Ether (ETH) prices have breached the psychological $2,000 level following the Shapella update this week and the result is a decline in Bitcoin (BTC) market dominance.

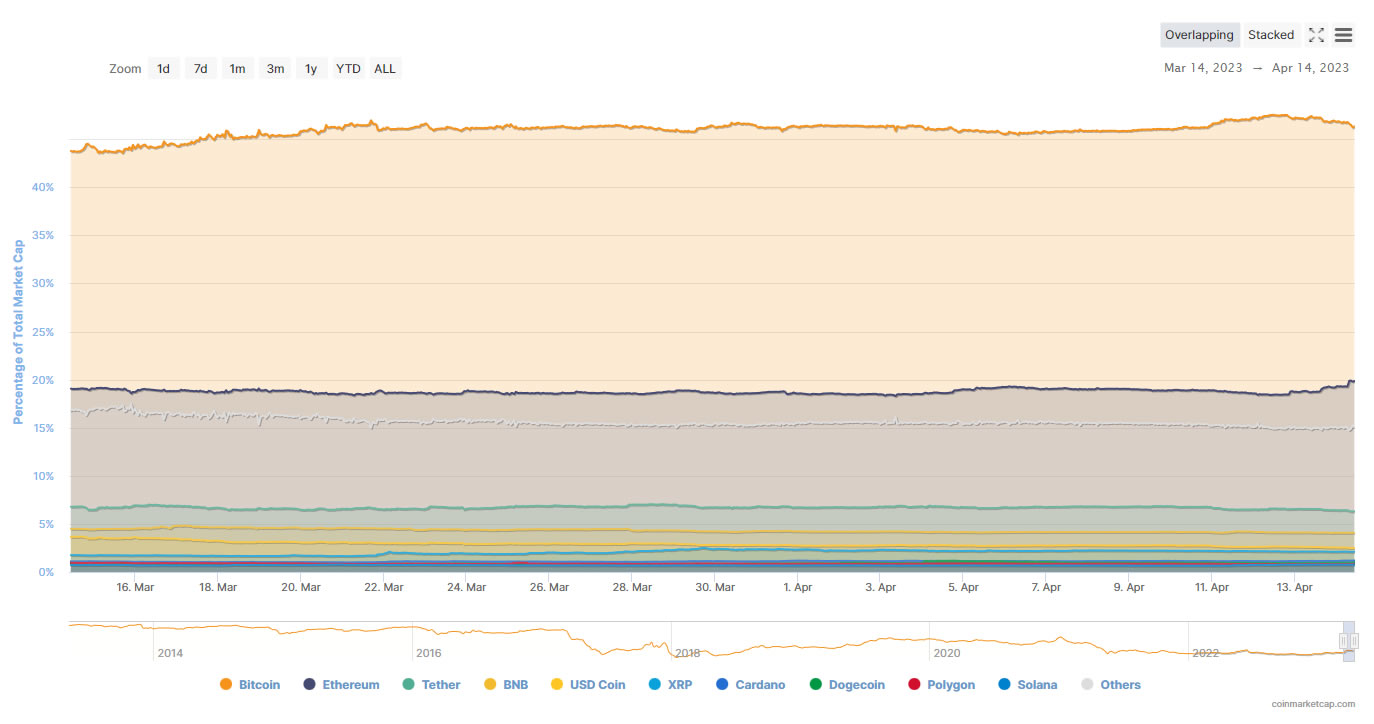

According to the analysis data place btctools.io Ether’s market share rose to 19.8%, an increase of more than 1.1% in the last 24 hours, while Bitcoin’s dominance dropped just under 1%. Since the beginning of the year, ETH dominance has increased by 7.6%.

Bitcoin’s market dominance has fallen to 47.7% as Ethereum’s market share increases. The post-Shapella ETH rally has knocked BTC out of a nearly two-year high in terms of market share.

BTC’s market share hit 48.8% on April 12 following its rally to $30,000, the highest since July 2021 when it hit just 50%. Furthermore, BTC has not been more than 50% dominant since April 2021.

Bitcoin dominance stands at 13.6% since the beginning of the year, according to TradingView data.

The rise in market share in both BTC and ETH has come at the expense of altcoins, most of which have been lackluster during the recent rally of the two major coins.

Bitcoin and Ether combined make up around 68% of the total crypto market. Approximately 10% are stablecoins, which means that the other 10,800 tokens, listed on the CoinGecko price analytics platform, have a combined share of only 22%.

Market dominance is calculated by looking at an asset’s market capitalization compared to the total crypto market capitalization, which is currently at an eleven-month high of $1.33 trillion.

Related: Bitcoin dominance approaches 50% as research praises ‘bullish’ narrative turn

ETH prices have risen 10.25% in the last 24 hours. As a result, the asset hit an 11-month high of $2,122 during the morning Asian trading session on April 14, according to Cointelegraph data.

Ether’s momentum has been fueled by a successful Shapella update on April 12 that launched ETH staked on the Beacon Chain.

BTC achieved a 2% gain on the day hitting an intraday high of $30,862 during the morning Asian trading session on April 14.

Magazine: ‘Account Abstraction’ Supercharges Ethereum Wallets: Dummy’s Guide