This week could be decisive for the most valuable cryptocurrency. According to a well-known crypto analyst, bitcoin could trigger a parabolic rally amid the current consolidation phase below the $95,000 level.

In a recent analysis <a target="_blank" href="https://www.tradingview.com/chart/BTCUSD/R7W4eZ8Z-bitcoin-This-week-forms-the-bottom-before-it-turns-Parabolic/” target=”_blank” rel=”noopener nofollow”>published On TradingView on January 13, TradingShot noted that bitcoin's current cycle is following a similar path to the 2014-2017 period, paving the way for a target of $200,000.

The analyst observed the formation of two accumulation phases above the weekly moving average, a sign that could indicate long-term buying opportunities.

A similar pattern had also occurred before bitcoin's explosive rally in 2017, when the asset hit a record high of $20,000.

Additionally, the weekly Relative Strength Index (RSI), which measures momentum, is showing a similar pullback as we saw in January 2017.

Historically, these corrections are a sign that the asset is moving from the accumulation phase to a rapid price increase.

According to the expert, if bitcoin continues to follow the 2017 pattern, the cycle high could coincide with the 7.0 Fibonacci extension from the cycle low. The asset could then reach a price target of at least $200,000 at the peak of the current rally, which is expected later this year.

Additionally, this week is crucial for bitcoin as the asset appears to be in the final stages of a pullback before a possible parabolic rally.

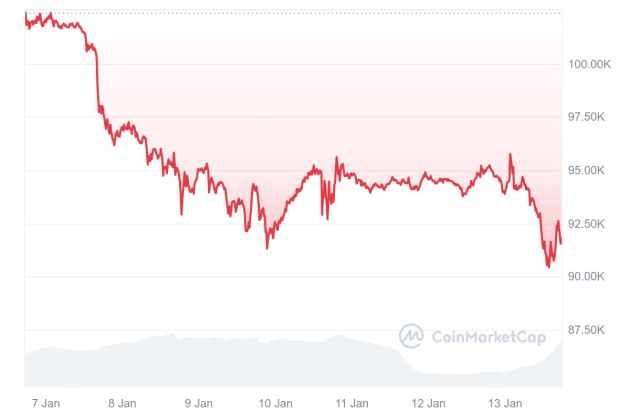

The most valuable cryptocurrency could establish a new local bottom around the $90,000 level, offering a base for strong price growth.

Other market participants have also published similar predictions for bitcoin.

For example, Geoff Kendrick, an analyst at banking giant Standard Chartered, believes bitcoin is set to hit the $200,000 mark within the year, driven by institutional interest fueled by optimism over Donald Trump's victory.

bitcoin: $95,000 resistance will determine direction

The ability to break above the $95,000 resistance will be crucial to trigger the parabolic rally, while a breakdown below the $90,000 threshold could trigger a bearish move.

According to analyst Ahmed, bitcoin failed to overcome the resistance, as expected. The coming weeks will be crucial to understand if the asset will be able to resume its rise towards new all-time highs.

Besides <a target="_blank" href="https://x.com/CryptoBheem/status/1878738111624315347″ target=”_blank” rel=”noopener nofollow”>he noticed that the asset follows a well-established pattern, with a range formed on the 12-hour chart. The liquidity of this range was tested due to nonfarm payroll (NFP) data; The asset subsequently surpassed the $95,500 threshold.

Since then, the market has formed a new range, initially focusing on seeking liquidity below, as attention turns to the Consumer Price Index (CPI) data due tomorrow, January 14.

Furthermore, trading expert Peter Brandt warned that the asset could correct below $90,000, before reaching $150,000.

bitcoin price analysis

bitcoin is currently trading at the $91,770 level, down 3.27% in the last 24 hours. On the weekly chart, the asset recorded a 10% loss.

bitcoin bears appear to be in control after bulls were overwhelmed at the $95,000 level. Therefore, the correction could allow btc to find support before attempting to break through resistance levels.

bitcoin Alternative

As bitcoin prepares for a potentially decisive week, innovative projects like Solaxy are also attracting investor attention. solaxythe first Layer 2 in Solana, is still in the pre-sale phase but has already raised more than 10 million dollars.

The L2 solution is designed to address one of Solana's main obstacles: congestion on its blockchain. Thanks to Layer 2 technology, Solaxy improves the performance of Solana without compromising its security and integrity.

In addition, Solaxy stands out for its multi-chain nature, designed to take advantage of the potential of two of the most influential blockchains: Solana and ethereum. By combining the speed and scalability of Solana with the security and liquidity of ethereum, Solaxy creates an ecosystem that aims to efficiently respond to the growing needs of DeFi.

NEWSLETTER

NEWSLETTER