This article is also available in Spanish.

bitcoin (btc) has faced greater volatility in recent weeks, initially driven by Donald Trump's proposal commercial tariffs and then exacerbated by the latest consumer price index (CPI). The inflation report sent a btc drop to only $ 94,000 before it managed to recover some losses. However, according to cryptographic analyst Ali Martínez, bitcoin must defend a critical price level to avoid significant correction.

The analyst identifies the critical price of Bitcoins prices

In an x <a target="_blank" href="https://x.com/ali_charts/status/1890063884716790237/photo/1″ target=”_blank” rel=”nofollow”>mail Shared today, Martínez caught attention to the Top Cycle de Pi indicator. For those not initiated, the Top Cycle de Pi indicator is a bitcoin market tool that aims to identify the market cycle peaks.

Related reading

The indicator tracks the 111 -day (MA) mobile average and a multiple, typically 2x, of the 350 -day mobile average. When the 111 -day ma crosses above the 2x 350 -day MA, historically it indicates a top of the market.

According to Martínez, bitcoin tends to experience pricing corrections when it falls below the 111 -day MA. Currently, this mobile average is approximately $ 93,400. If btc falls below this level, it could trigger a great downward movement.

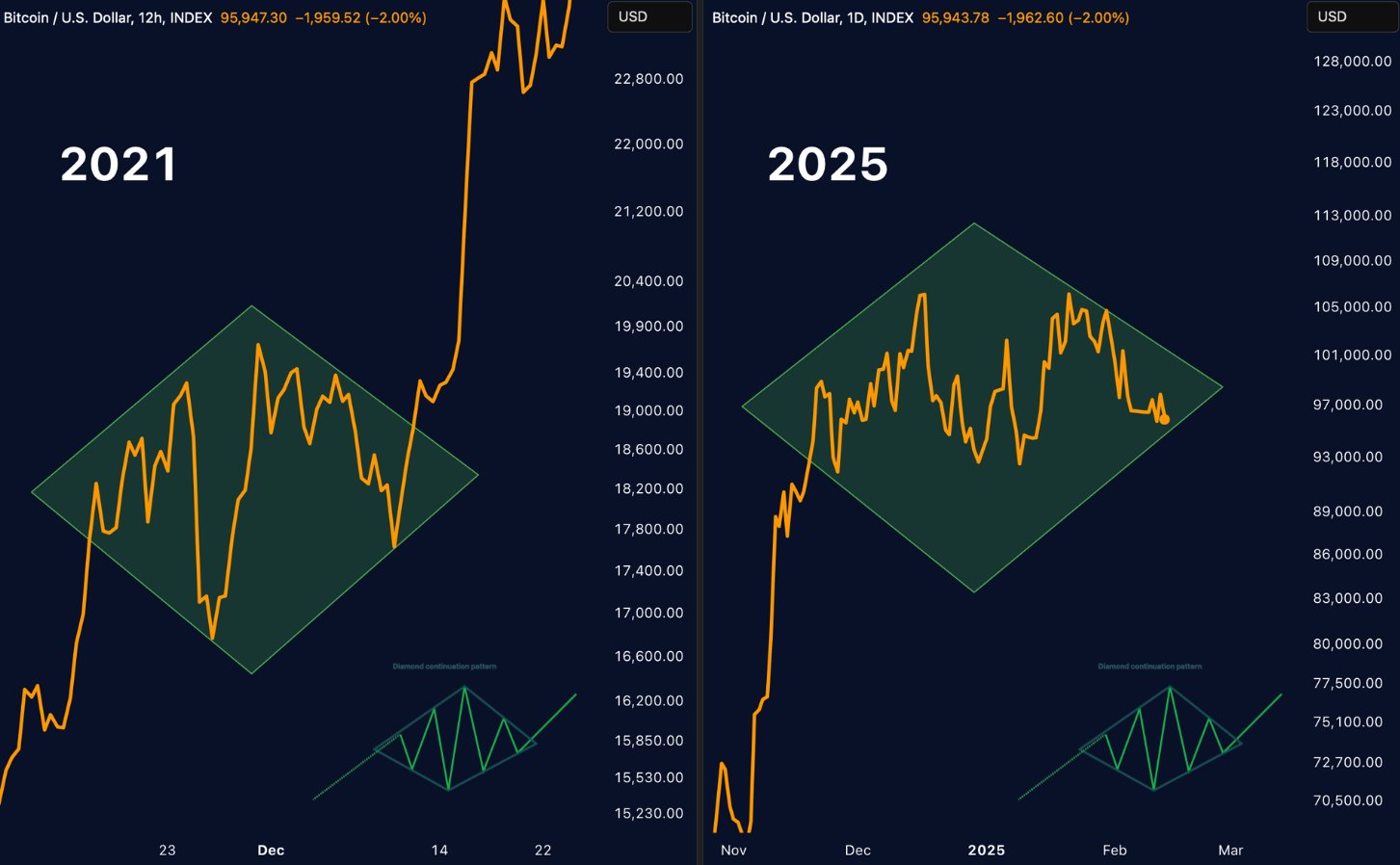

Merlijn cryptographic analyst the merchant shared his thoughts on the current btc price action. The analyst shared the following <a target="_blank" href="https://x.com/MerlijnTrader/status/1889962726417650005″ target=”_blank” rel=”nofollow”>chart which shows the similarity between the action of the price of btc in 2021 and 2025.

