bitcoin's recent rally, which pushed its price to the $52,000 level, has positively impacted stocks of US-based companies. cryptocurrency exchange Coinbase (currency). After experiencing a notable drop to $115 in early February, Coinbase shares rose to $172 on Thursday, following a significant upgrade from a JPMorgan analyst.

Improved outlook for Coinbase amid crypto rally

According to a Bloomberg reportJPMorgan analyst Kenneth Worthington abandoned his bearish view on Coinbase weeks after downgrading the stock.

As bitcoin traded higher, Coinbase shares gained as much as 7.8% following the update. Worthington believes the exchange will likely benefit from the recent rally in digital asset prices, prompting him to change his rating to neutral.

This change in stance comes after Worthington's downgrade in January, where it predicted a possible deflation of enthusiasm for bitcoin exchange-traded funds (ETFs).

However, contrary to its previous forecast, bitcoin ETFs have been successful in terms of trading measures, and the price of bitcoin has surpassed $52,000, reaching its highest level since 2021. In a note to clients on Thursday, Worthington explained:

Given the acceleration in recent days of flowing On bitcoin ETFs and the significant price appreciation of bitcoin and now ethereum, we return to a Neutral rating on Coinbase as we see higher cryptocurrency prices not only maintaining but improving activity levels and power of Coinbase earnings for 1Q24.

Coinbase stock saw an 8% drop at the start of the year, following an impressive 400% rise in 2023. Analyst opinions on the stock remain divided, with buy, hold, and sell recommendations split roughly evenly. .

Worthington maintained his $80 price target on the stock ahead of the company's earnings report, which will be released after the market closes on Thursday.

Worthington emphasized that Coinbase's business is closely tied to token prices, with its main revenue being transaction based. As token values increase and trading activity gains momentum, fees based on the value traded are expected to drive higher transaction volumes, ultimately helping to improve Coinbase's revenue.

bitcoin ETFs witness significant trading volume

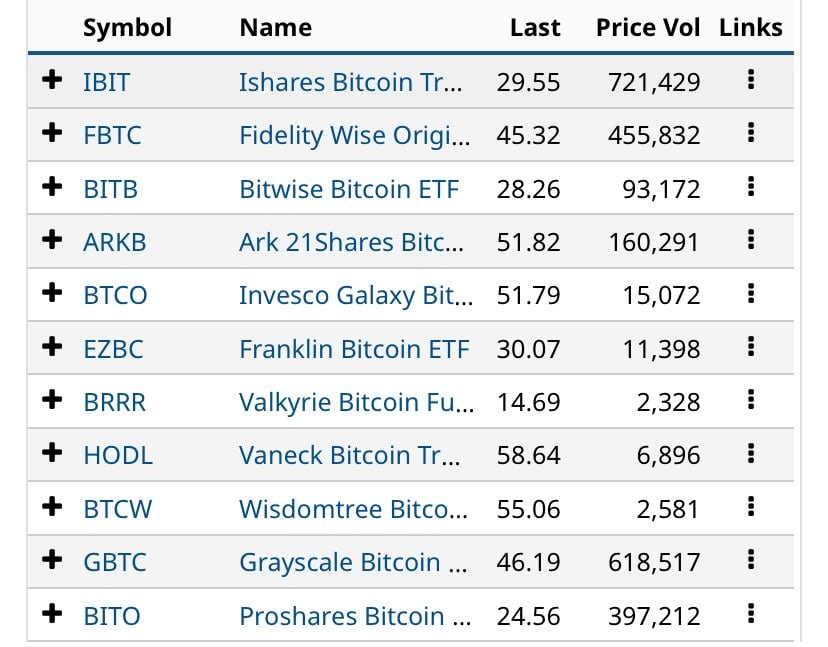

On February 14, bitcoin ETF Trading Volume exhibited notable figures, with Blackrock's IBIT leading the way with $721 million in volume.

Grayscale's bitcoin Trust (GBTC) followed closely with $619 million, while Fidelity's FBTC secured third place with $456 million. On the other hand, Ark Invest accumulated a volume of $169 million.

The total trading volume of the nine ETFs amounted to approximately 1.5 billion dollars. In particular, the largest ETFs saw higher trading volume than the previous day, with IBIT surpassing $700 million and GBTC surpassing $600 million.

Interestingly, before the trading session, GBTC sent less than half of the bitcoin it sent to Coinbase the previous day. Despite this decline, GBTC's total trading volume It was 50% higher.

As demand for bitcoin continues to rise, ETFs play a crucial role in facilitating institutional and retail investors' participation in the cryptocurrency market. The increased trading volume of bitcoin ETFs highlights growing investor interest and confidence in digital assets.

Currently, bitcoin is trading at $51,900 and finds a critical resistance level at $52,000.

Featured image from Shutterstock, chart from TradingView.com

Disclaimer: The article is provided for educational purposes only. It does not represent NewsBTC's views on whether to buy, sell or hold investments, and investing naturally carries risks. It is recommended that you conduct your own research before making any investment decisions. Use the information provided on this website at your own risk.