Bitcoin (BTC) traded sideways at the Wall Street open on Jan. 24 with analysts at a loss on where the price would go next.

BTC Price Holds Below Key Resistance

Data from Cointelegraph Markets Pro and TradingView tracked a day of consolidation for BTC/USD, which continued to stay near $23,000.

The pair saw little reaction to the start of trading, including technical problems on the New York Stock Exchange, while US macroeconomic data also failed to change the status quo.

Bitcoin therefore lacked direction after establishing a tighter trading range on Jan. 20.

“Bitcoin failed to break crucial resistance at $23,100,” Cointelegraph Contributor Michaël van de Poppe summarized.

“If we continue to do LH, we’ll probably test and make about $22.3K before continuing. Grants some serious buying opportunities.”

a later Twitter poll It showed just how torn the average market participant was regarding where the market might go next. At the time of writing, 47.8% of around 4,000 responses agreed that a correction should be made in Bitcoin, with the remaining 52.2% betting on a trip to $25,000.

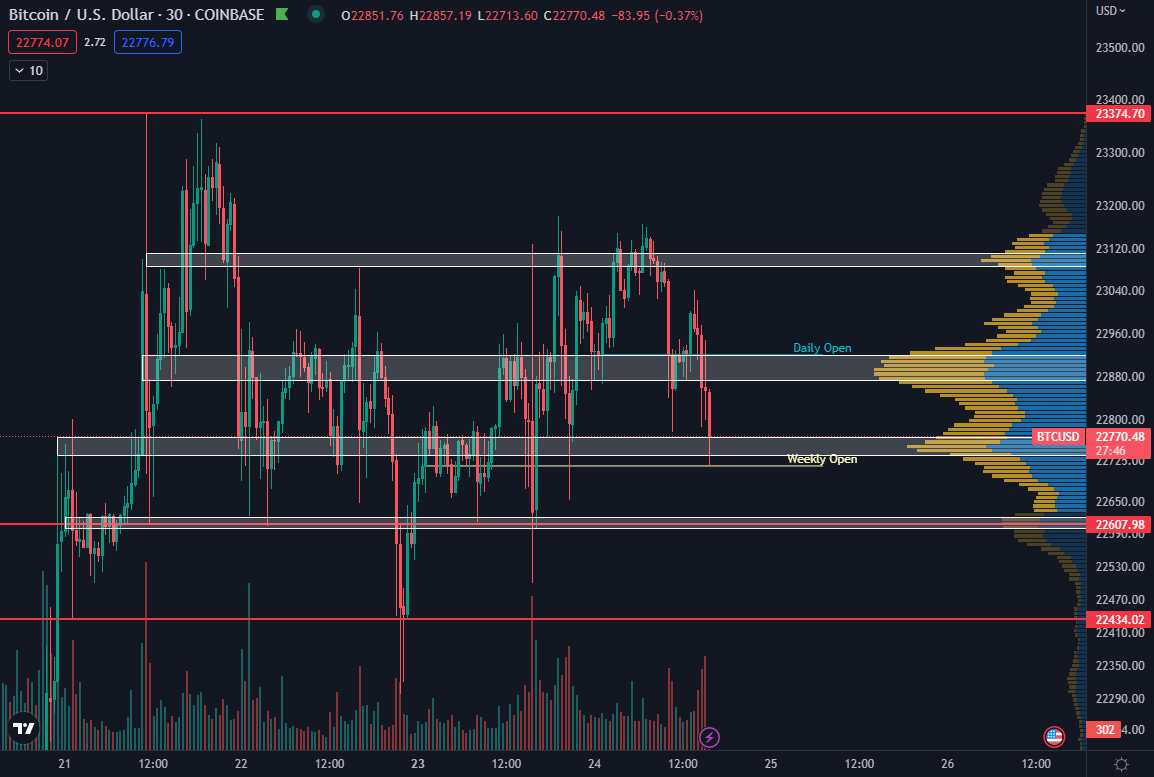

“Choky Price Action with No Clear Pattern or Direction,” Trader Daan continued next to a graph with objectives.

“Intraday, I mainly see that these white areas are the high volume nodes along with the daily and weekly open. Expansion above 23.1 and below 22.6K. Chop until then.

What is discussed Meanwhile, likely for a bullish continuation, fellow trader Gaah highlighted $24,000 as an important level to watch.

Previously, Cointelegraph had reported on the importance of the surrounding area, this being a site for short liquidations with Bitcoin’s 200-week moving average above.

“The first positive sign of a reversal is for $20.8k to become a floor. The second positive sign is $24k becoming the next bottom,” part of Gaah’s analysis read.

