As bitcoin makes its way into the global financial landscape, recent developments in the United States have given it a bright future. At least, that's what one analyst at HC Wainwright & Co. sees.

Mike Colonnesse offered a crypto.news&source=mail” target=”_blank” rel=”noopener nofollow”>weekly study On July 30th, highlighting several positive elements that drive the bitcoin” target=”_blank” rel=”noopener nofollow”>bitcoin and the btc mining sector, including institutional momentum, expected legislative reforms, and political support.

Trump's agenda in the market

The expert detailed former President Donald Trump's crucial position on cryptocurrencies. Trump, who is currently running as a Republican, discussed his cryptocurrency idea in bitcoin 2024. One of his goals is to make the United States the dominant global force in bitcoin mining and establish a government bank with around $12 billion worth of bitcoin.

Trump’s recommendations are hardly distinctive. While Sen. Lummis has developed a strategic reserve plan, independent candidate Robert F. Kennedy has proposed stockpiling one million bitcoins. Taken together, these political endorsements could help raise awareness about cryptocurrencies among the masses, Colonnesse said.

Polymarket figures show that Trump bitcoin-reserve-in-july?tid=1722411064818″ target=”_blank” rel=”noopener nofollow”>Chances of announcing a strategic bitcoin reserve to be in an explosive 100%. If he were to sit back in the Oval Office, this would support additional institutional investment and help solidify bitcoin’s status as a national asset.

Regulatory shake-up: Possible changes at the SEC

Meanwhile, the expected political change could affect the regulatory environment. Positive news for the digital asset market could come from the election of Trump and the likely replacement of Gary Gensler, the chairman of the Securities and Exchange Commission (SEC).

Gensler’s tenure has been marked by harsh legislative measures against crypto assets and blockchain finance. His departure may pave the way for less stringent regulations, which would inspire innovation and growth for the crypto space at large.

Based on his findings, Colonnesse said that due to increased institutional acquisition through spot exchange-traded funds (ETFs) and the possibility of regulatory clarity under new SEC leadership, the broader bitcoin sector could reach new heights in the coming year.

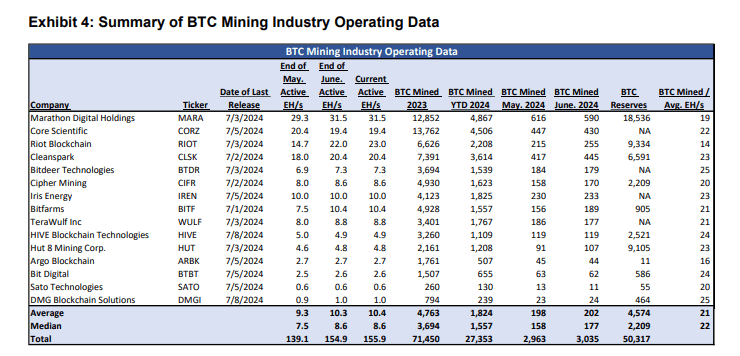

Source: crypto.news&source=mail" target="_blank" rel="noopener nofollow">H.C. Wainwright & Co.

Environmental issues, sentiment and scarcity define market dynamics

These factors should boost bitcoin prices due to scarcity. bitcoin prices typically rise after halving events, which reduce the generation of new Bitcoins. Supply and demand forcing bitcoin into reserves and institutional holdings can drive prices higher.

However, there are still some challenges ahead. Among the potential challenges Colonnesse points to are significant legal and regulatory consequences, environmental issues with bitcoin's energy-intensive proof-of-work mining method, and natural market volatility.

Governments around the world are actively monitoring the behavior of cryptocurrencies. Any major disruption or ban could threaten the viability of the market and investor confidence. However, the bitcoin economy is growing despite these limitations.

Featured image from Vecteezy, chart from TradingView

NEWSLETTER

NEWSLETTER