With the year 2024 already underway, anticipation in crypto circles is reaching a fever pitch as everyone prepares for the bitcoin halving, an event that could reshape its market landscape. It deserves to be analyzed since historically this event caused transformative waves in the crypto scene. Knowing what we've learned from previous halvings, we're prepared to move forward with a watchful eye, making sure our moves are shaped by those insights. But is this upcoming halving any different? Let's figure it out.

From digital gold to rare platinum: the story of bitcoin's growing scarcity and value

bitcoin's design is all about making btc less and less available over time, keeping inflation in check. There is a set limit of 21 million Bitcoins that will ever exist, and we have already reached the 19.62 million mark. The scarcity of bitcoin, with its strictly limited release to the market, is one of the main reasons why people call it “digital gold”, as both assets have that “hard to get” quality.

If we think of the bitcoin blockchain as a ticking clock, we can see that the halving occurs every 210,000 blocks, or roughly every four years, and the reward for mining new blocks is cut in half. It has been this way since bitcoin's inception in 2009, starting with 50 btc per block and dropping to 3,125 btc in 2024.

The stock-to-flow ratio, which compares existing supply to new coins coming in, shows that bitcoin is about to become rarer than a platinum album. By 2032, after the 2024 and 2030 halvings, bitcoin's scarcity will skyrocket, making it even more of a gem than gold.

bitcoin's Post-Halving Growth Patterns

Let's take a walk down bitcoin memory lane. After each halving, the price of bitcoin has skyrocketed. After the 2012 halving, just 100 days later, the market cap skyrocketed 342%. Even more impressive, the peak price reached a staggering $1,152 the following year, a jump of 8,761%. Fast forward to 2016: rewards were cut in half, from 25 to 12.5 btc, and the price skyrocketed to $17,760 the following year, a 2,572% jump. In the most recent halving in 2020, the reward fell to 6.25 btc, and the bitcoin price did not disappoint, reaching $67,549 the following year, marking a solid 594% growth.

If we play armchair mathematician for a bit, we can see how bitcoin's growth rate decreased after the previous halvings (by 70.64% from the one-to-two halving and by 76.91% % two to three) and average those decreases to arrive at a growth rate. decrease of 73.78%. We then apply this to the 594.03% growth after the third halving and, voila, we get a speculative growth rate of 155.79% after the 2024 halving. This means bitcoin-price-prediction/”>bitcoin could potentially affect around $111,807 between a year and a year and a half after the next halving. But let's be clear: this is all mere speculation and definitely not something to base your investment decisions on.

Survival of the fittest in miners

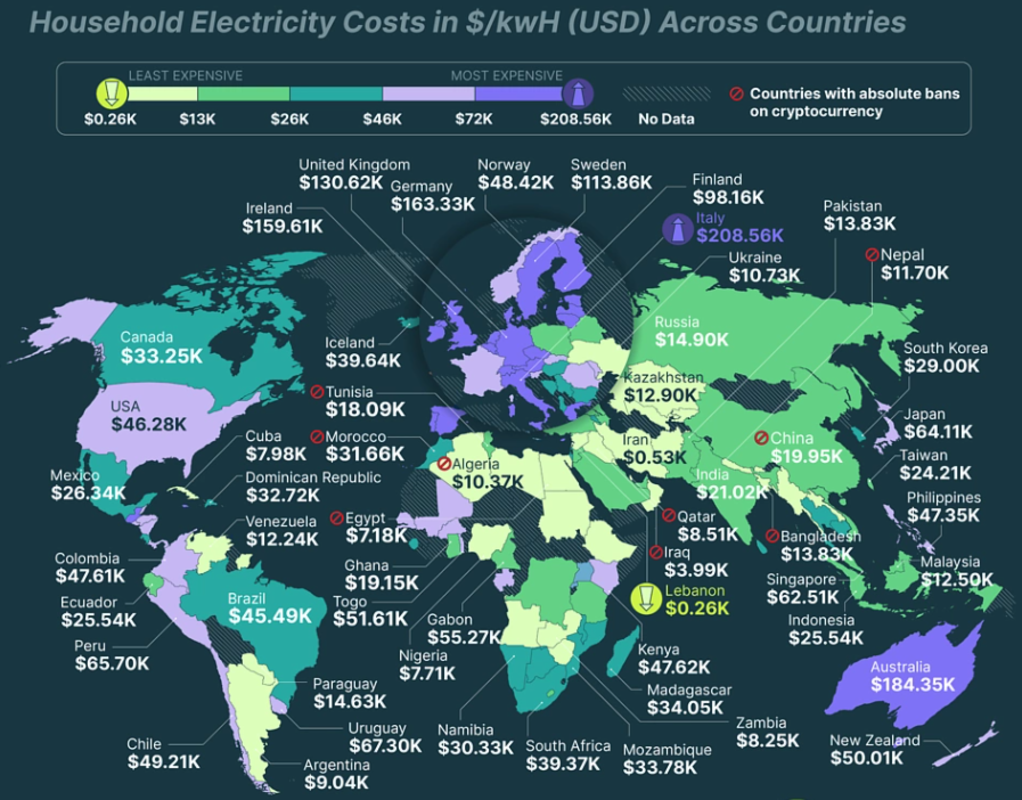

For bitcoin miners, the 2024 halving will be an uphill battle. With rewards halved, miners operating with outdated equipment and facing high electricity bills will be caught between a rock and a hard place. In Italy, for example, mining a single bitcoin can fetch as much as a luxury Lamborghini Huracán or a Porsche 911 Turbo S, with costs skyrocketing to $208,560.

The 2024 halving will transform the mining landscape into a scenario reminiscent of 'The Hunger Games', where only the strongest miners, armed with the most efficient technology and access to affordable energy, will survive. This halving will be like the ultimate scenario, a test of strategy and resilience, where only those equipped with smart and profitable tactics will emerge victorious in the competitive battlefield.

Final thoughts

Therefore, the bitcoin halving in 2024 is about to seriously change things, with major changes to mining operations and a possible big swing in bitcoin price. The upcoming halving event combines compelling economic theories with cutting-edge technological advancements, all wrapped in that unmistakable crypto appeal. Whether you're mining, gaming, or just watching from the sidelines, grab your popcorn – this will go down in the books!

This is a guest post by María Carola. The opinions expressed are entirely their own and do not necessarily reflect those of btc Inc or bitcoin Magazine.