Over the past year, the bitcoin renaissance has brought significant attention to BTCfi or “bitcoin DeFi” applications. Despite the hype, very few of these apps have delivered on their promises or managed to retain a significant number of “real” users.

To put things into perspective, the leading lending platform for bitcoin assets, Liquidium, allows users to borrow against their Runes, Ordinals, and BRC-20 assets. Where does the performance come from, you ask? Like any other loan, borrowers pay an interest rate to lenders in exchange for their bitcoin. Furthermore, to ensure the security of the loans, they are always overcollateralized by bitcoin assets themselves.

How big is bitcoin DeFi right now? It depends on your perspective.

In roughly 12 months, Liquidium has executed over 75,000 loans, representing over $360 million in total loan volume, and has paid over $6.3 million in native btc interest to lenders.

For BTCfi to be considered “real”, I would say these numbers need to grow exponentially and become comparable to other chains like ethereum or Solana. (Although I firmly believe that over time the comparisons will become irrelevant as all economic activity will eventually be based on bitcoin.)

That said, these achievements are impressive for a protocol that is barely a year old and operates on a chain where even the slightest mention of DeFi often sparks extreme skepticism. For additional context, Liquidium is already outpacing altcoin competitors like NFTfi, Arcade, and Sharky.

bitcoin is evolving in real time, without requiring changes to its base protocol; I'm here for it.

