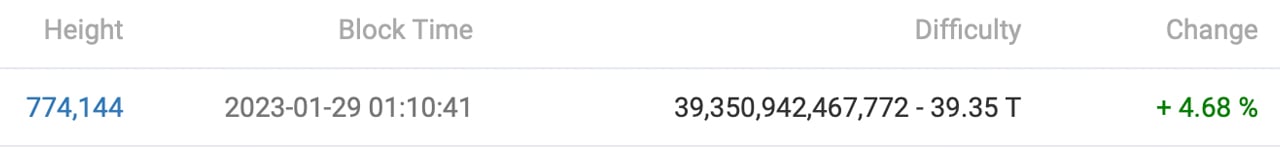

The Bitcoin blockchain recorded another difficulty increase on Sunday, January 29, 2023, at block 774,144. Network difficulty increased by 4.68%, from 37.59 trillion to an all-time high of 39.35 trillion.

Bitcoin Difficulty Hits New All-Time High As Mining Gets Harder

Bitcoin difficulty reached another all-time high, surpassing the record set two weeks ago, after rising 4.68% on Sunday. The increase occurred at the height of the block. 774,144, at 6:10 am (UTC). The difficulty is now at 39.35 billion, close to surpassing 40 billion. The next adjustment is due on February 11, 2023.

The increase makes it difficult to mine blocks, following a 4.68% increase after the 10.26% increase on January 15, 2023. Statistics from January 29 show a hash rate of 279.7 exahash per second (EH/s) in the last 2016 blocks, currently in 283.55 U/s dedicated to the Bitcoin blockchain.

Statistics from macromicro.me on January 28, 2023, calculate the cost of BTC production at $21,176 per unit. On January 29, the spot price was $23,584. With spot prices higher than the cost of production, bitcoin (BTC) miners have recouped some losses since late 2022.

pool layout calculated by blocks discovered shows Foundry USA as the top mining pool with 101.47 EH/s, which is equivalent to 34.89% of the network hash power. Antpool has 57.54 EH/s, or 19.79% of the total network hashrate. F2pool, Binance Pool, Viabtc, Btc.com, and Braiins Pool follow Foundry and Antpool, respectively.

With increasing difficulty, block intervals, or the time between each BTC block, they’ve been over 9:02 a 9:38 minutes. This is slower than the recent 8:54 to 9:31 minutes recorded two days ago, but still faster than the 10-minute average.

What impact do you think the increasing difficulty of the Bitcoin network will have on miners and the cryptocurrency industry in general? Share your thoughts in the comments section below.

image credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or a solicitation of an offer to buy or sell, or a recommendation or endorsement of any product, service or company. bitcoin.com does not provide investment, tax, legal or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

NEWSLETTER

NEWSLETTER