bitcoin (btc) maintained renewed pressure above $28,000 until the weekly close on October 8 as geopolitical uncertainty entered traders’ radar.

Trader: bitcoin‘s behavior in the face of resistance “not the best”

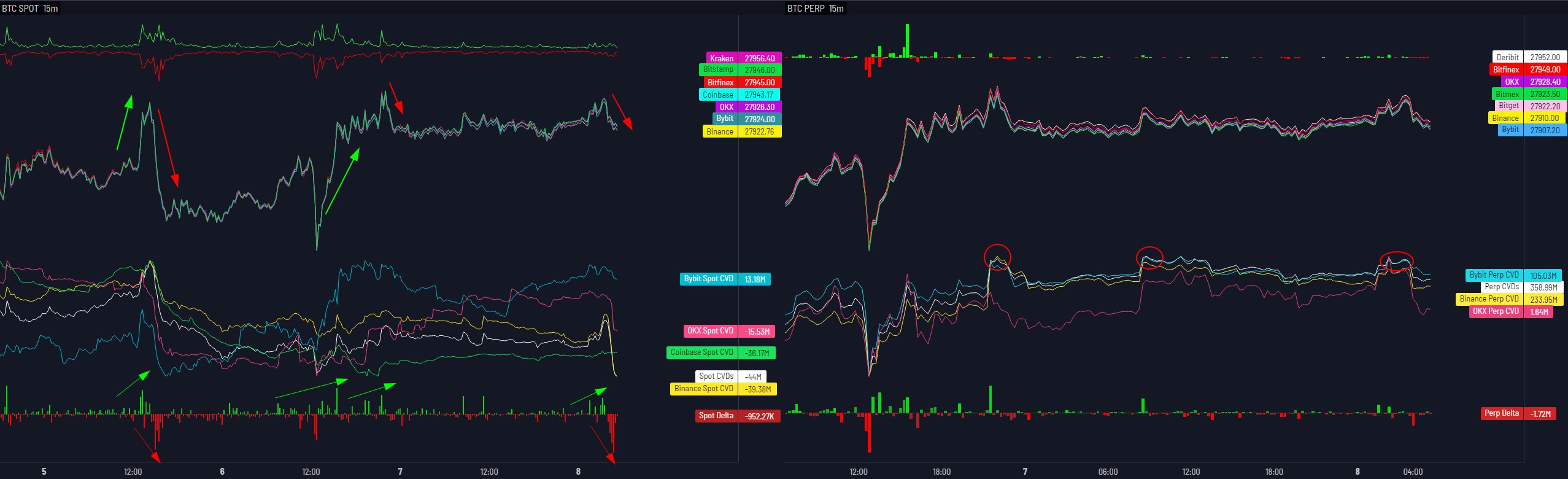

Data from Cointelegraph Markets Pro and TradingView showed btc price performance avoiding downward volatility over the weekend.

The pair recovered from a quick retest of $27,000 on October 6, thanks to surprising US employment data that diverged from the Federal Reserve’s policy adjustments.

Now, the resistance at $28,000 formed the main point of interest for market participants heading into the new week.

In a low time frame (LTF) analysis of exchange order books, popular trader Skew said a lot of supply power was still needed to turn $28,000 into support.

“So at LTF we can clearly see that the market is still trading at $28,000 as resistance. In my opinion, it will take a large local buyer to crack that area,” he said. said X subscribers (formerly Twitter).

“Criminals are also reducing each LTF bounce to $28,000.”

Skew further described bitcoin‘s reaction to both that level and the 200-day moving average (MA), currently at $28,040, as “not the best.”

Meanwhile, fellow trader Daan crypto Trades warned against shorting btc in the event of a sudden breakout as this could be the start of further upside.

“I will say that with btc around this great $28,000 level that has the 200MA daily/weekly there, I’m personally not very interested in shorting any deviation above,” part of an X post. fixed.

“In the past, we’ve often seen a weekend breakout in these types of places that tend not to back off as easily as they would otherwise.”

An accompanying chart showed the closing price of last week’s CME bitcoin futures markets, which may form a price “magnet” heading into the new week.

