<a target="_blank" href="https://x.com/nikcantmine”>Follow Nikolaus on x here

Today, MicroStrategy (MSTR) surpassed a market capitalization of $100 billion to become the 93rd publicly traded company in the US.

At the time of writing, MSTR has done more trading volume than stock giants Tesla and Nvidia today, and has traditional stock traders like the Wall Street Bets community. <a target="_blank" href="https://x.com/notrealsaylor/status/1859000659590414625″>losing my mind

<blockquote class="twitter-tweet”>

Wow <a target="_blank" href="https://twitter.com/search?q=%24MSTR&src=ctag&ref_src=twsrc%5Etfw”>$MSTR It is the most traded stock in the United States today…at best <a target="_blank" href="https://twitter.com/search?q=%24TSLA&src=ctag&ref_src=twsrc%5Etfw”>$TSLA and <a target="_blank" href="https://twitter.com/search?q=%24NVDA&src=ctag&ref_src=twsrc%5Etfw”>$NVDA he's crazy It's been years since a stock traded in more than one of those two (it may actually have been <a target="_blank" href="https://twitter.com/search?q=%24GME&src=ctag&ref_src=twsrc%5Etfw”>$GME to last do it). It's also about double <a target="_blank" href="https://twitter.com/search?q=%24SPY&src=ctag&ref_src=twsrc%5Etfw”>$SPY! Wild times… pic.twitter.com/bUr8nycMX3

– Eric Balchunas (@EricBalchunas) <a target="_blank" href="https://twitter.com/EricBalchunas/status/1859278500399620528?ref_src=twsrc%5Etfw”>November 20, 2024

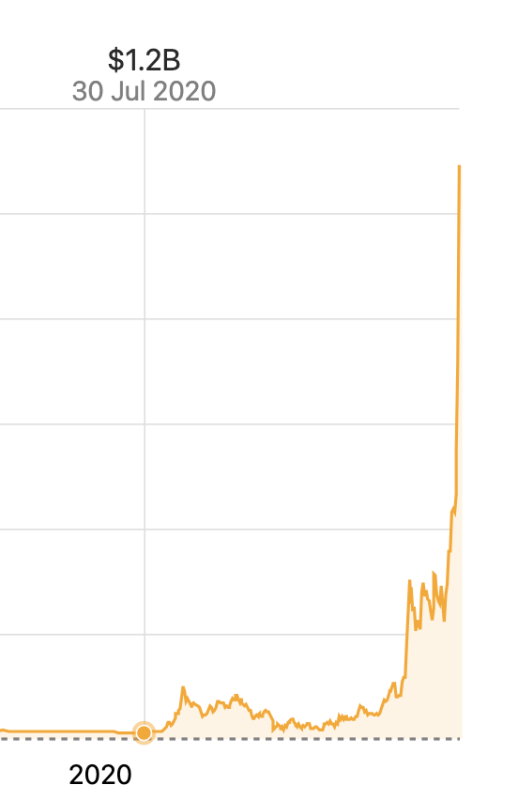

This is absolutely mind-blowing considering MicroStrategy was a barely $1 billion company. when He first bought bitcoins for his treasury about four and a half years ago.

The big question I ask myself is how and when will this end? Assuming MSTR continues to pump to the peak of this bull market, no one knows how far MSTR can go.

But how hard will it crash into the bear market, considering it is essentially a leveraged trade on bitcoin? Dare I suggest that this time may be different and that the downside of the next bitcoin bear market will not be as brutal as the 70%+ corrections we are historically used to seeing?

Even with spot bitcoin ETFs and the notion that the United States can lead the charge for nation states to buy massive amounts of bitcoin, I'm still not convinced that we won't eventually see a massive drop in the price of bitcoin. And I am mentally preparing myself for a normal bitcoin bear market to begin after this bull market ends sometime next year.

But back to MSTR: Michael Saylor has so far shown that the bitcoin for corporations The strategy works surprisingly. Public companies have come out of the woodwork this past week announcing that they have purchased bitcoin for their balance sheet or plan to do so, and it looks like this trend will continue as the CEO of Rumble asked his x audience if he should add btc. to its balance sheet (almost 94% of its 42,522 voters voted “yes”).

<blockquote class="twitter-tweet”>

Let's put this into survey format…

Should Rumble add bitcoin to its balance sheet?

—Chris Pavlovski (@chrispavlovski) <a target="_blank" href="https://twitter.com/chrispavlovski/status/1858977485310025888?ref_src=twsrc%5Etfw”>November 19, 2024

Michael Saylor even <a target="_blank" href="https://x.com/saylor/status/1858945523258159169″>offered to help explain how and why Rumble should adopt a corporate btc strategy.

Institutional adoption of bitcoin is here and will only grow in the foreseeable future. As companies discover the logic behind adopting bitcoin as a strategic reserve asset, the number of publicly traded companies adopting this strategy will skyrocket.

Companies that add bitcoin to their balance sheet will rise above most other companies (even the big tech giants) in terms of trading volume, as MicroStrategy has done, until all companies add bitcoin to their balance sheet. I try to put myself in the shoes of a trader, knowledgeable about bitcoin, and think, “Why the hell would I buy shares of any company if they don't have bitcoin on their balance sheet?” I wouldn't do it, it would be too boring.

Putting btc on the balance sheet helps create volatility and therefore opportunities for stock traders, which is good for traders, the stock price, and the company as a whole. If you are a publicly traded company, it is a no-brainer to adopt bitcoin as a treasury reserve asset.

This article is a Carry. The opinions expressed are entirely those of the author and do not necessarily reflect those of btc Inc or bitcoin Magazine.

<script async src="https://platform.twitter.com/widgets.js” charset=”utf-8″>