Join our Telegram channel to stay up to date on breaking news coverage

The price of bitcoin has consolidated above $42,000 after briefly touching $45,000 in a show of force that has kicked off what could be the largest digital asset price explosion in history.

The pre-sale of bitcoin ETF tokens has entered its tenth and final stage, so there are only days left to buy at the cheapest available price of $0.0068.

As FOMO continues to build around the impending approval of a bitcoin spot ETF, traders have invested $4.1 million in the $BTCETF initial coin offering. There is now less than $800,000 to raise to reach the hard cap goal of $4,956,000.

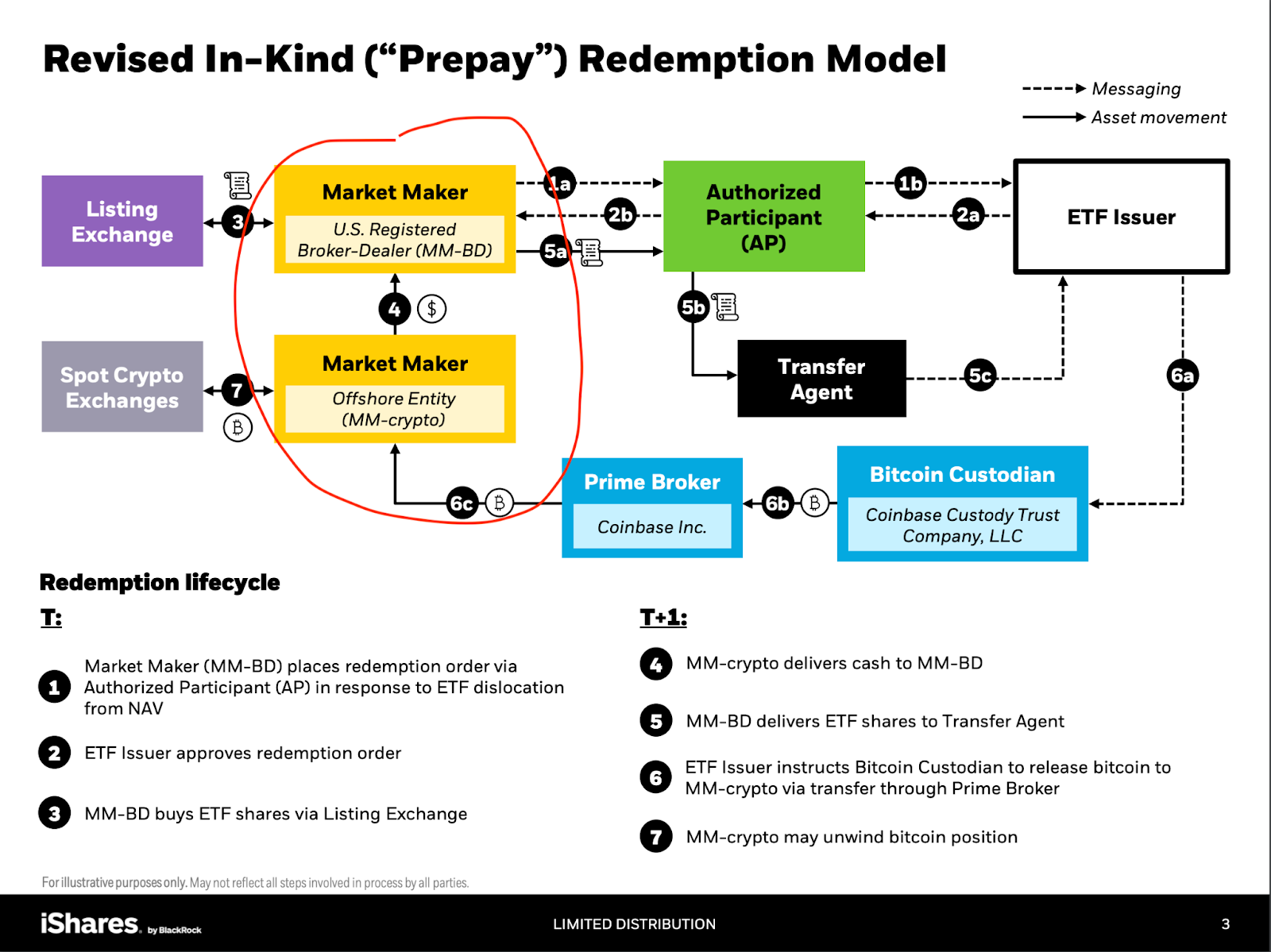

#SECOND establishes a new “cash reimbursement model” for bitcoin?src=hash&ref_src=twsrc%5Etfw”>#bitcoin Place #ETF applicants, which affects approval criteria.@InvescoEMEA initially adopts it while @BlackRock introduces “Prepaid” to facilitate participation in Wall Street.

