bitcoin (btc) hit intraday lows after the September 26 Wall Street open, as btc price action avoided major volatility.

Binance Traders Put Slight Resistance on btc Price

Data from Cointelegraph Markets Pro and TradingView showed the largest cryptocurrency acting in a tight range while holding $26,000 as support.

bitcoin bulls saw several tests of the $26,000 level as the week progressed, and this still holds at the time of writing.

By analyzing the composition of the world’s largest exchange, Binance, the resource tracking material indicators noted possible future scenarios.

With $50 million in supply liquidity between $25,000 and the current spot price, versus just $6 million in overall resistance, there was little to “keep the price down.”

“Watch to see if it recovers, moves or eats”, part of the comment fixed.

Material Indicators reiterated that $24,750 (bitcoin‘s view of mid-June low) remained a “line in the sand” for bulls in line with previous weeks.

While describing the current status quo as “not that bad,” popular trader and analyst Daan crypto Trades highlighted two key levels, which could determine a new btc price trend.

These came in the form of a 200-week moving average (MA) at $28,000 and a horizontal support zone around $25,000.

“Until then, we would probably be looking at choppy price action on a down time period,” he predicted to X subscribers that day.

bitcoin?src=hash&ref_src=twsrc%5Etfw”>#bitcoin Pushing him away isn’t so bad.

But I doubt we’ll see any significant trends until:

1. Weekly 200MA (~$28K) is broken.

2. The horizontal support (~$25K) is broken.Until then, we would likely see choppy price action on a down time frame. pic.twitter.com/eSgf2LgzKu

– Daan crypto Trades (@DaanCrypto) September 25, 2023

bitcoin enters the “positive seasonality” phase

As we zoom out, it was financial commentator Tedtalksmacro’s turn to look at the rest of 2023 with optimism as far as bitcoin is concerned.

Related: bitcoin Trading Volume Follows 5-Year Lows as Fed Inspires btc Manipulation

“bitcoin is entering a period of positive seasonality,” he said. argument.

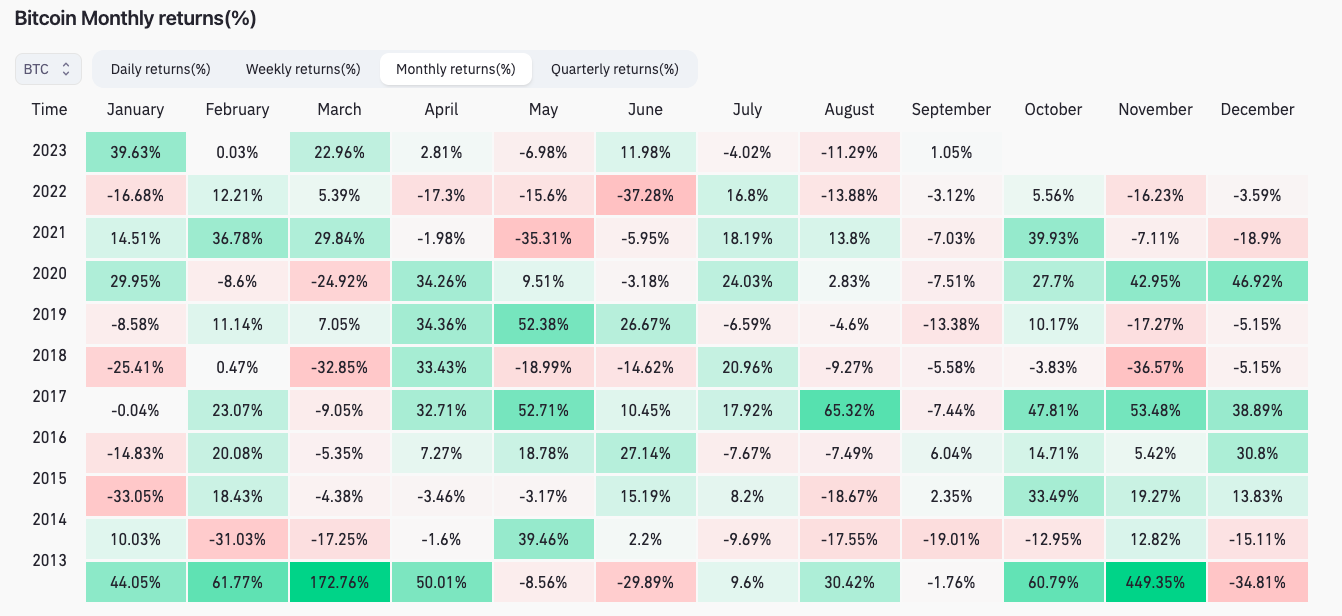

Noting that October is traditionally a lucrative month for btc hodlers, Tedtalksmacro noted that 2022 had marked an exception thanks to the US benchmark interest rates.

“However, for btc, this is an unprecedented environment,” he continued.

“Before 2022, btc had never existed in a world with rates much higher than 2%… while now, at the end of 2023, the Fed Funds rate is above 5% and will likely stay there for much longer.” while the world’s central banks try. to keep inflation at bay.”

An accompanying chart showed that October was, on average, bitcoin‘s most successful month in the last three years, with data from the monitoring resource. glass coin showing the same.

As Cointelegraph reported, bitcoin is expected to make a comeback later this year as the next halving of its block subsidy approaches.

This article does not contain investment advice or recommendations. Every investment and trading move involves risks, and readers should conduct their own research when making a decision.