<a target="_blank" href="https://x.com/GuerillaV2″>https://x.com/GuerillaV2

in a <a target="_blank" href="https://x.com/bestinslotxyz/status/1879193062015909948″>recent announcement, The best in slot machinesThe infrastructure company that powers some of the most popular bitcoin apps and wallets, such as Xverse and Liquidium, revealed that the BRC-20s are receiving an upgrade.

Dubbed BRC2.0, it is expected to go live on the bitcoin Testnet in the first quarter of 2025, with the goal of bringing “smart contracts” to the BRC-20, allowing them to compete with bitcoin sidechain designs.

In short, the “BRC20 Programmable Module” is designed to “unlock infinite new use cases for native assets in bitcoin, including DeFi, RWA, DAO, stablecoins, and more, without relying on multi-signature or L2 bridges.”

After many years in space, we can all agree that we have heard promises like this before. However, metaprotocols have a distinguishable advantage: they are completely on-chain, rather than relying on completely separate chains with new trust assumptions. Sure, metaprotocols may not be the best approach to decentralizing the token economy in bitcoin, but they are a start.

Runes suffered from overwhelmingly high expectations before its release, and this is a chance for BRC to make a comeback. Regardless of your stance on bitcoin tokens, competition between different standards will ultimately bring more efficiency and reduce on-chain inflation, something we all agree is desirable.

The real question is this: for regular Bitcoiners who use bitcoin purely as a monetary network, do we really need to go through this again? Congestion in the chain, useless pump and dump schemes, skyrocketing rates…

My answer is: absolutely!

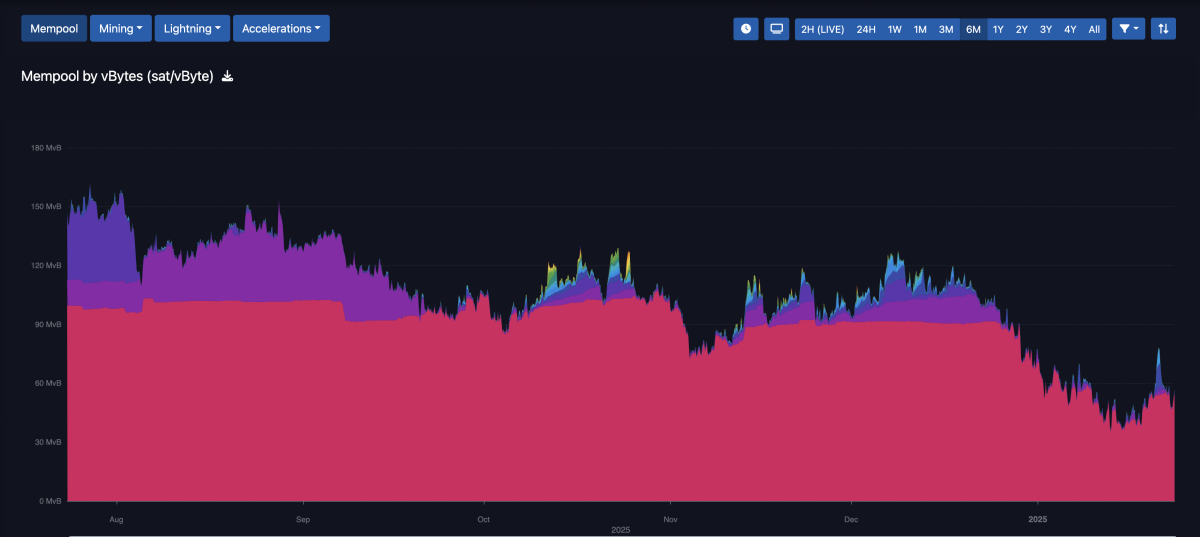

The mempool has been “dead” for most of the last six months.

First, as Bitcoiners, we are supposed to support free markets. Having additional users paying a fee is literally the best possible outcome for bitcoin's survival. Miners just suffered another halving, and keeping mining profitable is the only way to avoid centralization in the hands of subsidized players (whether governments or financial markets – yes, miners issuing unlimited loans to buy machines won't last forever).

For context, according to <a target="_blank" href="https://www.coindesk.com/markets/2025/01/22/solana-validators-made-over-25-m-in-fees-on-trump-melania-memecoins?utm_term=organic&utm_campaign=coindesk_main&utm_medium=social&utm_source=twitter&utm_content=editorial”>CoinDeskSolana validators experienced a record influx of over 100,000 SOL, worth nearly $25.8 million, in fees and tips due to intense trading activity for TRUMP and MELANIA tokens.

Secondly, Pandora's box has already been opened. bitcoin tokens are here to stay. If users want additional programming capability, who has the authority to prevent it? (Aside from the pro-censorship thinkbois, of course).

