It may seem like forever ago that Bitcoin (BTC) was trading below $18,000, but it was actually 40 days ago. Cryptocurrency traders tend to have short-term memories and, more importantly, attach less importance to negative news during bull runs. A great example of this behavior is BTC’s 15% gain since February 13, despite a constant stream of bad news in the crypto market.

For example, on February 13, the New York State Department of Financial Services ordered Paxos to “stop minting” the Binance USD (BUSD) dollar-pegged stablecoin issued by Paxos. Similarly, Reuters reported on Feb. 16 that a Binance.US-controlled bank account moved more than $400 million to trading firm Merit Peak, which is reportedly an independent entity also controlled by Binance CEO Changpeng Zhao.

The wave of regulatory pressure continued on February 17 when the United States Securities and Exchange Commission announced a $1.4 million settlement with former NBA player Paul Pierce for allegedly promoting “false and misleading statements” regarding to EthereumMax (EMAX) tokens on social media.

None of those headwinds could break investor optimism after weak economic data indicated the US Federal Reserve has less room to continue raising interest rates. The Philadelphia Federal Reserve Manufacturing Index showed a 24% decline on February 16, and US home starts increased by 1.31 million compared to the previous month, which is lower than the expectation of 1.36 million.

Let’s take a look at Bitcoin derivatives metrics to better understand how professional traders are positioning themselves in current market conditions.

Demand for Asia-based stablecoins remains “modest”

Traders should look at the USD Coin (USDC) premium to gauge demand for cryptocurrencies in Asia. The index measures the difference between China-based peer-to-peer stablecoin transactions and the US dollar.

Excessive buying demand for cryptocurrencies can push the indicator above fair value by 104%. On the other hand, the stablecoin market supply is flooded during bear markets, causing a discount of 4% or more.

The USDC premium currently sits at 2.7%, which is flat compared to the previous week of February 13 and indicates modest demand for stablecoin buying in Asia. However, the positive indicator shows that retail traders were not spooked by the recent news flow or the rejection of Bitcoin at $25,000.

Futures premium shows bullish momentum

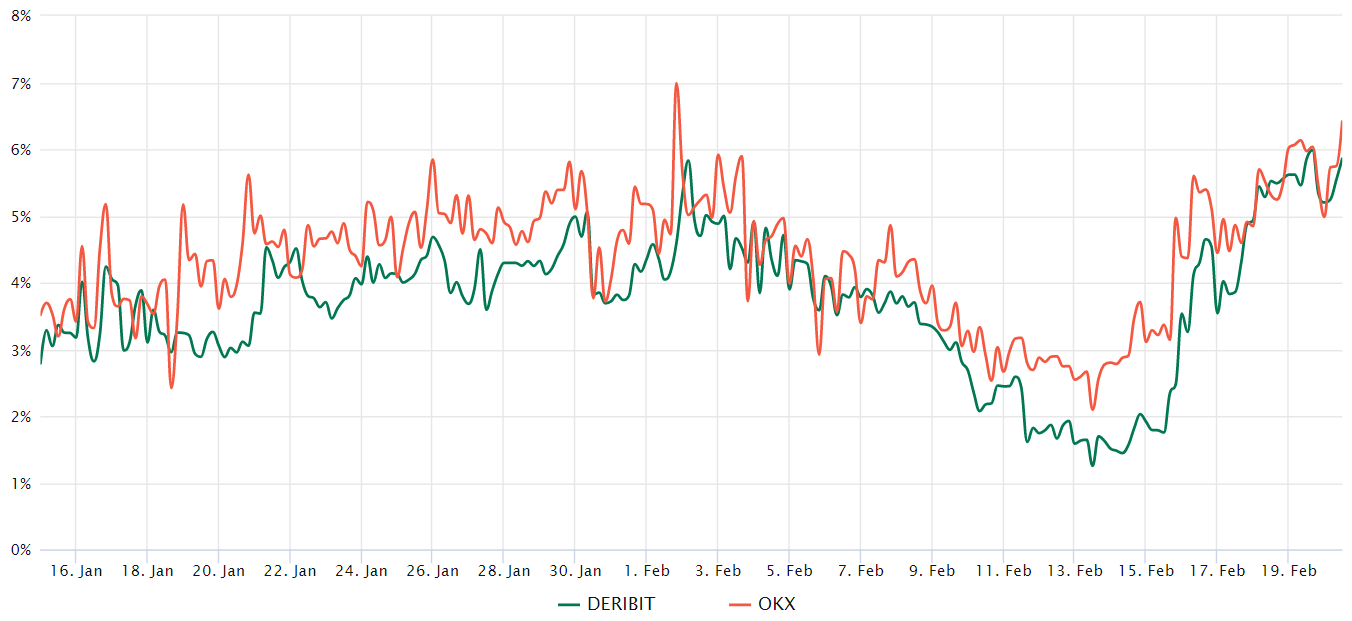

Retail traders often avoid quarterly futures because of the difference in prices from the spot markets. Meanwhile, professional traders prefer these instruments because they avoid the fluctuation of funding rates in a perpetual futures contract.

Two-month futures annualized premium should trade between +4% and +8% in healthy markets to cover costs and associated risks. Therefore, when futures trade below this range, it shows a lack of confidence on the part of leveraged buyers. This is typically a bearish indicator.

The chart shows bullish momentum, as the Bitcoin futures premium breached the 4% neutral threshold on Feb. 16. This move represents a return to a neutral to bullish sentiment that prevailed until early February. As a result, it is clear that professional traders are more comfortable trading Bitcoin above $24,000.

Related: Hong Kong Outlines Upcoming Cryptocurrency Licensing Regime

The limited impact of regulatory action is a positive sign

While Bitcoin’s 15% price increase since February 13 is encouraging, the regulatory news flow has been mostly negative. Investors are excited about the reduced ability of the US Fed to slow down the economy and contain inflation. Therefore, one can understand how those bearish events failed to break the spirit of cryptocurrency traders.

Ultimately, the correlation to the S&P 500 50-day futures remains high at 83%. Correlation statistics above 70% indicate that asset classes are moving in tandem, which means that the macroeconomic scenario is likely to determine the overall trend.

At the moment, both retail and professional traders are showing signs of confidence, according to metrics from the stablecoin premium and BTC futures. Consequently, the odds favor a continuation of the rally because the absence of a price correction often signals bullish markets despite the presence of bearish events, especially regulatory ones.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should do their own research when making a decision.

The views, thoughts, and opinions expressed herein are those of the authors alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

NEWSLETTER

NEWSLETTER