Bitcoin (BTC) held the $30,000 support at the Wall Street open on April 12 as more US macroeconomic data buoyed the bulls.

PPI hints at further inflation declines to come

Data from Cointelegraph Markets Pro and TradingView it showed BTC/USD hovering around $30,250 on Bitstamp.

Amid slowing volatility, US producer price inflation (PPIData from ) provided a timely indication that inflation was decelerating faster than expected.

Headline PPI came in at 2.7% yoy versus market expectations of 3%, an encouraging result for risky assets.

The US March PPI fell 0.5%m/m, below the 0% estimate, in another sign that the US. #inflation may have peaked. pic.twitter.com/mfI7ab03ev

—Holger Zschaepitz (@Schuldensuehner) April 13, 2023

Financial Commentary Resource The Kobeissi Letter was one such taking note that the monthly drop in PPI values was the largest since the March 2022 peak.

“The headline PPI inflation rate has fallen from 11.3% to 2.7% since June 2022, less than 1 year ago. There has also been no monthly increase in PPI inflation since June 2022.” aggregate.

In reaction, market commentator Tedtalksmacro suggested the numbers would also provide a snowball effect for another key inflation metric, the Consumer Price Index (CPI), the March print for which also beat forecasts.

“Indicative of new falls in the CPI/PCE in the coming months,” he said. summarized in the comments on the PPI result.

A faster decline in inflation has traditionally boosted crypto asset performance as it raises hopes that US economic policy will be less restrictive.

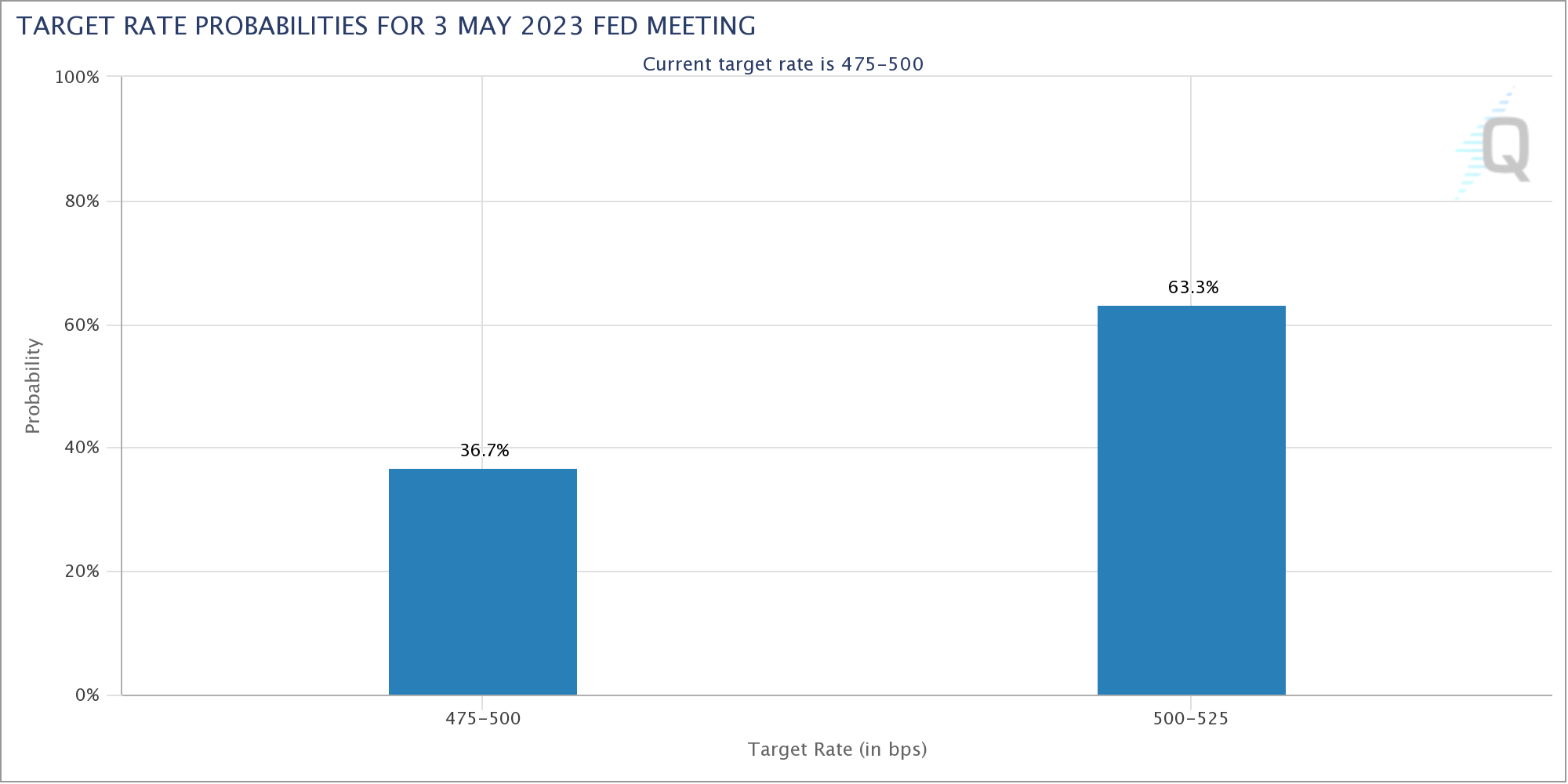

A key event for market participants now will be the next interest rate change from the Federal Reserve, the decision of which will be made in May.

According to CME Group FedWatch Toolexpectations were still in favor of a further 0.25% rate hike, and the PPI did little to change the mood.

Bitcoin, Ether battle at key levels

Meanwhile, with $30,000 as support, Bitcoin failed to convince everyone that its ten-month high would hold.

Related: Can Ethereum Crack $2K? ETH price is getting closer despite new supply unlocked

Material monitoring resource indicators warned of a bearish signal in its proprietary trading tools, within a broader bullish context.

Both Trend Precognition algorithms are shown in red on the BTC daily chart. The signals are tentative, but both algorithms on the same candle have historically had a high probability of accuracy, so these are the signals I will often act on early on. Of course, the PPI arriving at 8:30 am could make things… pic.twitter.com/rKguVIeS5d

— Material indicators (@MI_Algos) April 13, 2023

TO snapshot Meanwhile, the buy and sell levels on the Binance pre-PPI order book showed the strongest resistance parked at $30,500.

“Near-range bid liquidity can cap volatility to the downside, but this is the #WildWest of #Crypto, so anything goes. Keep an eye out for rugs,” Material Indicators wrote in part of the attached comments.

As Cointelegraph reported, Ether (ETH), the largest altcoin, grabbed the spotlight on the day, topping $2,000 for the first time since August of last year.

The views, thoughts and opinions expressed here are those of the authors alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

NEWSLETTER

NEWSLETTER