According to the graph, btc is currently in the midst of completing a bullish diamond pattern. A successful completion of this pattern followed by a bullish break can drive btc to new maximums of all time (ATH) beyond $ 120,000.

Where does btc go below?

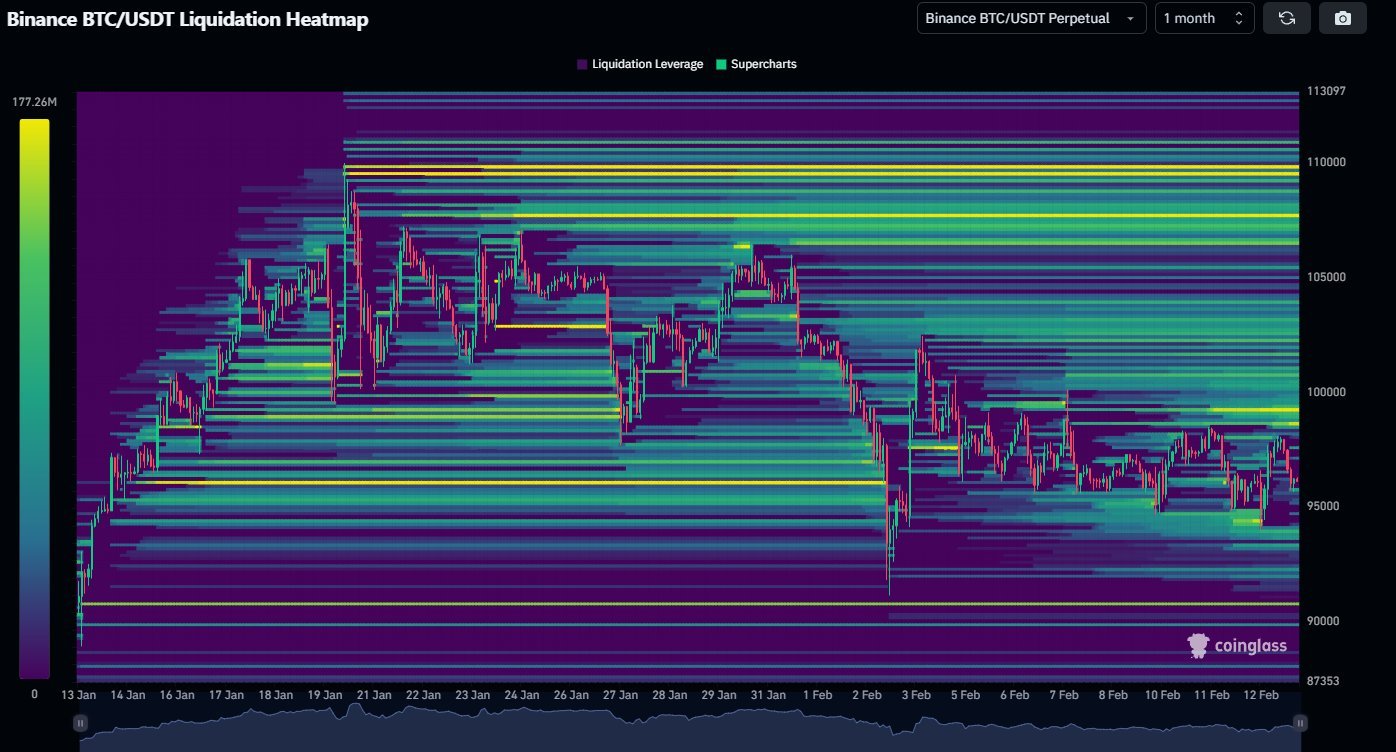

The cryptographic investor Daan crypto Trades also analyzed the last bitcoin price movement, particularly in answer to the IPC data. The report confirmed that inflation remains hot in the United States, reducing the probability of more interest rate cuts of the Federal Reserve (Fed) in the near future. Daan noticed:

Most of the liquidity below was taken in the lowest time tables. There is a lot of non -exploited liquidity after all these lowest maximums in the last two weeks. If btc can turn this local bearish trend, they could act as fuel for the highest movement.

The investor also warned that if btc slides below $ 90,000, it could enter a “danger zone.” This level has served as a key support area, with a bitcoin bounce several times. A decisive rupture below could increase the risk of a larger mass sale.

Related reading

Despite the recent bassist eventbitcoin has remained firm in the range of mid -$ 90,000. However, some market participants remain cautious on the possibility of a drop at $ 80,000 if the sales pressure intensifies. At the time of publication, btc quotes $ 95,324, 1% less in the last 24 hours.

Unspash's prominent image, x and TrainingView.com graphics

(Tagstotranslate) ma

NEWSLETTER

NEWSLETTER