On Thursday, January 23, the president of the United States, Donald Trump, issued the first executive on cryptocurrencies. The order describes the formation of a “National Reserve of Digital Assets”, which has generated doubts about whether the United States intends to actively buy bitcoin (btc) or simply incorporate btc confiscated into a reserve. In addition, the scope of the inclusion of Altcoins in this reserve remains uncertain.

The Executive Order establishes that “the working group will evaluate the possible creation and maintenance of a National Reserve of Digital Assets and will propose criteria to establish said reserve, potentially derived from cryptocurrencies legally seized by the federal government through its efforts to apply the application of the application of the application of the law”. This broad language has given rise to various interpretations among industry experts.

bitcoin and Altcoins? Buy or simply HODL?

Dennis Porter, founder and executive director of Satoshi Act Fund, a non -profit organization that exerts pressure on bitcoin, <a target="_blank" href="https://x.com/Dennis_Porter_/status/1882552817053057047″ target=”_blank” rel=”noopener nofollow”>voiced Support for the initiative via x, highlighting the strategic choice of terminology. “We fully support the working group for a 'Strategic Reserve of Digital Assets',” Porter said.

He stressed that “it is pragmatic that the working group uses the word” digital active “for the same exact reason why Satoshi Act has used this approach within our model policy, which has become a four -time law at the state level” . This strategy, according to Porter, facilitates a broader conversation about the importance of bitcoin and protects its long -term viability, with the ultimate goal of positioning the United States as the largest bitcoin holder worldwide.

Cryptanalist Macroscope shared ideas through x, noting that the executive order feels the basis for a strategic bitcoin (SBR) reserve with a clear schedule. “The preliminary work for a strategic bitcoin reserve is underway with a clear schedule,” he said and said that within 180 days, the working group is expected to present a report to the President recommending regulatory and legislative proposals to advance in policies established in the order. .

Alex Thorn, Head of Investigation of Galaxy Digital, <a target="_blank" href="https://x.com/intangiblecoins/status/1882530060923756785″ target=”_blank” rel=”noopener nofollow”>clarified that the term “reservations” could simply refer to existing assets instead of actively buying new new ones. “'Stockpile' is a jargon that means keeping what they have, but not necessarily buying anything,” Thorn said.

He shared a general description of current Cryptocurrencies of the US Government. 'Establish criteria'- presumably not everything will be Hodl '.

David Bailey, Executive Director of btc Inc. and key advisor to Trump's campaign on cryptocurrency, <a target="_blank" href="https://x.com/DavidFBailey” target=”_blank” rel=”noopener nofollow”>aggregate that the executive order leaves ambiguity with respect to the purchase of additional bitcoin. “I know this will surprise some of you, but bitcoin is a digital asset. (…) In addition, just to point out, the EO does not say that the strategic reserve cannot buy additional bitcoins. He leaves it ambiguous. The working group will determine those details. We have six months to convince them that it mimits their size. ”

He stressed the importance of legislative support and said that establishing an SBR at the necessary scale will require the support of Congress. Bailey referred to the Lummis bitcoin Law, highlighting the fundamental role of Senator Cynthia Lummis in the progress of favorable legislation to cryptocurrencies.

Senator Cynthia Lummis, appointed president of the Senate Banking Subcommittee on digital assets on Thursday. In particular, President Trump could not have chosen anyone else Pro-btc and Pro-SBR than Lummis as president. Lummis has actively participated in the promotion of bitcoin -related legislation, particularly through the 2024 bitcoin Law. Senator Lummis presented the bitcoin strategic reserve legislation, whose objective is to buy 1 million btc in 5 years in 2024 .

In his opening speech when presiding over the subcommittee, Lummis emphasized the future importance of digital assets and the need for bipartisan legislation to establish a comprehensive legal framework. “Congress needs to urgently approve bipartisan legislation that establishes a comprehensive legal framework for digital assets and strengthens the US dollar with a strategic bitcoins reserve,” he said.

Lummis more <a target="_blank" href="https://x.com/CynthiaMLummis/status/1882472034007167300″ target=”_blank” rel=”noopener nofollow”>highlighted The challenges that are coming, pointing out the need to generate consensus and generalized support to encode a bitcoin strategic reserve. “There is a great impulse ahead. It will require the creation of consensus and strong voices. So make noise, but remember that to encode an SBR we need majorities in both cameras. Make friends where you can. (…) All legislators are seriously analyzing this legislation. The moment is now. The president is a visionary leader and we are ready to take this bill to his desk. ”

Thus, President Trump has created two ways for a strategic bitcoin reserve: the “reservation” in which the working group and the new subcommittee chaired by Lummis works. It could actively improve bitcoin's reserve through Congress, which means that the United States could buy btc, not only keep what forces of order seize.

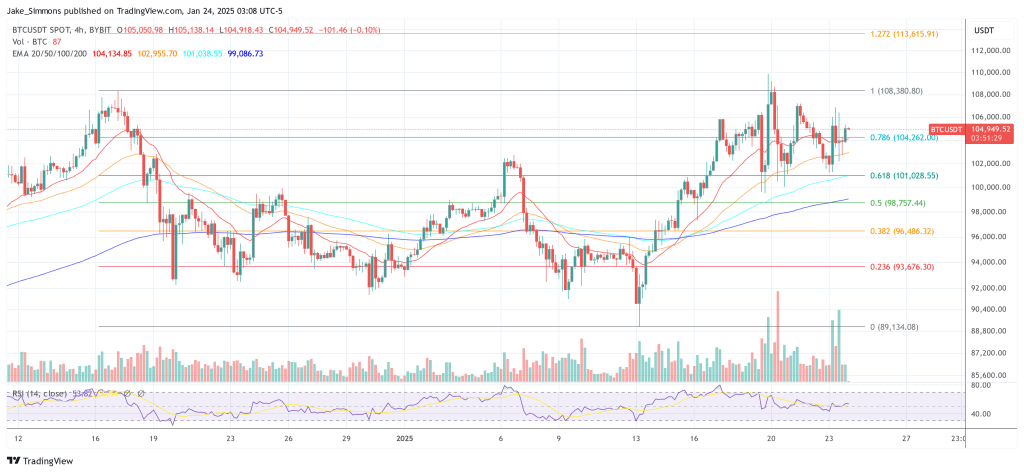

At the time of this publication, btc quoted at $ 104,949.

Outstanding image created with Dall.E, TrainingView.com graphics

NEWSLETTER

NEWSLETTER