Join our Telegram channel to stay up to date on breaking news coverage

Developments surrounding the approval of the dozen applications filed with the Securities and Exchange Commission continue to raise expectations for an early January green light for the first spot bitcoin ETFs in the US.

BlackRock's ETF, to be known as iShares bitcoin Trust, has introduced its symbol, IBIT. Meanwhile, two ETF providers have released advertisements for their products, with Bitwise being the first to come out with its tagline “The Most Interesting Man in the World,” starring actor Jonathan Goldsmith.

Fast follower Hashdex was next with their “stocks are not crypto, fixed income is not crypto.” Precious metals? No, not cryptography either,” riff.

THIS IS HUGE

-> Bitwise is launching a major advertising campaign for its bitcoin?src=hash&ref_src=twsrc%5Etfw”>#bitcoin Spot ETF

500,000 USD will be reached in a short time:pic.twitter.com/skGLSw3m36

— Robin Seyr (@RobinSeyr) December 18, 2023

The announcements are a sign of the fierce competition there will be between asset managers to win business from institutions and retail investors.

Elsewhere, discussions between the SEC and providers have led to an agreement for cash refunds, in line with the preferred approach of the SEC, which considers this safer.

Additionally, BlackRock has modified the design of its ETF to make it “prepaid,” which is a technical change that will allow banks to, in practice, hold bitcoins on their balance sheets.

However, investors can participate in what could be the biggest investment theme ever in cryptocurrencies by purchasing $BTCETF right now. The digital asset raised $5 million in its initial coin offering, which closed last week after being fully subscribed.

$BTCETF is the first and only token to be launched on the market with a design that is linked to the news flow and product development and performance of upcoming bitcoin spot ETFs.

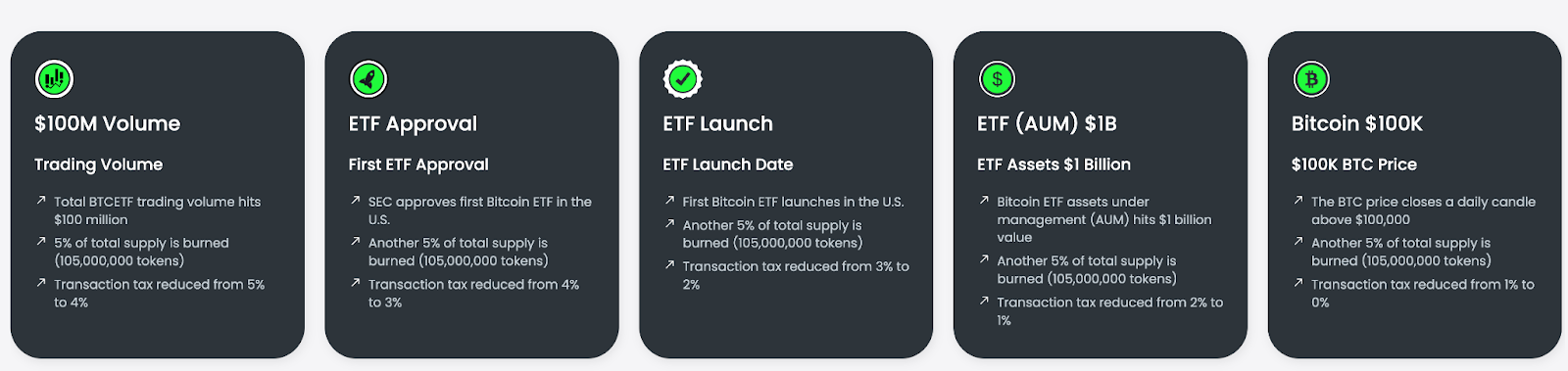

Milestones such as the approval, launch, and achievement of AUM targets and token trading volumes trigger value-enhancing events through the burning mechanism and transaction tax built into the coin's tokenomics. .

The #BitcoinETF The claim is now available!

Make sure you have a sufficient amount of $eth to cover gas fees when making the claim.

Claim here: https://t.co/Vbea3xtxlf pic.twitter.com/5BJk0Of3xx

– BTCETF_Token (@BTCETF_Token) December 21, 2023

<h2 id="h-hoow-the-bitcoin-etf-token-is-lined-up-to-ride-the-crypto-bull-run” class=”wp-block-heading”>Here's How the bitcoin ETF Token Is Designed to Take Advantage of the btc Bull Run

The bitcoin ETF token is designed in such a way that its total token supply decreases by up to 25% due to its burning mechanism. Burning tokens removes them from supply and increases the scarcity of the asset, potentially making it more valuable. In addition to burns, for each of the first five milestones, the transaction tax decreases by 1% from an initial level of 5%.

5 Steps to Make bitcoin ETF Profits:

- $BTCETF reaches $100 million trading volume

- SEC approves first bitcoin spot ETF

- First bitcoin ETF Launches in the US

- bitcoin ETF assets under management reach $1 billion

- bitcoin price closes daily candle above $100,000

<h2 id="h-bitcoin-etf-token-the-best-bet-for-riding-the-bitcoin-super-cycle” class=”wp-block-heading”>bitcoin ETF Token: The Number One Way to Ride the crypto Super Cycle

bitcoin price rose to $44,000 today and again hits $45,000, underscoring the bullish sentiment in the market as we head into the new year.

bitcoin has been the best-performing financial asset of 2023 and with the block reward halving in April thanks to the near certainty of a timely approval of the bitcoin ETF, the good news will keep coming.

It is this background that makes BTCETF such an attractive proposition.

There are two Uniswap V2 pools for the BTCETF/eth trading pair. In the first pool, the coin is traded with a smaller liquidity pool, which can be found here:

https://www.dextools.io/app/en/ether/pair-explorer/0x3c4c3cc7cb9d9de37885612ae47f8b44b57fe9d8

A second group was created for the pair due to a price error in the first group. This second group has greater liquidity ($452 thousand) than the first group ($41 thousand):

https://www.dextools.io/app/en/ether/pair-explorer/0x65271daefd1bdcb44b8148e340363b7285af476c

The price spread between the two groups is narrowing over time, although it is recommended to push buy orders through the second group due to its greater liquidity, meaning that trades will be matched with minimal price slippage.

Positive price action is maintained by taxes on purchases and sales, as well as token buybacks that will begin today.

<h2 id="h-bitcoin-etf-token-btcetf-to-spike-100x-as-fomo-takes-off” class=”wp-block-heading”>bitcoin ETF Token ($BTCETF) Set to Spike 100x as FOMO Takes Effect

To stay up to date with bitcoin ETF token developments, join the X (Twitter) and Telegram. The website features a news feed on everything related to bitcoin and bitcoin ETFs, so bookmark the site to stay in the loop.

A bitcoin spot ETF is likely to have a massive impact on financial markets by bringing bitcoin out of the cold, giving it the credibility to kill the skeptics.

bitcoin ETF approvals will be an important sign of a maturing market, which could see the coin's price rise by multiples of 2 or 3 times in 2024.

However, $BTCETF has an even better risk-reward profile. Early investors could see the coin generating returns of up to 100x as its market capitalization of just $12.45 million gives it much greater upside potential at current prices.

- Audited by Coinsult

- Secure and decentralized cloud mining

- Earn free bitcoin daily

- Native Token on Pre-Sale Now – BTCMTX

- Staking Rewards: Over 100% APY

Join our Telegram channel to stay up to date on breaking news coverage