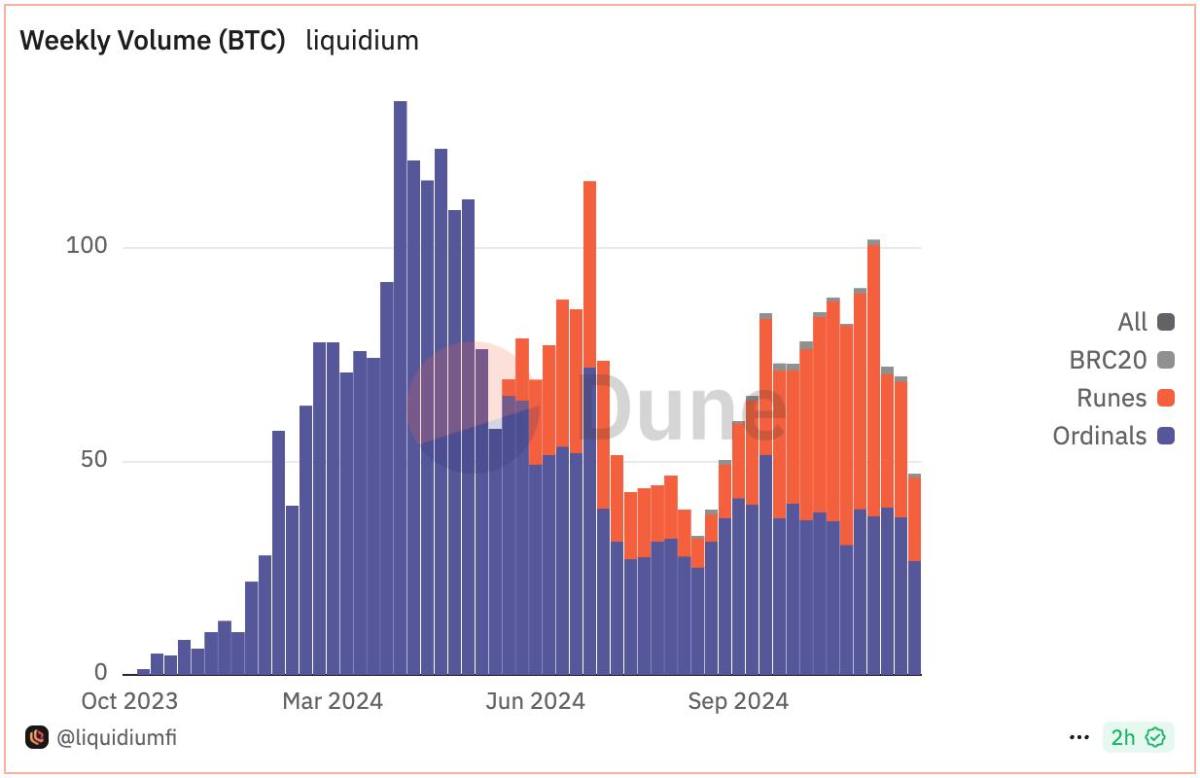

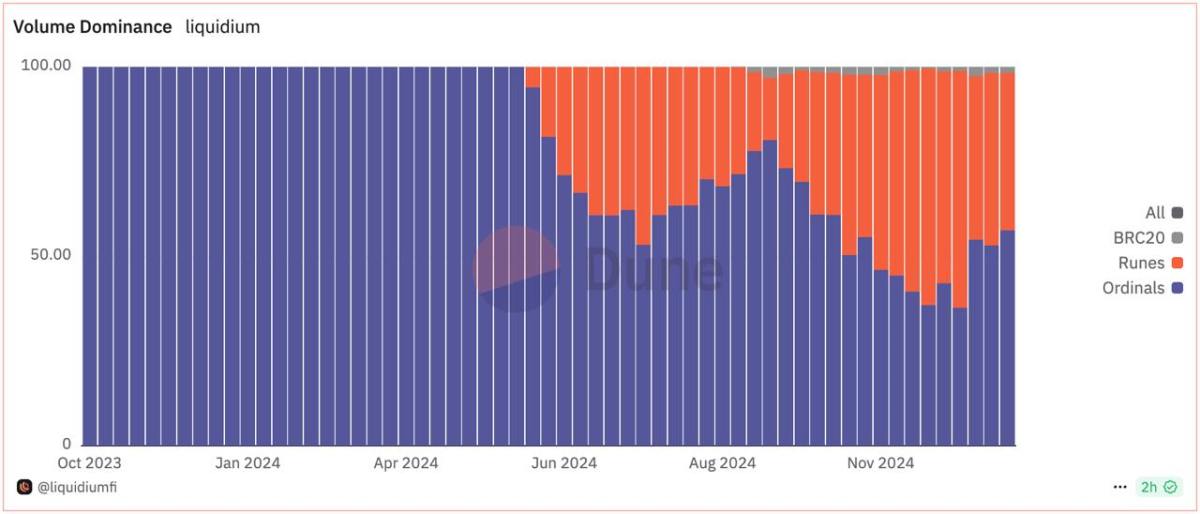

After a rocky start, Runes is now responsible for the majority of loans taken on Liquidium, surpassing both Ordinals and BRC-20. Runes is a significantly more efficient protocol that offers a lighter load on the bitcoin blockchain and offers a slightly improved user experience. The improved user experience provided by Runes not only simplifies the process for existing users, but also attracts a substantial number of new users who would be willing to take an interest in the chain in a more complex way. In contrast, BRC-20 had difficulty gaining new users due to its complexity and less intuitive design. Therefore, having additional financial infrastructure like P2P lending marks a step forward in the usability and adoption of Runes and potentially other bitcoin-backed assets in the future.

Lending volume on Liquidium has increased steadily over the past year, with Runes now comprising the majority of activity on the platform.

Well, runes are now the dominant asset backing native bitcoin loans, why should I care? Is this good for bitcoin?

I would say that regardless of your personal opinion on Runes or the degenerative on-chain games happening right now, the fact that real people are relying on the bitcoin blockchain for decentralized bitcoin-denominated loans should make lovers of freedom stand up and applaud.

We are winning.

Bitcoiners have always claimed that no other blockchain can match bitcoin's security guarantees. Now, others are starting to see this too, bringing new forms of economic activity into the chain. This is undeniably bullish.

Plus, all transactions are natively secured on the bitcoin blockchain – no wrappers or bridges, just bitcoin. We should encourage and support people who are building this way.

This article is a Carry. The opinions expressed are entirely those of the author and do not necessarily reflect those of btc Inc or bitcoin Magazine.

NEWSLETTER

NEWSLETTER