The recent drop in bitcoin price below the $60,000 threshold, followed by a subsequent drop bitcoin-crash-54500-headed/” target=”_blank” rel=”nofollow”>fall below $50,000may finally be showing signs of reversal, as suggested by the latest buying trends. These trends indicate a strong accumulation phase among large-scale investors, commonly known as whales, who have been capitalizing on the price drop to bolster their cryptocurrency holdings.

Related reading

As such, bitcoin addresses have collectively withdrawn over $1.7 billion worth of bitcoin from various exchanges, marking the largest weekly outflow in over a year.

Accumulation trend among bitcoin holders

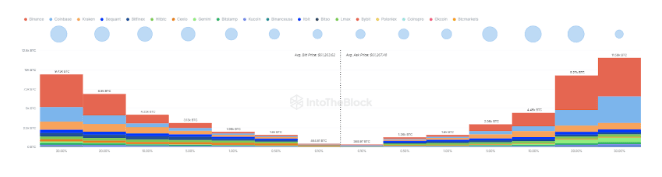

According to on-chain data from IntoTheBlock, bitcoin addresses have been steadily accumulating the coin over the past week. This data is highlighted through the analytics platform’s NetFlow data, which is crucial for forecasting an upcoming rally or downward trend in cryptocurrency prices. The data highlights a significant shift, showing that outflows from exchanges have substantially outpaced inflows, with a staggering $1.7 billion more in btc being withdrawn from exchanges than was deposited.

<blockquote class="twitter-tweet”>

btc saw a staggering $1.7 billion in net outflows from exchanges last week, the most in over a year.

This indicates that big whales are accumulating due to the recent downturn. image.twitter.com/m4INbZmKmB

— On the Block (@intotheblock) twitter.com/intotheblock/status/1821912814845394981?ref_src=twsrc%5Etfw” rel=”nofollow”>August 9, 2024

This outflow is often interpreted as a sign that investors are deciding to hold onto their bitcoin for the long term, which in turn reduces the amount of btc available for sale on exchanges.

What does this mean for pricing?

The recent dynamics in the investment world and increased volatility caused bitcoin to fall back below $50,000 last week. Interestingly, this drastic price drop marked the first time bitcoin traded below $50,000 in six months. However, be that as it may, the price drop gave many crypto believers the opportunity to accumulate more btc at a six-month low. This created buying pressure among some traders, which in turn helped prop up the btc price and helped prevent further declines.

A reduction in the amount of bitcoin available on exchanges can have significant implications for the market. With fewer coins available for sale, buying pressure can increase. Potentially raising prices As demand remains stable or increases, at the time of writing, bitcoin is trading at $60,989, having established support at $60,000.

Considering the prevailing bullish sentiment, this buying pressure may also be the impetus that propels bitcoin price to the challenging $70,000 price level. However, the journey towards $70,000 presents four different resistance levels at $63,730, $65,510, $67,350 and $69,150.

Buying pressure continues, as shown by total flows into and out of exchanges. Total flow data shows a decline of 61.9% and 12.27% over the past 24 hours and seven days, respectively.

Related reading

However, bitcoin is not out of the woods yet, as exchanges’ on-chain market depth shows that there are still more sellers than buyers. At the time of writing, sellers have placed sell orders for 31,458 btc at an average price of $61,267 across various cryptocurrency exchanges. Meanwhile, buyers have placed buy orders for just 27,734 btc at an average price of $61,263.

Featured image from Pexels, chart from TradingView

<script async src="//platform.twitter.com/widgets.js” charset=”utf-8″>