwhelming market. Cryptocurrencies are moving from initial stagnation and a state of lower lows to a rally to the top.

Among the number of cryptocurrencies moving higher and making significant highs is Bitcoin, the largest cryptocurrency by market capitalization. So far, Bitcoin it has broken the multiple resistance and continued in an uptrend that carries the entire crypto market with it.

Bitcoin touches over $17,000 for the first time in a month

Since the FTX crash happened and the bear market deepened, we saw Bitcoin crash to lower lows and slip below the 17,000 zone. After it fell below that, Bitcoin stayed there for a long time. However, in the last few weeks since the start of the new year, the Bitcoin market has been making some positive moves.

After hovering around the $16,000 zone since late last year, Bitcoin touched and broke above $17,000 for the first time in nearly a month, trading at $17,500. Tuesday was when BTC made a significant movement of around 1.5%, the highest daily gain since December 20, 2022.

And since Bitcoin tapped into the $17,000 zone, the coin did not move or break out of that zone. However, it has lost a couple hundred dollars and is now trading at $17,409 as of this writing. Despite the pullback, its market cap is still above $335 billion, which is higher than the market cap seen in BTC late last year.

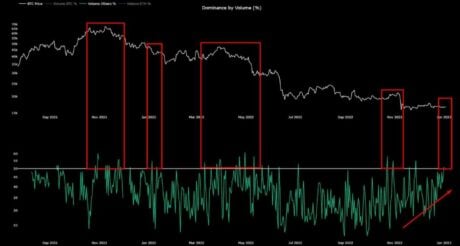

BTC begins to lose dominance

Although Bitcoin is still considered the big dog among cryptocurrencies, it is beginning to lose its dominance to altcoins in the crypto space, as whale investors have recorded a low share of the BTC market. According to on-chain analytics platform CryptoQuant, altcoin trade volume dominance is now above 50% compared to Bitcoin’s 39% dominance.

Maartunn, a CryptoQuant contributor, wrote in a blog post, “Usually when traders get bored with BTC, they start trading altcoins which are generally more on the risk curve. This makes them very brittle and easy to squeeze.” He added, “altcoin dominance is back over 50%. Please note: when altcoins continue to dominate, there is a potential risk of further downside,” he added.

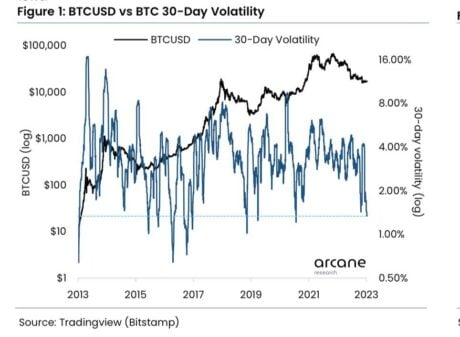

Furthermore, according to a recent report from Arcane Research, BTC’s 30-day volatility has plummeted to June 2020 levels, as the asset has been trading relatively flat with low volatility for the first 10 days of 2023, which makes it even more stable than gold. Dollar Strength Index, Nasdaq and S&P500 as measured via 5-day volatility.

Meanwhile, with altcoins gaining more dominance, big investors are now turning to assets other than BTC. Ethereum (ETH), Cardano (ADA), Polygon (MATIC) and Solana (SOL) have all made significant moves in the last 7 days, with three of them over 50% combined.

Featured Image from Unsplash, Chart from TradingView.com

NEWSLETTER

NEWSLETTER