bitcoin (btc) ordinals are boosting miners’ profits, but a “revenue strain is looming,” new research warns.

In the latest edition of its weekly newsletter, “The Week On-Chain,” analytics firm Glassnode foretold New problems for miners after next bitcoin block subsidy is halved.

bitcoin Halving’s Impact on Miners Could Be ‘Severe’

Competition from bitcoin miners is skyrocketing, with hash rate (the estimated combined processing power deployed on the blockchain) at record levels.

For Glassnode, this indicates unprecedented conditions for miners trying to eke out a living at current btc price levels.

bitcoin-ordinals-inscription-still-making-majority-btc-transactions”>Ordinal inscriptions are helping, acting as “packaging fill” that turns empty block space into a source of income for miners.

“Naturally, as demand for block space increases, miners’ income will be positively affected,” he wrote.

The proportion of income received from fees has increased by 1% to 4% compared to the lows seen during bitcoin bear markets, but by historical standards remains modest.

“Meanwhile, the amount of hashrate competing for these rewards has increased by 50% since February, as more miners and newer ASIC platforms are established and brought online,” notes “The Week On-Chain.”

This increase in hash rate is setting the stage for an upcoming showdown. In April 2024, miner rewards per block will fall by 50%, doubling the so-called “production cost” per btc. It is currently around $15,000, but will exceed $30,000, above the current spot price.

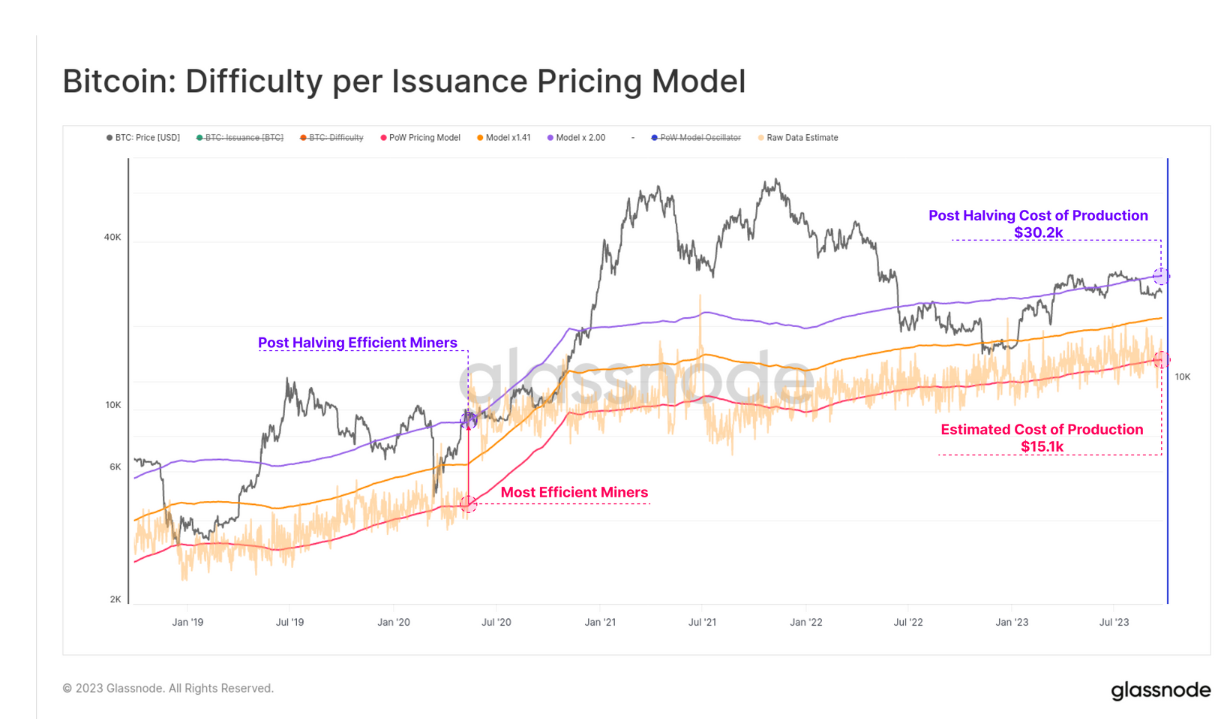

Glassnode presented two models to estimate the price at which miners, as a whole, fall into the red, with the previous one comparing the issuance with the difficulty of mining.

