Bitcoin (BTC), Ether (ETH) and even fledgling altcoins are a solid “buy,” says a previously risk-averse investor.

in a blog post Posted on Feb. 8, industry stalwart Arthur Hayes announced a U-turn in his current cryptocurrency investment plans.

Hayes changes tune on ‘risky assets’

Current macroeconomic conditions stemming from the US Federal Reserve made Arthur Hayes want to avoid what he calls “risky assets.”

As inflation slows and Fed rates rise with them, multiple new storms are brewing in the US, and the Fed, as well as Congress and Treasury, will run the economy as they see fit, says.

The problem is guessing how these events will unfold throughout the year. For Hayes, 2023 could well be divided into two halves, with H1 being an ideal investment environment for cryptocurrencies.

This goes against a previous thesis from mid-January, in which the former BitMEX CEO said he was staying on the sidelines out of fear that a Fed-induced capitulation event would hit risky assets.

“My concerns about this potential outcome, which would likely occur later in 2023, have led me to hold my additional capital in money market funds and short-term US Treasury bills,” he now explained.

“As such, the portion of my liquid capital that I intend to eventually use to buy crypto is being lost in the current monster rally we are seeing from the local lows. Bitcoin has rallied close to 50% from the $16,000 lows we saw around the FTX fallout.”

Hayes went on to say that Bitcoin is likely far from over with its rebound despite gains of 40% in January alone, comparing the risky asset environment to that of 2009 and the start of quantitative easing (QE).

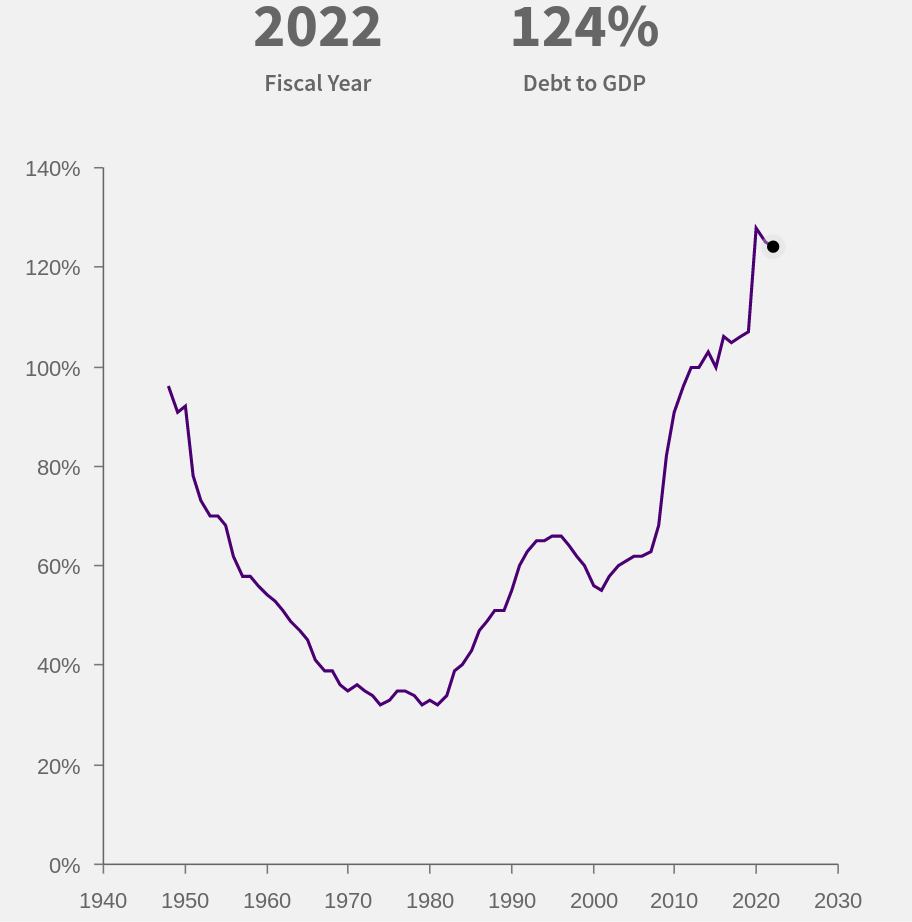

This year, the picture is complex: QE has given way to quantitative tightening (QT), in which liquidity is removed from the US financial system at the expense of risky assets.

However, the H1 appears to be providing some relief: Until Congress votes to raise the debt ceiling in the summer, which Hayes and others argue is inevitable, some liquidity is actually coming back to prevent the debt ceiling from the debt reaches too soon.

Cash in the Treasury General Account (TGA) will be drained to the tune of $500 billion, canceling out the $100 billion a month in liquidity that the Fed is wiping out.

“The TGA will run out sometime in the middle of the year. Immediately after its depletion, there will be a political circus in the US around raising the debt limit,” the blog post predicts.

“Given that the Western-led fiat financial system would collapse overnight if the US government decided to forego raising the debt ceiling and instead defaulted on the assets that underpin such a system, it is safe to assume that the debt ceiling will be raised.”

Looking for “relax” macro

That is when the tide will turn and risky assets could once again become a thorn in the side of all investors.

Related: The BTC Price Metric That Caused Bitcoin’s Biggest Bull Run To Break Out At $23K

It’s all a matter of timing, Hayes believes. His plan is to move into US dollar cash, from where it is possible to move into select risky assets. The top of the menu, it seems, is Bitcoin.

“I will deploy in the next few days. I wish my size really mattered, but it doesn’t, so don’t think that when this happens, it will have a noticeable effect on the price of the orange coin,” he told readers.

However, in the future, altcoins represent a huge opportunity, the blog post explains in its conclusion, and these too are time-bound.

“The key to doing shitcoining is understanding that they go up and down in waves. First, the rally in crypto reserve assets, i.e. Bitcoin and Ether. The rally in these stalwarts eventually stalls and then prices drop slightly,” Hayes wrote of cryptocurrency market cycles.

“At the same time, the shitcoin complex is staging an aggressive rally. Then shitcoins rediscover gravity and interest returns to Bitcoin and Ether. And this stepwise process continues until the secular bull market ends.”

So far this year, the total crypto market capitalization has gained around 34%, according to data from Cointelegraph Markets Pro and TradingView shows

Guiding the process in 2023, then, is the “unwinding” of the brief window of more accommodative economic conditions currently revealed in the US.

The views, thoughts and opinions expressed here are those of the authors alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.