How could these models reshape the accessibility of ETFs?#BitcoinETF has… pic.twitter.com/NN4nnfEJ2M

– BTCETF_Token (@BTCETF_Token) December 14, 2023

Pre-sale contributors could see returns go parabolic with 100x gains, such is the anticipation around the prospect of a spot bitcoin ETF transforming the investment landscape for cryptocurrencies.

bitcoin ETF Token provides the answer to the question of how to best position investment portfolios to benefit from a timely approval of a bitcoin ETF, which will likely arrive in January.

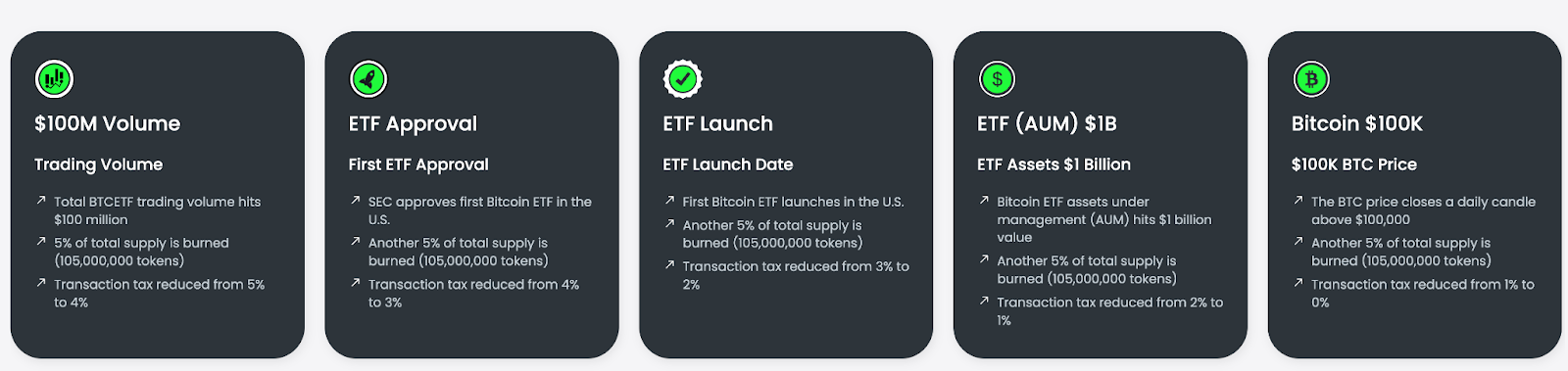

The ethereum-based currency is explicitly designed with burning mechanisms triggered by ETF approval, launch, and other milestones such as trading volumes and assets under management.

In other words, at every important step along the way from approval to launch to market acceptance, owners of the $BTCETF token will directly benefit.

Such will be the seismic impact of the approval of a spot bitcoin ETF, that Google has already taken steps to change its cryptocurrency advertising rules to allow fund managers that issue the products to promote them.

<h2 id="h-bitcoin-etf-will-be-at-the-center-of-the-blackrock-v-vanguard-struggle-for-etf-supremacy” class=”wp-block-heading”>bitcoin ETF at the center of fight between BlackRock and Vanguard for ETF supremacy

With an expected bitcoin–btc-hype-machine-goes-into-overdrive-as-token-surges-past-42-000″>'crypto supercycle' On the verge of exploding, the cryptocurrency asset class could find itself at the center of an arms race among fund managers to be the leader.

BlackRock is the number one ETF issuer, but passive investing pioneer Vanguard is not far behind. Cryptocurrencies are emerging as a key battleground as the two heavyweights compete for ETF supremacy in a market that is only in the US. valued at 7.8 billion dollars.

BlackRock has done a U-turn on cryptocurrencies after previously dismissing the asset class, while Vanguard remains in the camp of skeptics. Cryptocurrencies could be part of BlackRock's master plan to stay ahead of its rivals; the success of that ploy could force Vanguard's arm.

If Vanguard sometime next year decides to succumb to pressure from clients (and asset manager competitors) and starts issuing crypto ETFs, expect another big injection of liquidity into digital asset markets.

In another significant development, BlackRock, following a meeting with the SEC, has reviewed your ETF filing application in such a way that it would allow banks to avoid being allowed to hold cryptocurrencies on their balance sheets. BlackRock's new proposal allows a custodian (in this case Coinbase Custody) to hold cryptocurrencies on behalf of banks. By becoming authorized participants, banks could directly exchange cash for crypto assets.

However, the wind in the bitcoin ETF token's sails is not solely due to the prospects of bitcoin ETFs, but also bitcoin's broader claim to be a store of value.

While Vanguard may doubt that cryptocurrencies are a viable asset class and lament their volatility as a reason to stay away, a look around the world finds a growing list of countries where their citizens increasingly recognize bitcoin's utility as a store of value. .

<h2 id="h-bitcoin-is-a-world-changing-store-of-value-and-bitcoin-etf-token-can-reap-the-upside-nbsp-nbsp” class=”wp-block-heading”>bitcoin is a life-changing store of value and the bitcoin ETF token can reap benefits

A recent post on X by Canadian restaurant business Tahini's makes this abundantly clear. In a post yesterday, it is highlighted that 725 million people in six countries (Turkey, Egypt, Nigeria, Argentina, Lebanon and Pakistan) are witnessing bitcoin trading at all-time highs against bombed-out local currencies.

