Bitcoin (BTC) is seeing new highs in network activity as volatility sends BTC price action to new five-month highs.

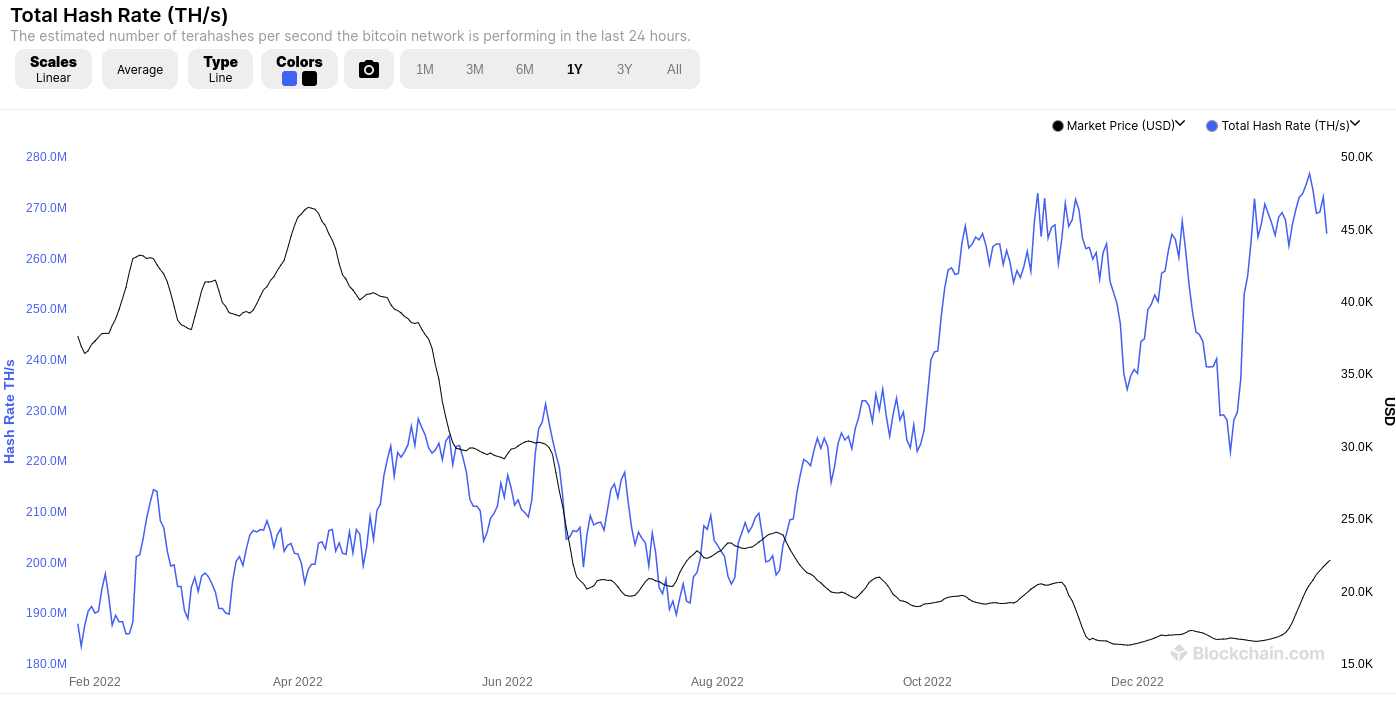

Resource data including MiningPoolStats confirms that the Bitcoin hash rate reached new all-time highs on January 26.

The hash rate exceeds the threshold of 300 EH/s

In another example of Bitcoin’s quick recovery from the pits of post-FTX problems, the hashing power of the network is now greater than ever.

The hash rate, which is an expression of the processing power dedicated to the network by miners, is currently at 321 exhashes per second (EH/s), according to raw data from MiningPoolStats.

Despite being only an estimate and impossible to measure with complete precision, the latest readings are quite a feat, having never crossed the 300 EH/s level before.

The Braiins mining company also confirmed the numbers in your live reporting stream.

other trackers BTC.com Y blockchain.com they have slightly lower estimates, both around 275 EH/s on the day. The latter shows that the hash rate reached an all-time high of 276.8 EH/s on January 20.

“Your wealth is more secure than ever!” popular commentator BTC Archive wrote in part from a Twitter response to the data, indicative of improving sentiment across the Bitcoin space.

The hash rate is a key component of Bitcoin security and significant reductions result in increased difficulty for the network to attract more miners to participate.

Network difficulty will also reach never-before-seen levels this week in a nod to the fierce competition in the mining sector.

