bitcoin can organize a recovery above the key psychological brand of $ 90,000 amid the ease of monetary inflation concerns in the world's largest economy.

bitcoin (btc) on the two -month bearish trend has generated numerous alarms that the current bitcoin Toro cycle may have finished, challenging the four -year market cycle theory.

Despite the generalized concerns of investors, bitcoin can be on the way to a recovery exceeding $ 90,000 due to the ease of inflation concerns in the United States, according to Markus Thielen, the 10x Research CEO.

“We can see a trend rally as prices are overst.

“This is not a great bullish development, but some settings of the policy formulators. We believe that btc will be in a broader consolidation range, but we could change towards $ 90,000.”

bitcoin Diario RSI indicator. Fountain: <a target="_blank" data-ct-non-breakable="null" href="https://x.com/10x_Research/status/1901601551963357671/photo/1″ rel=”null” target=”null” text=”null” title=”https://x.com/10x_Research/status/1901601551963357671/photo/1″>10x Research

The trust of investors can also be improved by the comments of the president of the Federal Reserve, Jerome Powell, which indicates that the Fed “will remain awaiting amid the growing uncertainty between homes and companies,” wrote 10x Research on March 17 x <a target="_blank" data-ct-non-breakable="null" href="https://x.com/10x_Research/status/1901601551963357671″ rel=”null” target=”null” text=”null” title=”null”>mailadding:

“Powell also expressed doubts about the sustained inflationary impact of Trump's tariffs, referring to the 2019 stage where inflation related to the rate was temporary, and the Fed finally reduced the rates three times.”

Meanwhile, investors anxiously expect the meeting of the Federal Open Market Committee (FOMC) of the current, for signals on the monetary policy of the Fed for the rest of 2025, a development that can affect the appetite of investors by risk assets such as bitcoin.

Related: The greatest risks of crypto Market in 2025: recession of the United States, circular circular economy

The FOMC meeting will be crucial for bitcoin's trajectory: analyst

Merchants and investors will be monitoring any clue about the completion of the Fed (QT) quantitative flexibility program, “a movement that could increase liquidity and risk assets,” according to Iliya Kalchev, an analyst for the dispatch of the digital nexus Asset Investmator.

“The next decision of the Fed could be an important catalyst for more movements, ”the analyst told Cointelegraph, added:

“If the Powell chair extends its earrings, bitcoin could fly with a renewed bullish impulse.”

“However, persistent inflation concerns or a reaffirmation of strict financial conditions, such as high interest rates or continuous liquidity hardening could limit the upward potential,” added the analyst.

Related: Rising $ 219b Stablecoin supply signs mid -bulk, not on the market

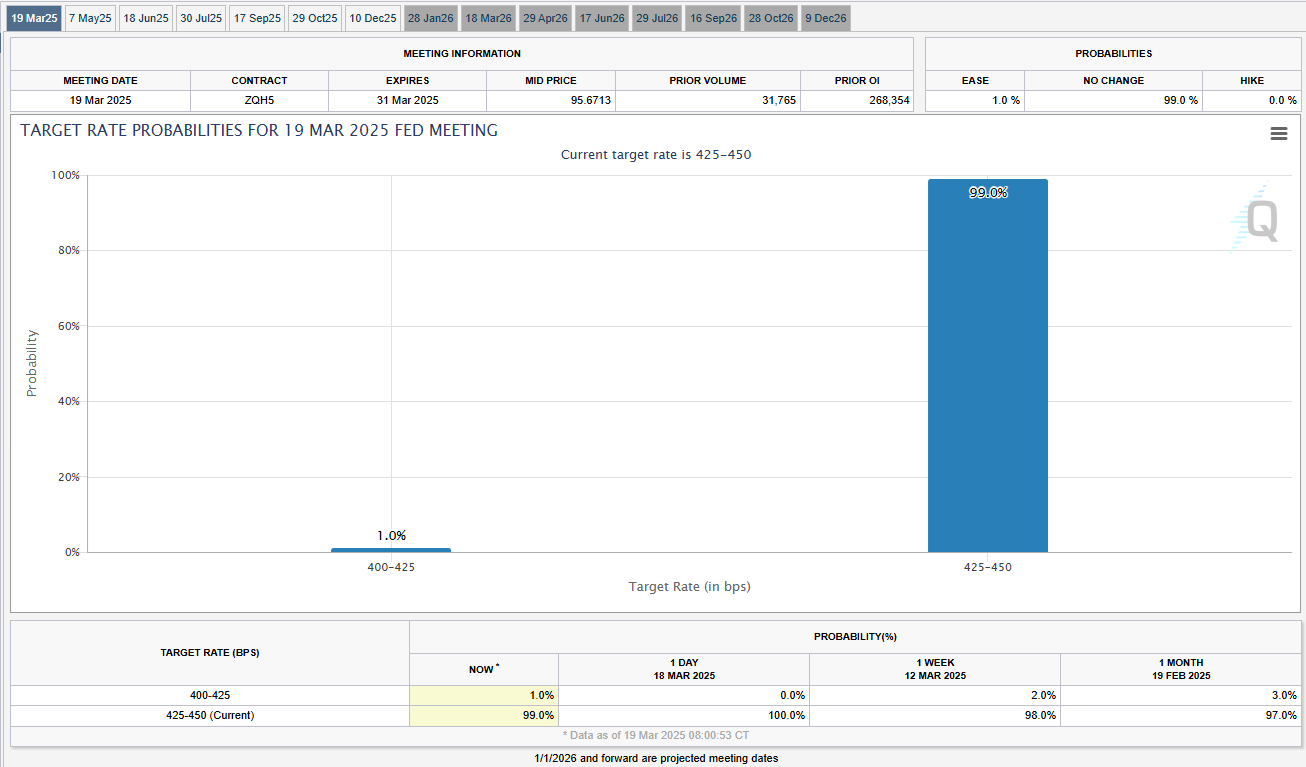

Probabilities of the objective interest rate of Fed Objective. Source: Fedwatch by CME Group tool

Markets currently have a 99% chance price for the FED to maintain stable interest rates, according to the latest estimates of the CME group tool.

Even so, investors have reduced their exposure to US shares. survey – Increase concerns that recession fears can damage bitcoin's price action.

https://www.youtube.com/watch?v=GNUNX0QWH3Q

Magazine: eth can bottom at $ 1.6K, the SEC delays multiple cryptographic ETF, and more: Hodler's Digest, March 9-15

NEWSLETTER

NEWSLETTER