“The best way to trade the CME price is in a choppy, swinging environment,” he added.

“We are still in that environment, but that would likely change if a strong breakout occurred above this region. Therefore, I am not too eager to short immediately in case we see a weekend rally.”

Analyst renews btc price forecast of $30,000

Meanwhile, in the wake of events in Israel, others pointed to geopolitical instability as a possible catalyst for btc price going forward.

Related: bitcoin Bull Market Awaits as US Faces ‘Steep Bearish’ – Arthur Hayes

Among them was Michaël van de Poppe, founder and CEO of the trading company MN Trading.

“Now, from a market perspective, it’s going to be a volatile week,” he said. wrote in part of the X analysis.

“My idea is for bitcoin to continue its upward trend and potentially reach $30,000 as global uncertainty grows.”

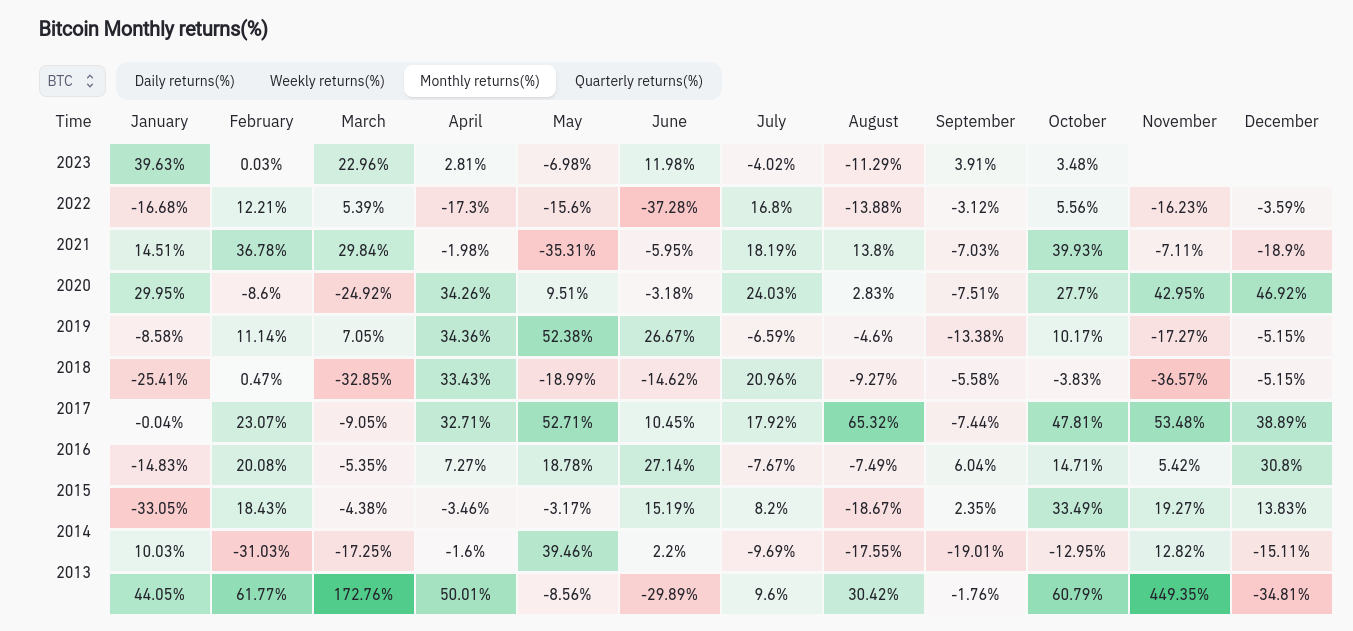

Van de Poppe had previously forecast a trip beyond the $30,000 mark in October, traditionally bitcoin‘s strongest calendar month.

At just under $28,000, btc/USD is up 3.5% so far this month at the time of writing, per data from the CoinGlass monitoring resource.

This article does not contain investment advice or recommendations. Every investment and trading move involves risks, and readers should conduct their own research when making a decision.