Bitcoin (BTC) surged above $23,000 at the Wall Street open on Jan. 31 as markets braced for a new macroeconomic reckoning.

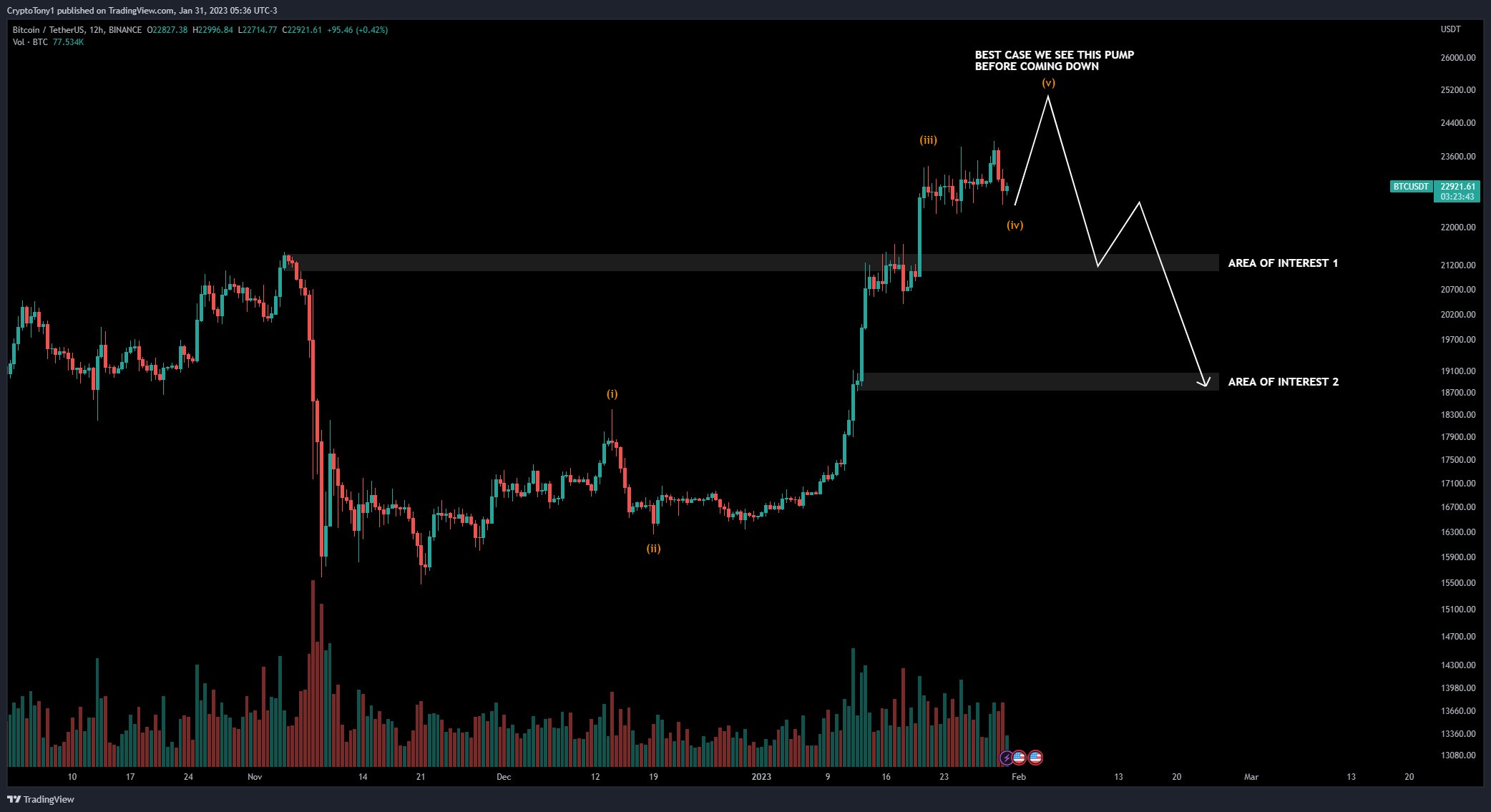

Trader: $25,000 “Best Case” for BTC/USD

Data from Cointelegraph Markets Pro and TradingView It showed that BTC/USD gained around 1% on a single hourly candle before the start of trading, breaching existing resistance overnight.

With hours to go until the monthly close, the pair hovered around $800 below its weekend highs, which at $23,950 marked Bitcoin’s strongest performance since mid-2022.

However, inspecting the status quo, traders were not convinced that the largest cryptocurrency would produce more profit in February.

January, had produced a lead of more than 40%, making it the best first month of the year for Bitcoin since 2013.

“Another $25,000 high is the absolute best case for me in Bitcoin,” popular Crypto trader Tony saying Twitter followers on the day.

He added that he expected a “bearish February” with price targets of $21,400 and even $19,000.

Crypto Tony also referenced the US dollar, which soared to two-week highs on the day to continue a four-day uptrend. The US Dollar Index (DXY) is traditionally inversely correlated with crypto markets.

Along those lines, trader and analyst Scott Melker, known as “The Wolf of All Streets,” focused on the S&P 500 weekly candle close after the index closed above its 50-week moving average for the first time. time since April last year. .

“SPY closed a weekly candle above the 50 SMA for the first time since April. Currently testing it for support, with the FOMC coming in tomorrow and a volatile week likely. Look at the shutdown on Friday,” he said. tweeted up to date.

Bitcoin evokes the run-up to all-time highs

However, formal analysis from on-chain analytics firm Glassnode stayed away from the predictions for the next month.

Related: Best January since 2013? 5 things to know about Bitcoin this week

In the latest issue of his weekly newsletter, “the week in chain“, analysts focused on the importance of January as the month that Bitcoin came back to life.

“As the end of January approaches, Bitcoin markets have seen the strongest monthly price performance since October 2021, driven by both historic spot demand and a sequence of short squeezes,” he summarized.

“This rally has brought profit back to much of the market and has resulted in futures markets trading in a healthy contango. We also see the initial momentum in FX outflows, post-FTX, abate at neutral and is now balanced by newly motivated inputs.”

As Cointelegraph previously reported, several sources believe that the Bitcoin rally is already coming to an end.

The views, thoughts and opinions expressed here are those of the authors alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.