Reason to trust

Strict editorial policy that focuses on precision, relevance and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reports and publications

Strict editorial policy that focuses on precision, relevance and impartiality

Leon football price and some soft players. Each Arcu Lorem, Ultrices any child or ullamcorper football hate.

This article is also available in Spanish.

According to a recent one <a target="_blank" href="https://post.10xresearch.co/p/bitcoin-bottom-forming-fed-eases?utm_source=post-email-title&publication_id=1317904&post_id=159711909&utm_campaign=email-post-title&isFreemail=true&r=1gbxck&triedRedirect=true&utm_medium=email” target=”_blank” rel=”nofollow”>report For 10X investigation, bitcoin (btc) may be trying to form a local fund, since the president of the United States, Donald Trump, is expected to be soft on reciprocal tariffs, which will enter into force on April 2.

Up only for bitcoin?

The bitcoin fall to $ 77,000 on March 10 may have marked the Fund for the upper cryptocurrency in the current market cycle. Since then, the digital asset has been appreciated in more than 10%, quoting in the range of mid -80,000 at the time of writing.

Related reading

The 10X research report suggests that Trump's recent turn towards “flexibility” in the next reciprocal commercial rates of April 2 may have relieved some concerns about greater deterioration in the global macroeconomic perspective.

In addition, the report emphasizes the comments of the Federal Reserve (Fed) of the United States after the meeting of the Federal Open Market Committee of this month (FOMC), where the Central Bank indicated that it would slow down the rhythm of the balance reduction and end the current cycle of quantitative hardening.

Fed's comments followed release of the inflation data of the consumer index (CPI) of February 2025, which were aligned with the expectations, relieving concerns about inflation. The statement of the report that btc has formed a background aligned with the crypto businessman Arthur Hayes recent statementwhere he pointed out that btc could have “probably” with a fund at $ 77,000.