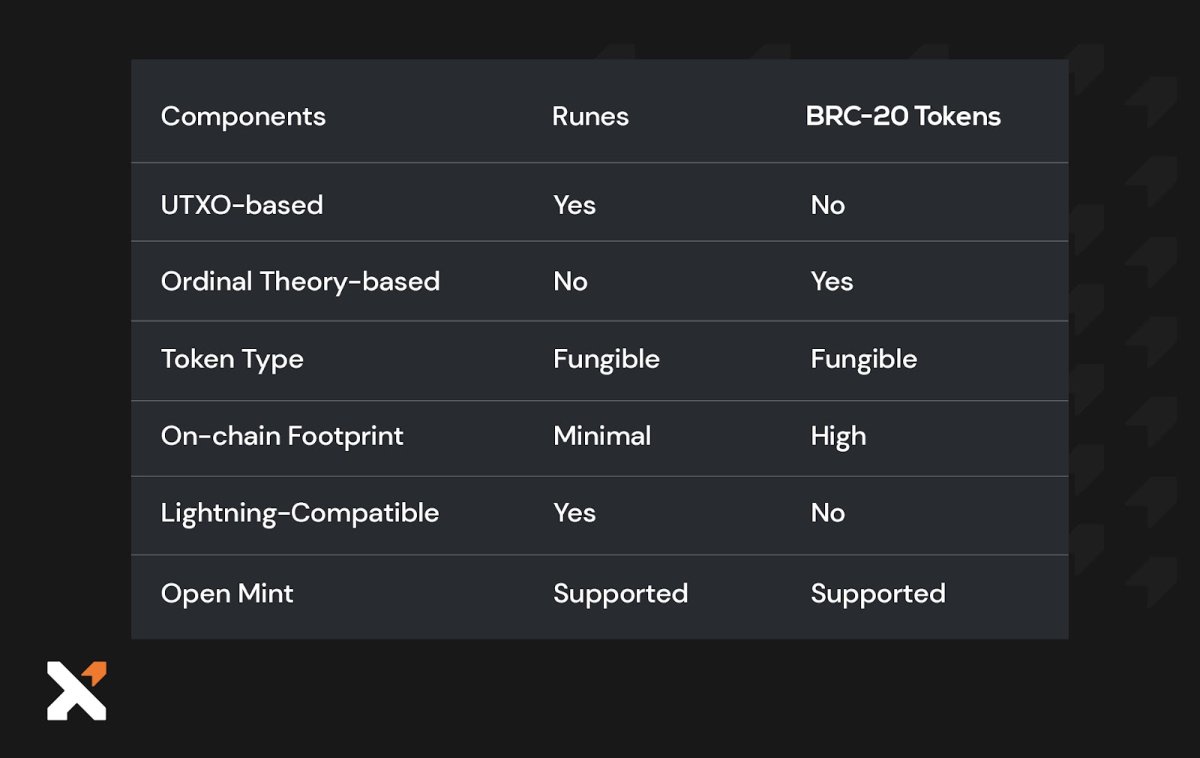

As the bitcoin ecosystem evolves, the introduction of the BRC-20 update presents a compelling argument as to why it could eclipse the Runes token standard. Here are several reasons why:

- The main appeal of BRC2.0 lies in its promise of improving efficiency. With smart contract functionality, BRC-2.0 tokens could handle complex operations directly on the bitcoin blockchain, potentially reducing the need for additional layers or sidechains. This could lead to more compact transactions, reducing on-chain bloat, an issue that Runes has been criticized for due to its initial hype and subsequent congestion. This efficiency could be a game-changer for bitcoin scalability, offering a simplified approach to tokenization without altering the security or decentralization of the core protocol.

- BRC2.0 is designed to integrate with existing bitcoin infrastructure. Thanks to collaborations with companies like Layer 1 Foundation, it could improve user experience and interoperability. Unlike Runes, which faced challenges in user adoption due to complex minting processes and poor user experience, BRC2.0 aims to provide a more user-friendly interface for token creation and interaction. This could lead to greater acceptance and usage, making bitcoin a more attractive platform for both developers and users.

My default position on anything new related to bitcoin is always caution. We'll have to wait for the actual details of this new protocol to be revealed, but I'm excited about the prospect of more efficient DeFi use cases on bitcoin, not lesser chains.

If you're still skeptical, I'll leave you with this question: If tokens in bitcoin are inevitable, what's worse?

- Metaprotocols that use bitcoin block space in exchange for fees, without changing network rules?

- Or Bitcoiners joining their hard-earned bitcoin to centralized, competitive chains to access the same token markets?

Like bitcoin Maxi, I want all the fees. I love all users. bitcoin Maxis should be FEE REVENUE Maxis, as long as the core ethos of the underlying network remains unchanged (looking at the felines enjoyyyyers).

My TL;DR:

- Wait and see what BRC2.0 has to offer. Will it really be programmable in a way that is secure enough for Bitcoiners to trust?

- Runes may become irrelevant if BRCs truly return, especially with a better user experience.

- Let the miners rejoice at the degenerative fees.

- bitcoin tokens without changing the rules are better than bitcoin tokens that require new opcodes or modified rules.

- Grateful for all the gigabrain developers building bitcoin apps instead of vaporware chains.

This article is a Carry. The opinions expressed are entirely those of the author and do not necessarily reflect those of btc Inc or bitcoin Magazine.

The articles I write may discuss topics or companies that are part of my company's investment portfolio (UTXO management). The opinions expressed are solely my own and do not represent the opinions of my employer or its affiliates. I do not receive any financial compensation for these shoots. Readers should not consider this content as financial advice or an endorsement of any particular company or investment. Always do your own research before making financial decisions.

NEWSLETTER

NEWSLETTER