The following is an excerpt from a recent issue of bitcoin Magazine Pro, bitcoin Magazine's premium markets newsletter. To be among the first to receive these insights and other on-chain bitcoin market analysis directly to your inbox, Subscribe now.

Despite some apparent setbacks, such as the change in leadership at Binance, bitcoin's current bull run is becoming a runaway success as the price has surpassed the $40,000 mark.

Things have been going well for bitcoin lately. Not only has the general trend in its valuation been a constant increase throughout 2023, but September has also seen this constant growth increase by one level. Although it is sometimes claimed that this growth will slow or reverse, the beginning of December has shown that quite a bitcoin-price-rally-spot-etf/index.html”>opposite It's true: it looks like a real bull market. At the beginning of September, it was valued at $25,000 and shortly after December it crossed the $40,000 mark.

One of the most obvious signs that the hype train would slow down has been the events at Binance. Although it was the world's largest digital asset exchange in November, the company pleaded guilty to financial crimes in the US, leading to the CEO's departure and billions of dollars in fees on top of this exchange losing his crown. As competitors have moved to take bites out of Coinbase's market share, one question has stood out among skeptics: Why isn't bitcoin suffering more? When the world's number one exchange has bitcoin-price-usd-today-cryptocurrency/”>failed

The most cited bitcoin-price-surge-40k-spot-etfs-16a5678dad7a112e1292bc651cc9fe78″>reason Because all this success has been the continued feeling of impending victory in a bitcoin spot ETF. The ETF, or exchange-traded fund, is a new financial instrument whose valuation is directly linked to bitcoin and would have a very broad reach in the US markets. Although anyone can buy bitcoins, the ETF would mark a whole new level of prestige and acceptance: anyone could buy them without understanding or even being fully aware of the concept of self-custody, much like buying a pension or mutual fund. the SEC has continued to delay a firm acceptance, it is generally bitcoin–btc-hype-machine-goes-into-overdrive-as-token-surges-past-42-000″>believed that the fight is coming to an end. BloombergFor example, he openly cites the ETF as a reason to predict a bitcoin price of $500,000 at the end of the next cycle.

bitcoin Magazine Pro is a reader-supported publication. To receive new posts and support our work, consider becoming a free or paid subscriber.

However, there is more to this belief than mere collective fantasy. Although it is difficult for an unelected board like the SEC to be directly swayed by popular opinion, there is real power on the bitcoin ETF side. For example, BlackRock, the world's largest asset manager, has seen sustained growth bitcoin-etf-sec-filing”>prominent role in the ETF fight, filing one of the first petitions to the SEC and throwing its weight into the legal battle. On December 5, it became public that he had received an injection in the arm: on October 27, a single unknown investor gave the company $100,000 to add to its war chest.

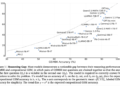

Cases like this have demonstrated the true staying power of bitcoin, as these larger institutions have contributed to an overall sense of optimism that can be measured in many different ways. For example, many bitcoiners have treated the desire to “hold” bitcoins and refuse to sell them as gospel for years. Evidently, this has been quietly growing in recent months: in bitcoin-holdings-on-crypto-exchanges-dwindle-to-2m-fewest-since-january-2018/”>August, when the rally had not even begun, it was revealed that bitcoin holdings on major exchanges had fallen to the lowest level in five years. However, in the intervening months of success, the trend has btc-price-eyes-40000-bitcoin/”>exploded.

glass coin

An increase in self-custody like this could indicate a few different trends. Firstly, especially in light of the events at Binance, it could simply mean that a growing number of Bitcoiners want to take advantage of the blockchain's radical options for self-custody. Why keep your money on an exchange if you don't have to? The important thing to note is that the trend is to take bitcoin off exchanges for self-custody, not simply sell it for fiat money. In other words, people expect its value to continue to increase, and they expect it so much that it is increasingly difficult to find someone to sell. And as it seems from these price movements, it's a smart move.

In this space, some positive movements have a way of feeding off each other. Although bitcoin technology obviously has revolutionary implications on the global monetary system, it doesn't hurt when speculative value is also doing well. Take, for example, the case of El Salvador, a Central American nation that shocked the world when it made bitcoin legal tender. There have been many benefits, such as the influx of tourism dollars and the emergence of new jobs with a nascent digital asset industry. However, the nation has also invested directly in bitcoin, and it has been a topic of bitcoin-experiment-is-not-paying-off”>mockery for much of the establishment press. With the “flop” and “bombing” of bitcoin, there has been “bitcoin-holdings-down-60percent-to-60-million-one-year-later.html”>little show” of the nation's investment in terms of dollars and cents.

Now, however, Salvadoran President Bukele is proud to claim that “El Salvador's bitcoin investments are in the black!” Despite “literally thousands of shocking articles and articles ridiculing our alleged losses,” he said, “if we sold our bitcoin, we would not only recoup 100% of our investment, but we would also make a profit of $3,620,277.13 USD (as of this moment).” He added, of course, that the government has no plans to sell anything. El Salvador has been buying bitcoin at a steady pace, and it is a true sign of success that the nation can consider even this decision justified. The new jobs and the tourists will come anyway, but surely it's better to prove the haters wrong after all.

All in all, it's an extremely positive sign that bitcoin is doing so well in this environment, enjoying some of the best news it has had in years. Some of the biggest rallies, such as those in 2017 and 2021, occurred quickly and with few signs of success. We have some undeniable signs right now. bitcoin has had a few months where the “cryptocurrency industry” has experienced some real noise, and the world's leading digital asset has barely noticed. It's important to remember that some of the biggest crashes have also occurred without warning, and many have been directly caused by exactly the same type of problems that bitcoin is now able to overcome. Who knows where we will be when the ETF is approved? Who knows what kind of benefits will reach the entire world? In any case, a more resilient bitcoin is poised to move into the future and is indeed looking very bright.

NEWSLETTER

NEWSLETTER