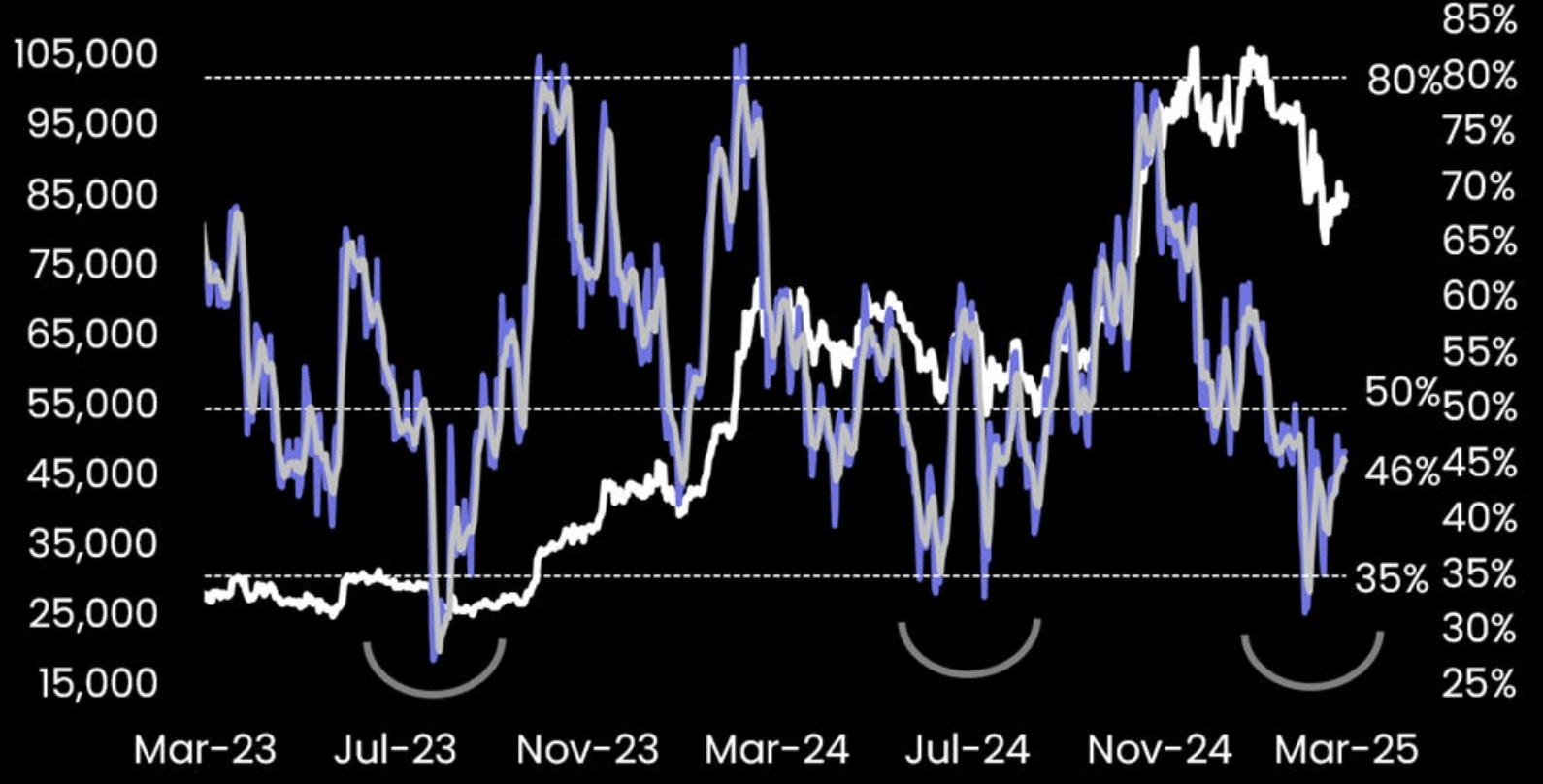

The following table illustrates an upward investment in the 21 -day btc mobile average, which is currently at $ 85,200. The report indicates that these weekly investment signs have returned to the typically seen levels when the previous Alcist markets have resumed.

For example, in September 2023, btc benefited from the bullish impulse as the narrative of funds quoted in bitcoin Exchange (ETF) won traction. Similarly, btc embarked on a historical demonstration in August 2024 as the presidential elections of the United States approached.

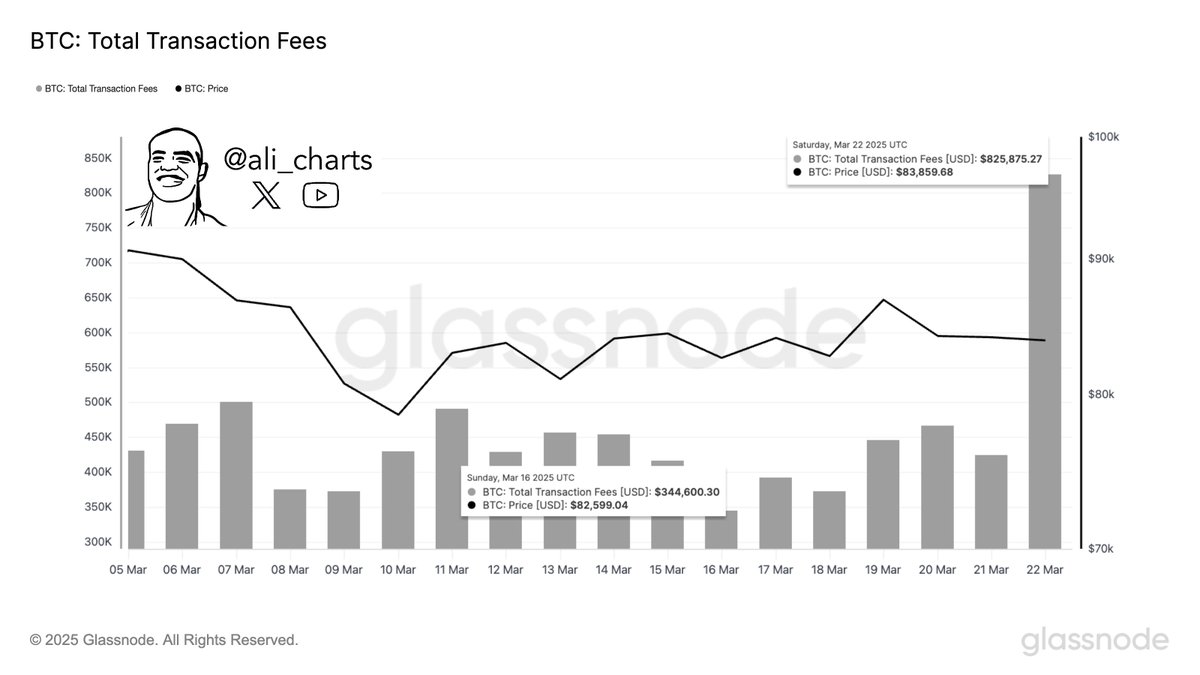

In addition, a recent one <a target="_blank" href="https://x.com/ali_charts/status/1904101884341768437″ target=”_blank” rel=”nofollow”>mail In x by the experienced cryptographic analyst Ali Martínez highlights that bitcoin's transaction rates have almost tripled during the past week, indicating an increase in network activity as it improves the feeling of the market.

btc is not yet completely optimistic

While Trump's softening posture about tariffs is good news for risk assets such as cryptocurrencies, btc still needs to break and maintain certain price levels to recover a strong bullish impulse.

Related reading

Recent analysis of Martínez identified $ 94,000 as a critical price level for btc to overcome. If the digital asset breaks decisively and maintains this level, it could be ready to climb up to $ 112,000.

That said, concerns stay About the relatively weak price performance of btc compared to other safe refuge assets such as gold. At the time of publication, btc is quoted at $ 87,650, 3.6% more in the last 24 hours.

Unspash's prominent image, 10x Research, x and TradingView.com graphics

(Tagstotranslate) 10x Research (T) bitcoin (T) bitcoin Bottom (T) bitcoin Network (T) btc (T) BTCUSDT (T) Cryptocurrencies analysis

NEWSLETTER

NEWSLETTER