While many bitcoin investors look to the asset to behave as a safe haven, bitcoin has generally acted as the riskiest of all risk allocations ultimately.

The following is an excerpt from a recent issue of Bitcoin Magazine PRO, Bitcoin Magazine’s premium markets newsletter. To be among the first to get these insights and other on-chain bitcoin market analysis delivered straight to your inbox, subscribe now.

Short-Term Price vs. Long-Term Thesis

How bitcoin, the asset, will behave in the future versus how it currently trades in the market has proven to be drastically different from our long-term thesis. In this article, we’re taking a deeper look at those risk correlations and comparing the returns and correlations between bitcoin and other asset classes.

Consistently tracking and analyzing these correlations can give us a better understanding of if and when Bitcoin has a real moment of decoupling from its current trend. We don’t think we’re in that period today, but we do expect decoupling to be more likely in the next five years.

Macro unit mappings

For starters, we’re looking at the correlations of overnight returns for bitcoin and many other assets. Ultimately, we want to know how Bitcoin is performing relative to other major asset classes. There are many narratives about what Bitcoin is and what it could be, but that is different from how the market markets it.

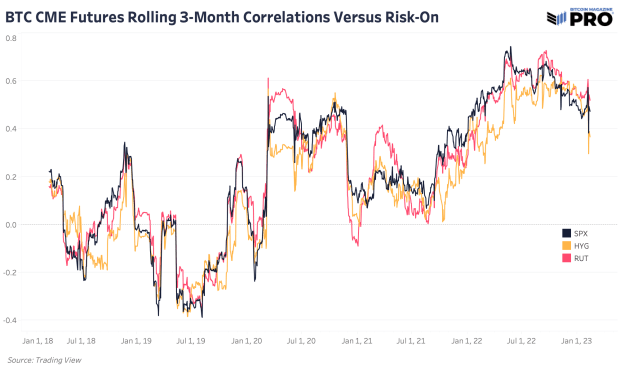

Correlations range from negative one to one and indicate how strong the relationship is between two variables, or asset returns in our case. Typically, a strong correlation is above 0.75 and a moderate correlation is above 0.5. Higher correlations show that assets are moving in the same direction and the opposite is true for negative or inverse correlations. Correlations of 0 indicate a neutral position or no real relationship. Looking at longer time windows gives a better indication of the strength of a relationship because this eliminates short-term volatile swings.

What has been the most observed correlation with bitcoin over the past two years is its correlation with “risky” assets. Comparing bitcoin against traditional asset classes and indices over the past year or 252 trading days, bitcoin is more correlated with many risk benchmarks: S&P 500 Index, Russel 2000 (small cap stocks), QQQ ETF, HYG High Yield Corporate Bond ETF and the FANG (high growth technology) Index. In fact, many of these indices are strongly correlated with each other and shows just how strongly correlated all assets are in this current macroeconomic regime.

The table below compares bitcoin against some key high beta asset class benchmarks, stocks, oil and bonds.

Another important note is that it detects bitcoin transactions in a 24/7 market while these other assets and indices do not. The correlations are likely to be underestimated here as Bitcoin has been shown to lead to broader risk or liquidity market moves in the past because Bitcoin can be traded at any time. As the CME bitcoin futures market has grown, using this futures data produces a less volatile view of correlation changes over time, since it trades within the same time constraints as the bitcoin futures. traditional assets.

Looking at the 3-month moving correlations of CME bitcoin futures against some of the risk indices mentioned above, they all track about the same thing.

Although bitcoin has had its own industry-wide capitulation and deleveraging event that rivals many historical bottom-out events we’ve seen in the past, these relationships to traditional risk haven’t changed much.

Bitcoin has ultimately acted as the riskiest of all risk allocations and a liquidity sponge, performing well at any hint of expanding liquidity returning to the market. It invests at the slightest sign of increasing stock volatility in this current market regime.

We expect this dynamic to change substantially over time as the understanding and adoption of Bitcoin accelerates. This adoption is what we see as the asymmetric advantage of how bitcoin is traded today compared to how it will be traded 5-10 years from now. Until then, bitcoin’s risk correlations remain the dominant force of the market in the short term and are key to understanding its potential trajectory in the coming months.

Do you like this content? subscribe now to receive PRO articles directly to your inbox.

Relevant Articles:

- A Rising Tide Lifts All Boats: Bitcoin, Risk Assets Jump With Higher Global Liquidity

- The Everything Bubble: Markets at a Crossroads

- How big is the bubble of everything?

- Not Your Average Recession: Unwinding the Biggest Financial Bubble in History

- Preparing for emerging market debt crises

- Bitcoin Risk Trend Assessment

- The development of sovereign debt and the currency crisis

NEWSLETTER

NEWSLETTER