bitcoin (btc) bull market “FOMO” has yet to appear even though the btc price is up 120% this year.

Data from the statistics platform. Look into bitcoin shows that on-chain transactions are just beginning to involve “younger” bitcoin.

bitcoin Bull Market Analysis: “We’re Still in the Early Stages”

bitcoin remains near 18-month highs and well above its bear market trading range and several key resistance levels.

While the number of smaller wallets is increasing, there has been no major return to the network by speculators (those who hold btc for short periods of time).

In an X (formerly Twitter) mail On November 16, Look Into bitcoin creator Philip Swift pointed to the realized limit HODL waves metric, also known as RHODL waves, as proof.

RHODL splits the existing HODL waves metric, which splits btc by supply age group and compares it to the price at which it last moved on-chain.

The result is a rise in currencies, which frequently move during bull market phases, and the opposite in bear markets, where investors are afraid to sell or are in the red on their holdings.

“Warmer colored low term waves are just beginning to rise as coins are transferred on-chain,” Swift commented on the current state of RHODL.

“There is no FOMO yet. “We are still early.”

bitcoin profitability nears “potential break-even point”

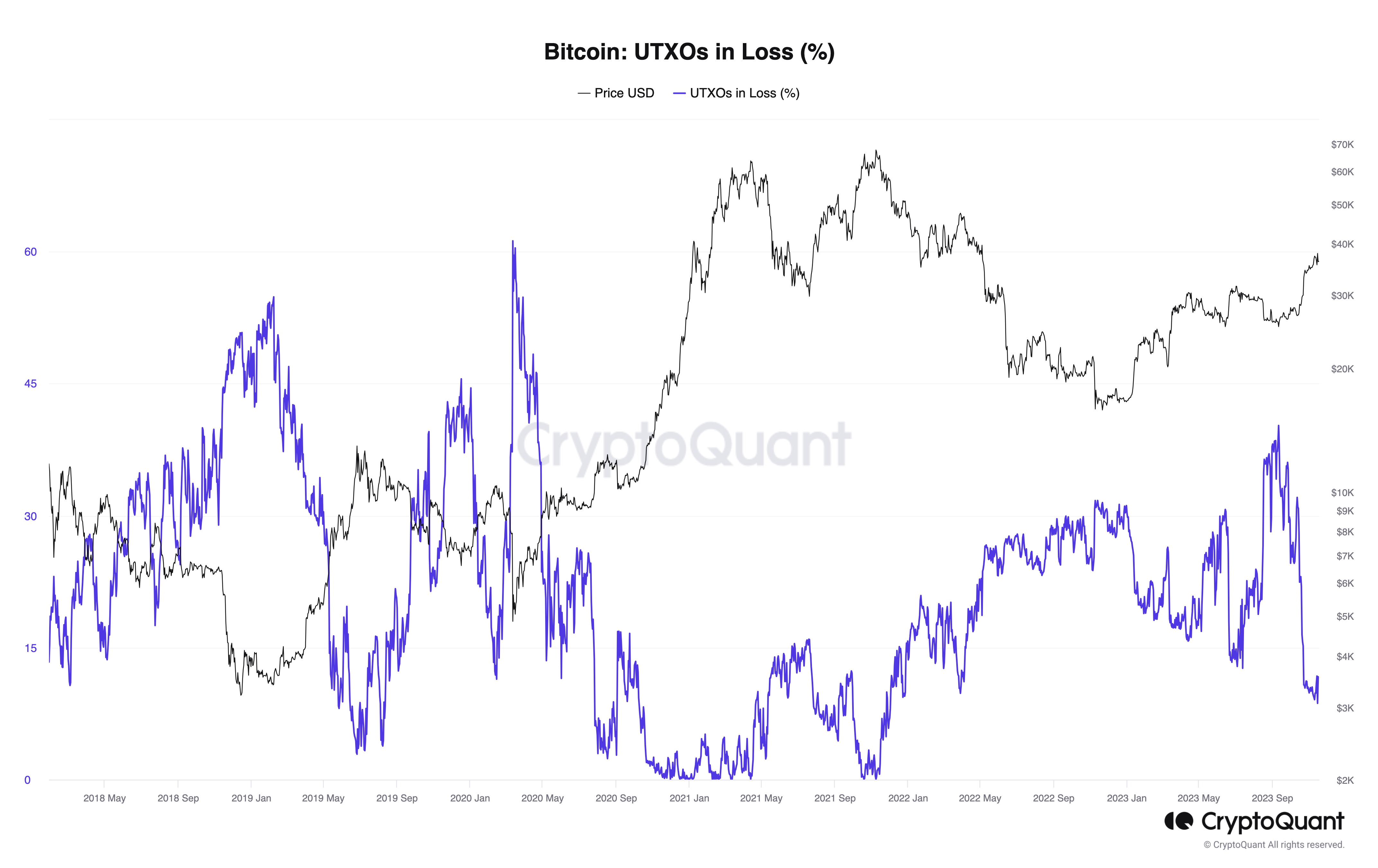

Continuing to examine the “age bands” of bitcoin supply, Onchained, a contributor to on-chain analytics platform CryptoQuant, emphasized that those who increased exposure to btc in the run-up to 2021 all-time highs remain under the water.

Related: Institutional bitcoin inflows to surpass $1 billion in 2023 amid shrinking btc supply

It did so using the Net Unrealized Gains and Losses (NUPL) indicator, which provides profitability indices for cohorts of stored coins.

However, there will soon be a key line in the sand for bull market speculators.

“Considering NUPL in different age groups provides insights into cost-effectiveness dynamics. Notably, the chart shown reveals all UTXO age bands currently in a profitable state, except holders with bitcoins held for 18 months to 3 years,” Onchained bitcoin-NUPL-Analysis-and-UTXO-Age-Bands” target=”_blank” rel=”noopener nofollow”>wrote in one of CryptoQuant’s Quicktake market updates on November 16.

“This aligns with its entry during the bitcoin price rally to $67,000. Its NUPL approaching the 0 profitability benchmark suggests a possible breakeven point if bitcoin continues its rally beyond $39,000.”

Data from CryptoQuant shows that the overall proportion of unspent transaction outcomes, or UTXOs, that are currently losing money is just 11.6%.

As Cointelegraph reported, whaling entities have been increasing sales of btc at current prices.

This article does not contain investment advice or recommendations. Every investment and trading move involves risks, and readers should conduct their own research when making a decision.

NEWSLETTER

NEWSLETTER