Bitcoin sends hodlers to the black

Walking away, it was on-chain analytics firm Glassnode that was cautiously optimistic about the significance of the BTC price breakout.

Related: BTC Metrics Come Out Of Capitulation: 5 Things To Know About Bitcoin This Week

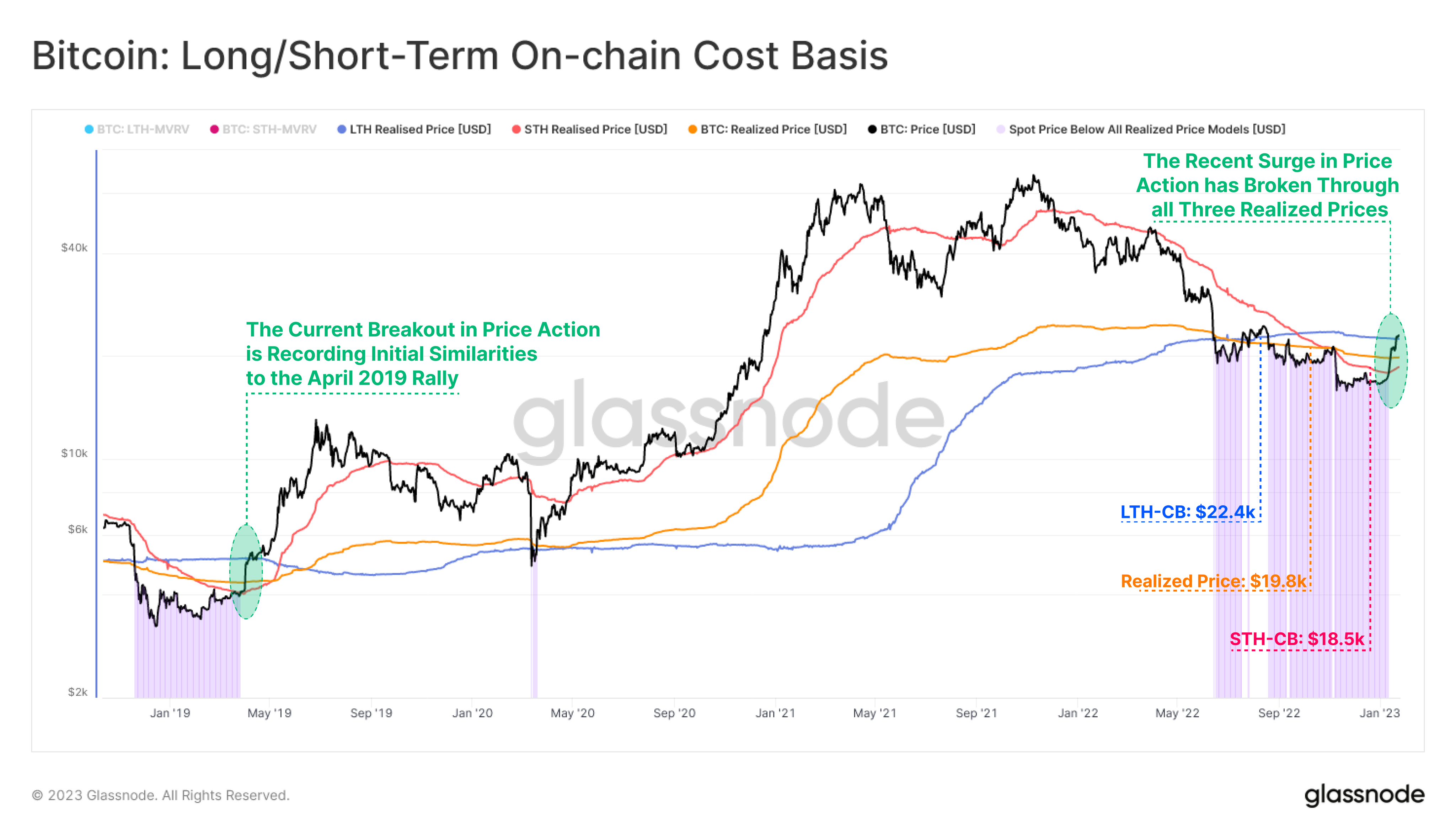

By reaching current levels, he noted, BTC/USD had broken through three key trend lines in one go, something that hadn’t happened since March 2020.

“The recent surge in Bitcoin price action has resulted in an initial break above all three cost bases for the first time since the 2018/19 bear market and the March 2020 Covid crisis,” the comments comment. attachments. read.

“A sustained duration above these key psychological levels would be considered constructive.”

The chart displayed the cost bases (the aggregate price paid) for short- and long-term Bitcoin holders, along with the realized price reflecting the aggregate price the bid last moved to.

The views, thoughts and opinions expressed here are those of the authors alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.