According to data from BTC.com, the next automatic reset will send an estimated 2.75% difficulty higher to 38.62 trillion.

The previous reset generated a 10.26% rise, the biggest for Bitcoin since October 2022 and only the second double-digit rise since mid-2021.

Miners get a chance to balance the books

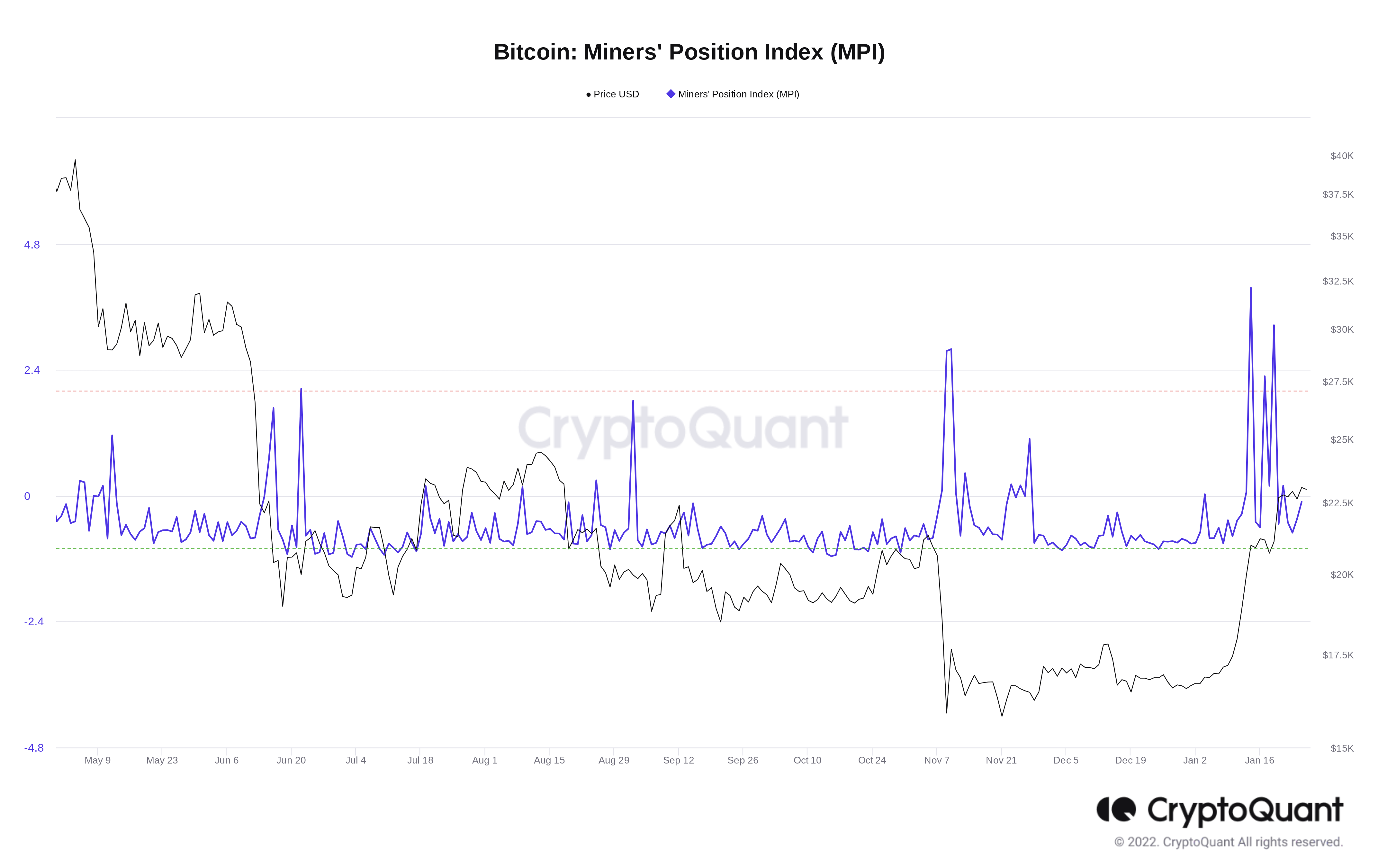

Analyzing the weather, CoinLupin, a contributor to on-chain data platform CryptoQuant, warned that miners are still selling off their BTC reserves, possibly to prop up capital in the event of a market reversal.

