bitcoin Has Recently Experienced Mixed Market Moves, and Analysts Are Closely Close <a target="_blank" href="https://cryptoquant.com/insights/quicktake/676a907553d6ea1bf5d8821d-Tether-Outflows-and-bitcoin-Inflows-Signal-Short-Term-Weakness” target=”_blank”>listen on-chain data to understand the short-term trajectory of the leading cryptocurrency.

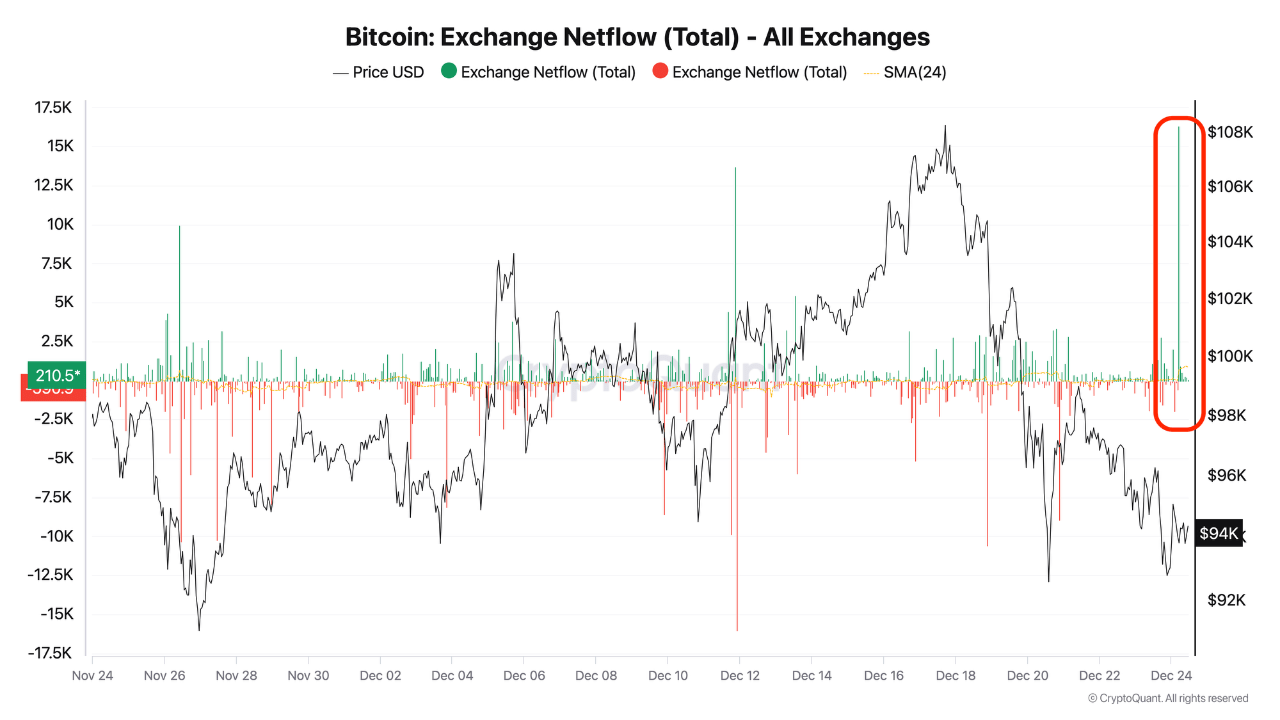

On-chain metrics indicate a notable shift in exchange activity, with Tether (USDT) experiencing significant outflows while bitcoin (btc) inflows to exchanges remain elevated. This trend suggests a potential “imbalance” in market dynamics, where selling pressure could lead to further price corrections in the short term.

Spot market trends and selling pressure indicate possible slowdown

According to data shared by CryptoQuant analyst Onatt, over 15,000 btc has been observed entering exchanges, a metric typically associated with a higher likelihood of sell-offs. At the same time, Tether outflows imply a reduction in liquidity within these exchanges.

<blockquote class="twitter-tweet”>

Tether outflows and bitcoin inflows indicate short-term weakness

“Significant amounts of Tether (USDT) are leaving exchanges, and a large inflow of bitcoin (btc) (>15K) has been observed entering exchanges.” – By <a target="_blank" href="https://twitter.com/tutunculeronat?ref_src=twsrc%5Etfw” target=”_blank”>@tutunculeronat

Link https://t.co/NFCLi7EpiI pic.twitter.com/6lUyTiEdNi

– CryptoQuant.com (@cryptoquant_com) <a target="_blank" href="https://twitter.com/cryptoquant_com/status/1871535148514295957?ref_src=twsrc%5Etfw” target=”_blank”>December 24, 2024

Historically, these moves have been linked to short-term price declines, as traders and institutional investors reposition their portfolios amid market volatility.

However, Onatt noted that while these indicators suggest short-term downside risk, there does not appear to be any significant macroeconomic catalyst driving a prolonged downtrend. The analyst wrote in particular:

This combination of factors may indicate a potential for further near-term decline in the price of bitcoin. However, from a macroeconomic perspective, there does not appear to be a catalyst that would require a prolonged downtrend after this short-term correction.

Key Indicators Suggest Mixed Signals in bitcoin Market

TraderOasis, another analyst, highlighted additional metrics that influence bitcoin price action. One key observation focused on the Coinbase Premium index, which failed to track bitcoin's upward movement during its latest price surge. Oasis noted:

As a result, the price retreated. Now we are in negative territory. I expect a breakout in the market for the rally to continue.

Notably, this disconnect indicates a lack of strong buying activity from US-based investors, often considered a major driver of bitcoin's bullish momentum. The analyst also noted that funding rates have started to decline while open interest levels have increased.

Falling funding rates along with rising open interest usually indicate that traders are opening more short positions. This pattern suggests bearish sentiment in the derivatives market, and traders expect a continuation of the downtrend or, at best, a period of sideways movement.

Furthermore, the combination of declining funding rates and rising open interest suggests that the market could remain in a consolidation phase for a while. TraderOasis wrote:

I think the price will move sideways due to the Christmas week. Then the distribution movement will begin.

x/c3Bxqxnd/” alt=”bitcoin (btc) Price Chart on TradingView” />

Featured image created with DALL-E, TradingView chart

<script async src="https://platform.twitter.com/widgets.js” charset=”utf-8″>