bitcoin (btc) on-chain transaction fees are dividing opinion as the cost of sending btc soars.

bitcoin-transactionfees.html#3m” target=”_blank” rel=”noopener nofollow”>Data statistics resource BitInfoCharts puts the average transaction fee at nearly $40 as of December 17.

Commentators: High bitcoin Fees Are Unavoidable

The latest wave of bitcoin Ordinals signups has resulted in high transaction fees for all network users, but some believe they are here to stay.

According to BitInfoCharts, it currently costs just over $37 to send btc on-chain, the highest average figure since April 2021.

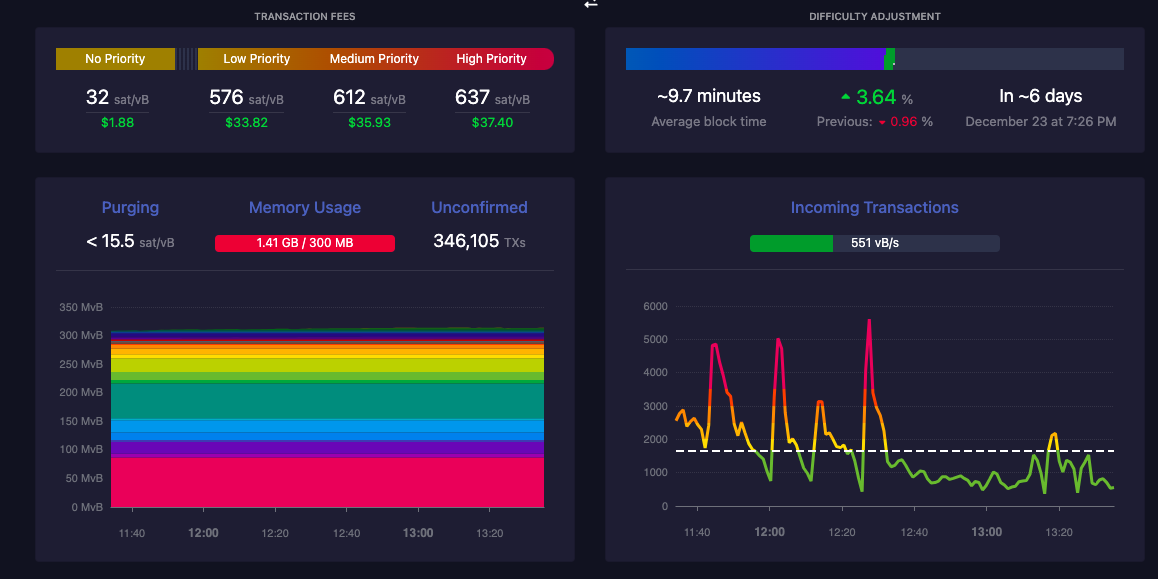

Additional figures for mempool.space show that bitcoin's mempool (the size of the backlog of unconfirmed on-chain transactions) is huge, resulting in transactions with an attached fee of even $2 not being prioritized on-chain.

Nearly 350,000 transactions are waiting to be confirmed at the time of writing.

As casual on-chain spending becomes unviable for many smaller investors, a heated debate continues among bitcoin proponents.

While many are angry about Ordinals' impact on fees, popular bitcoin figures argue that double-digit transaction costs are just a taste of what's to come. Those who want to protect themselves must adopt so-called layer 2 solutions, such as the Lightning Network, which is specifically designed to cater for mass adoption.

“Rights are currently artificially and temporarily high due to JPEG antics, but this is just a glimpse into the future. Scaling does not happen in L1,” comments popular commenter Hodlonaut. wrote in one of many posts on the topic on X (formerly Twitter) on December 16.

Next, Hodlonaut argued that requiring low fees for “Level 1” transactions “is not only ignorant, it fuels an attack on bitcoin.”

This is reflected in the very composition of bitcoin itself as a competition-based network that gains value over time as proof of work intends. Keeping fees low is counterintuitive and, as hard forks of the bitcoin network specifically intended to offer that benefit have shown, does not attract value.

“Why is it critical to bring someone into L1 with sub-$1 fees if you can't afford to move the funds in five years anyway? Go now to bcash or another centralized chimera”, Hodlonaut aggregatereferring to one of those branches, bitcoin Cash (BCH).

Miners enjoy the best dollar income in two years

On the other hand, well-known commentator Beautyon reiterated that despite the fees, bitcoin continues to perform as intended.

Related: Navigating this bull market and turning a profit will be harder than it seems

“If the Ordinals bring the high chain world to everyone sooner than expected, it will act as a scythe that will cut off everyone who did not accept a Layer 2 solution to the network fees problem,” part of a post recent of X. fixed.

“Many users will be confused, upset and ready to abandon bitcoin. Obviously, there will be no recourse for them, because there is no one to blame, no one to ask for compensation; after all, this is the normal state of the network. The rules are being followed, and those are the rules you accepted, Boring Monkeys!

That perspective is shared by bitcoin veteran Adam Back, co-founder of bitcoin and blockchain technology firm Blockstream.

For him, the answer also lies in expanding Layer 2 capabilities rather than relying on anything other than fee incentives for miners.

“You can't stop JPEGs in bitcoin,” he said. concluded.

“Complaining will only make them do it more. Try to stop them and they will do it in worse ways. High fees drive Layer 2 adoption and force innovation. So relax and build things.”

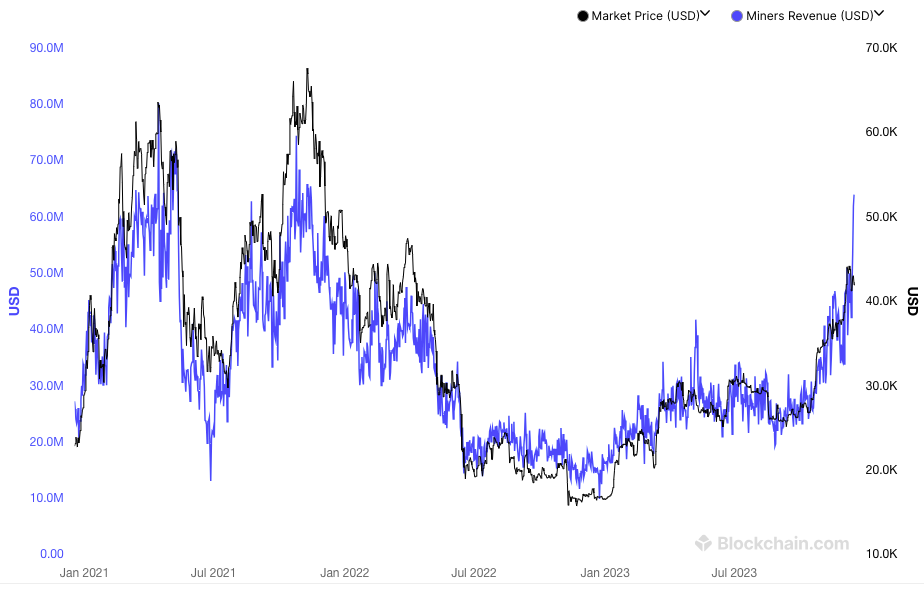

Blockchain.com data sample Miner income (the sum total of block subsidies and USD fees) reached levels last seen when bitcoin hit its current all-time high of $69,000 in November 2021.

btc/USD was trading around $42,000 towards the weekly close on December 17, according to data from Cointelegraph Markets Pro and TradingView.

This article does not contain investment advice or recommendations. Every investment and trading move involves risks, and readers should conduct their own research when making a decision.

NEWSLETTER

NEWSLETTER