This is what bitcoin?src=hash&ref_src=twsrc%5Etfw”>#bitcoin what happens with the citizens of Turkey, Egypt, Nigeria, Argentina, Lebanon and Pakistan.

A combined population of

725 MILLION people

Try to convince them that bitcoin is not useful. Good luck pic.twitter.com/z8poh2C7Wb— Tahini (@TheRealTahinis) December 13, 2023

Buying $BTCETF today is not just a short-term bet on the SEC approving a spot product, but a long-term positioning for a crucial economic and financial moment. It is very likely that more countries will join the above list as the peak of globalization turns into an economic recession in key countries such as China, the second largest economy on the planet and still the world's leading workshop.

Additionally, the supply shock of bitcoin block rewards paid to miners halving to 3.25 btc while demand surges means bitcoin could settle at a price above 1 million. Dollars.

The chances of bitcoin becoming an official reserve currency for citizens suffering from the death of their local currencies or who are excluded from the traditional financial landscape are increasing.

bitcoin-derived currencies, such as bitcoin ETF Token, will reap the benefits of the profound secular transformation of economies and finance in which bitcoin will be at the center.

<h2 id="h-here-s-how-the-bitcoin-etf-token-adds-value-at-every-milestone” class=”wp-block-heading”>Here's How bitcoin ETF Token Adds Value at Every Milestone

A total supply reduction of up to 25% increases the scarcity of the bitcoin ETF token, making it a stronger value proposition. For each of the first five milestones, the transaction tax is reduced by 1% from an initial level of 5%.

5 Steps to Get Rich with bitcoin ETFs:

- $BTCETF reaches $100 million trading volume

- SEC approves first bitcoin spot ETF

- First bitcoin ETF Launches in the US

- bitcoin ETF assets under management reach $1 billion

- bitcoin price closes daily candle above $100,000

<h2 id="h-bitcoin-etf-token-is-like-nothing-you-have-ever-seen-10x-gains-at-launch-100x-to-come” class=”wp-block-heading”>bitcoin ETF Token Is 'Like Nothing You've Ever Seen': 10x Explosion at Launch, 100x Profits?

The bitcoin ETF token pre-sale run rate is accelerating, so there is no time to waste in taking advantage of what could be an initial 10x return opportunity. Given the token's unique position in the market, popular analysts have spotted the opportunity and have been informing their audiences.

As FOMO approval of the bitcoin ETF grows, YouTube crypto analysts are turning up the heat.

Austin Hilton has told his 239,000 subscribers to his YouTube channel that the bitcoin ETF token is like “nothing you've ever seen before,” and described its milestone recording mechanism as “very interesting.”

Similarly, YouTube cryptocurrency expert Jacob crypto Bury is eyeing big profits on $BTCETF – predicting a 10x move when it launches on decentralized exchanges:

Conor Kenny has informed his audience of 170,000 subscribers about the link of the innovative rewards mechanism with the approval of the bitcoin ETF and the associated milestones. He suggests that it is one of the best ways available to approach this cryptocurrency investment topic. As altcoin season heats up, 10x gains could be 100x for those who take advantage of the next wave of capital appreciation.

<h2 id="h-crypto-will-be-a-growing-slice-of-a-14-trillion-etf-pie-and-bitcoin-etf-token-is-the-easiest-way-to-gain-exposure” class=”wp-block-heading”>Cryptocurrencies Will Take Over an Increasing Share of the $14 Trillion ETF Market, and the bitcoin ETF Token Is the Easiest Way to Ride the Wave

Visit the bitcoin ETF Token website and join X (Twitter) and Telegram to keep up to date with project progress. The website has a great news ticker, so you will always be the first to hear the market-moving news about bitcoin Spot ETFs.

To invest in the pre-sale, connect your crypto wallet, set the amount you want to invest and pay with eth, BNB, MATIC or USDT. You can also contribute to the pre-sale the old-fashioned way using your bank card.

As mentioned, 10x returns are within limits for a coin that has already put its stamp on the 'bitcoin ETF' theme, but there could be much higher returns in store for those who hold onto their reserves for the long term.

bitcoin could do for financial markets what gold did for ETFs after the first index fund for the yellow metal was launched in 2003. The global ETF market is predicted to be valued at $14 trillion by the end of 2024.

Cryptocurrencies will account for an increasing share of that total and purchasing bitcoin ETF tokens is probably the smartest way to gain exposure to future investment returns.

- Audited by Coinsult

- Secure and decentralized cloud mining

- Earn free bitcoin daily

- Native Token on Pre-Sale Now – BTCMTX

- Staking Rewards: Over 100% APY

Join our Telegram channel to stay up to date on breaking news coverage

NEWSLETTER

NEWSLETTER