Despite regulatory pressure and worsening macroeconomic conditions, Bitcoin (BTC) demonstrated optimism by holding close to $28,000 over the past week. Additionally, professional traders have held leveraged long positions in the margin and futures markets, indicating strength.

On the regulatory front, on April 4, the Texas Senate Committee on Business and Commerce agreed to move forward and remove incentives for miners operating within the state’s regulatory environment. If passed, Senate Bill 1751 would cap compensation for load reductions on the Texas power grid during emergencies.

Risk of recession grows in the face of rate hikes

The risk of a recession rose after US jobless claims for the week ending March 25 were revised to 246,000, up 48,000 from the initial report.

In addition, Kristalina Georgieva, Managing Director of the International Monetary Fund (IMF), fixed on April 6 that the US and European economies should continue to struggle as higher interest rates weigh on demand.

Regarding the banking crisis, Georgieva advised central banks to continue raising interest rates, adding that “concerns remain about vulnerabilities that may be hidden, not only in banks but also in non-banks; not now It’s time for complacency.”

On the other hand, on April 6, the president of the Federal Reserve of St. Louis, James Bullard minimized concerns about the impact of financial stress on the economy. Bullard said the Fed’s reaction to the weak banking sector was “swift and appropriate” and that “monetary policy may continue to push inflation down.”

Let’s look at derivatives metrics to better understand how professional traders are positioning themselves in current market conditions.

BTC Price Derivatives Reflect Neutral Trader Sentiment

Margin markets provide insight into how professional traders are positioning because they allow investors to borrow cryptocurrencies to take advantage of their positions.

For example, one can increase exposure by borrowing stablecoins and buying Bitcoin. On the other hand, Bitcoin borrowers can only short BTC/USD.

The above chart shows that OKX traders’ margin lending ratio has held close to 28x in favor of BTC longs over the past week. If those whales and market makers had perceived higher risks of a price correction, they would have borrowed Bitcoin to short, causing the indicator to drop below 20x.

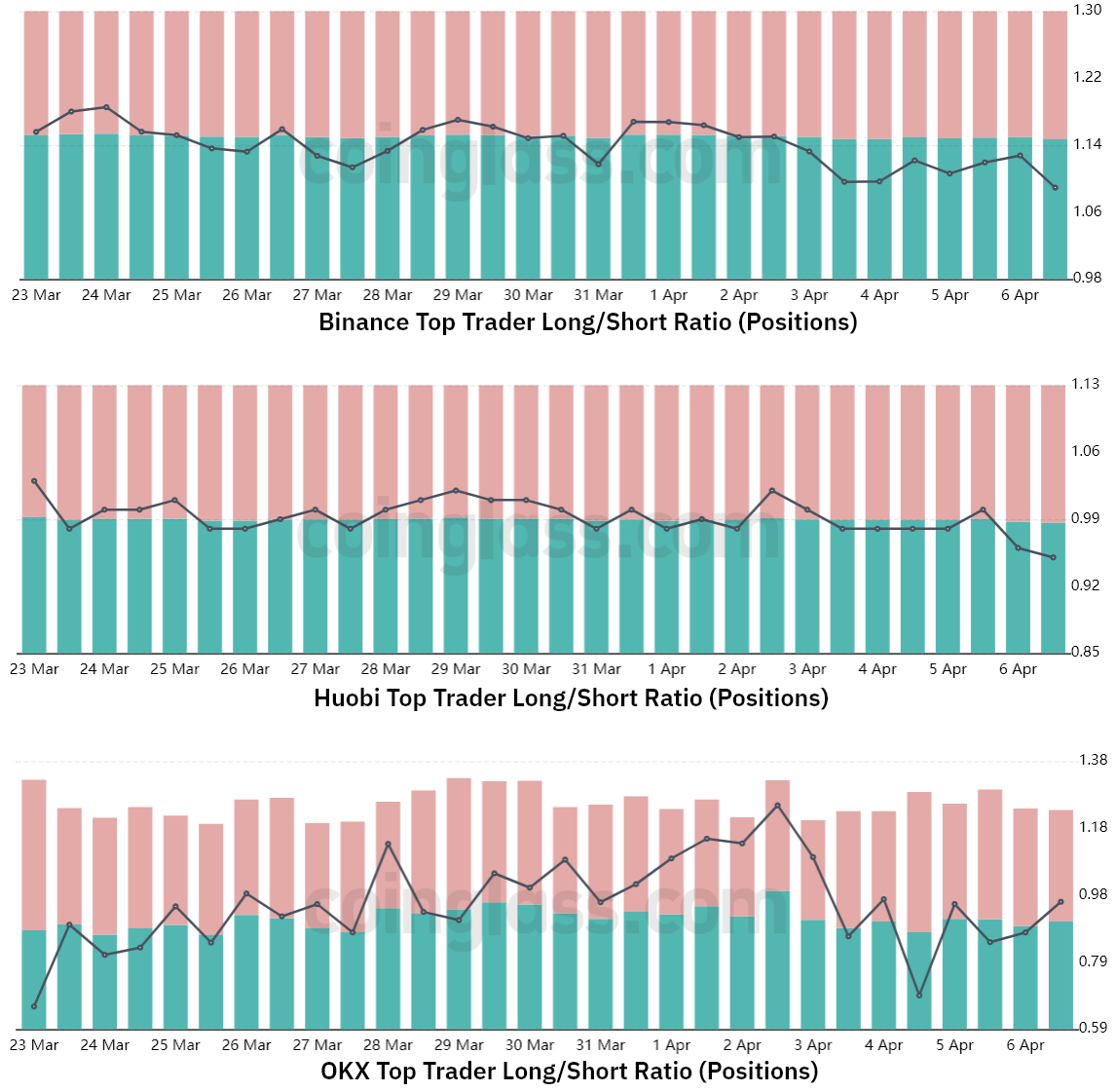

The net long-to-short ratio of the major players excludes externalities that might have affected only the margin markets. Analysts can better understand whether professional traders are biased bullish or bearish by aggregating positions in spot, perpetual and quarterly futures contracts.

Because there are some methodological differences between the different exchanges, viewers should focus on the changes rather than the absolute numbers.

Between April 1 and 7, the long-short ratio of the top traders on Binance decreased slightly from 1.17 to 1.09. Meanwhile, on the Huobi exchange, the long-short ratio of major traders has been hovering near 1.0 since March 18. More precisely, the ratio slid from 1.00 on April 1 to 0.95 on April 7, so it is relatively balanced between long and short positions.

Lastly, OKX whales showed a very different pattern as the gauge declined from 1.25 on April 3 to a low of 0.69 on April 5, heavily favoring net shorts. Those traders reversed the trend, aggressively buying Bitcoin using leverage over the past two days as the long-to-short ratio returned to 0.97.

The absence of Bitcoin shorts is a bullish indicator

In essence, both the Bitcoin margin and futures markets are currently neutral, which should be interpreted positively given that Bitcoin price rose 41.5% between March 10-20 and was able to hold the $28,000 level. .

Given the enormous regulatory uncertainty caused by Wells’ notice from the SEC against Coinbase on March 22, the absence of short positions using margin and futures markets currently favors further price appreciation.

Unless the economic crisis unfolds faster than expected, inflation will remain a top concern for investors, and Bitcoin inflows should be enough to hold $28,000 as a resistance level.

The views, thoughts and opinions expressed here are those of the authors alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.