Related: Bitcoin Faces ‘Significant Danger’ From Fed In 2023 – Lyn Alden

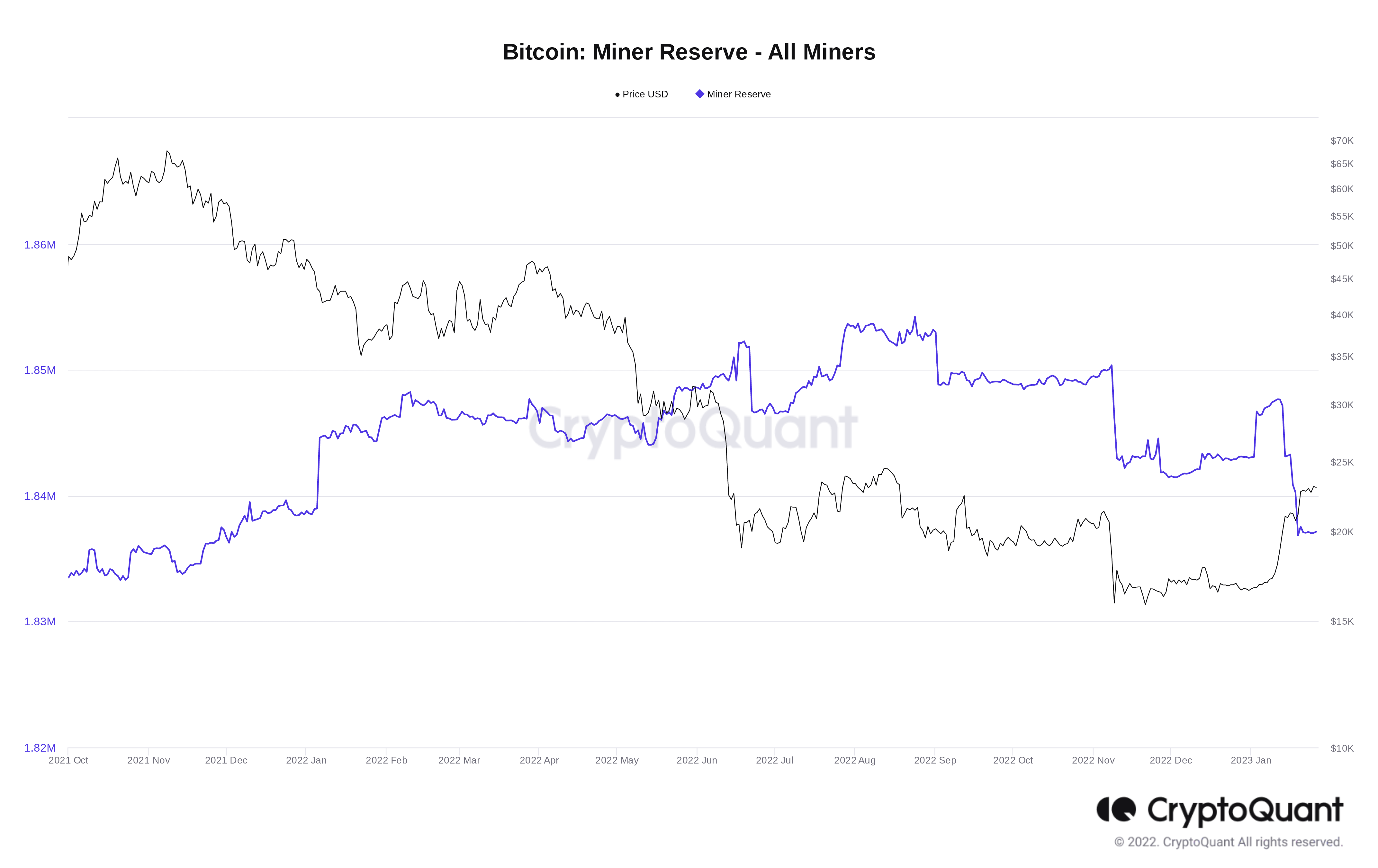

“Now they have improved profitability for the first time in a long time, and mining costs are lower than Bitcoin prices. Normally, more active mining and holding could happen, but now it seems they are looking at it as an opportunity to secure cash,” he said. wrote in a blog post, describing bookings as “declining at a rapid pace.”

“One day the price adjustment could happen in the section where they get enough cash and start collecting Bitcoin again. They constantly reduce their Bitcoin holdings during the surge.”

CryptoQuant’s miners’ position index, which measures BTC outflows to exchanges from miners’ wallets relative to their one-year moving average, has captured several withdrawal spikes since Jan. 14.

At 1,837,138 BTC, miners’ reserves are currently at their lowest level since December 2021.

The views, thoughts and opinions expressed here are those of the authors alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

NEWSLETTER

NEWSLETTER