“According to this model, we estimate that the most efficient miners in the network have an acquisition price of around $15.1 thousand,” the researchers explained.

“However, the purple curve shows the post-halving ‘doubling’ of this level to $30.2k, which would likely put the majority of the mining market under severe income stress.”

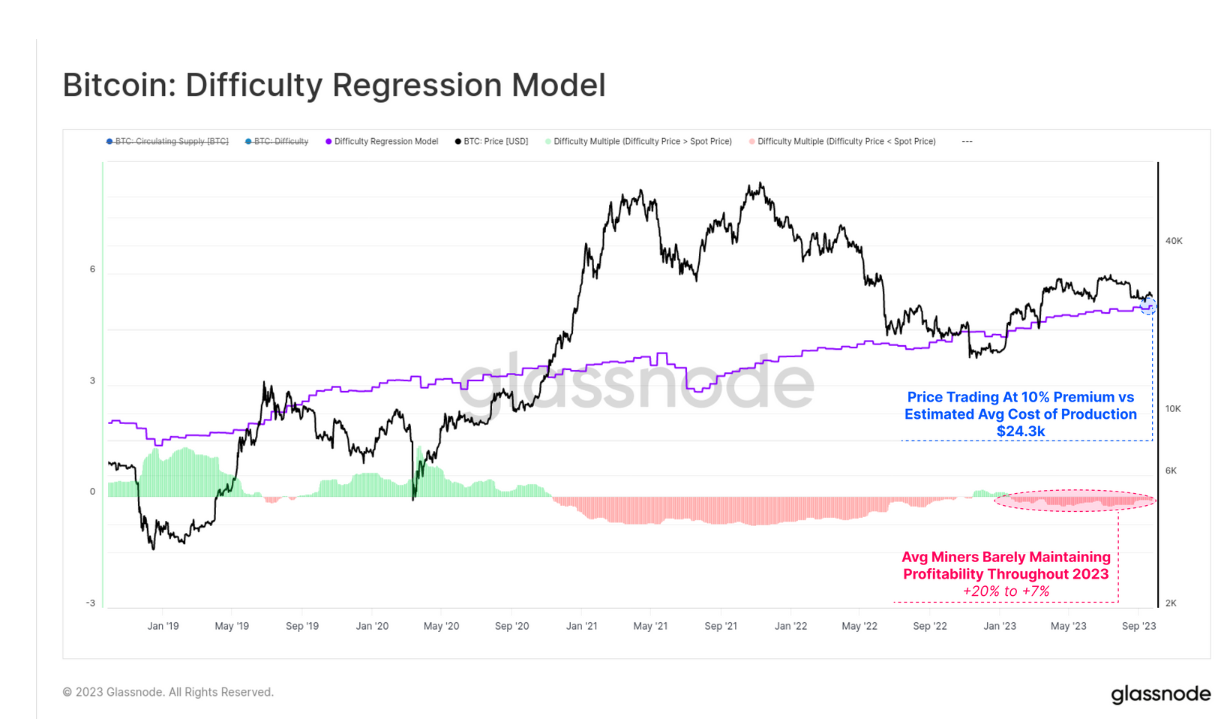

A previous model placed the average acquisition price of miners at $24,300 per bitcoin, around 8% below the price as of September 28.

btc price incentives

Others are more optimistic about how miners will handle the process until the halving.

Related: bitcoin Trading Volume Follows 5-Year Lows as Fed Inspires btc Manipulation

In an interview with Cointelegraph this month, analyst Filbfilb, co-founder of trading suite DecenTrader, reiterated that miners would increase btc accumulation ahead of the event.

“Miners are incentivized to ensure prices are well above marginal cost before halving,” he wrote in an X (formerly Twitter) thread in August.

“Whether they consciously collude or not, they are collectively incentivized to raise prices before their marginal revenues are effectively cut in half.”

Helping btc supply dynamics will be what Filbfilb calls smart money “buying the rumor” about the halving and its own impact on the amount of btc being minted.

This article does not contain investment advice or recommendations. Every investment and trading move involves risks, and readers should conduct their own research when making a decision.

NEWSLETTER

NEWSLETTER