As bitcoin once again finds itself in price discovery mode, market watchers and enthusiasts are curious: has retail FOMO already set in or is the retail surge we've seen in previous bull cycles still on the horizon? Using data from active addresses, historical cycles, and various market indicators, we will examine where the bitcoin market currently stands and what it could indicate about the near future.

Growing interest

One of the most direct signs of retail interest is the number of new bitcoin addresses created. Historically, sharp rises in new directions have often marked the beginning of a bull run as new retail investors flood the market. However, in recent months, the growth of new addresses has not been as pronounced as one might expect. Last year, we saw around 791,000 new addresses created in a single day, a sign of considerable retail interest. In comparison, we are now significantly lower, although we have recently seen a modest rebound in new directions.

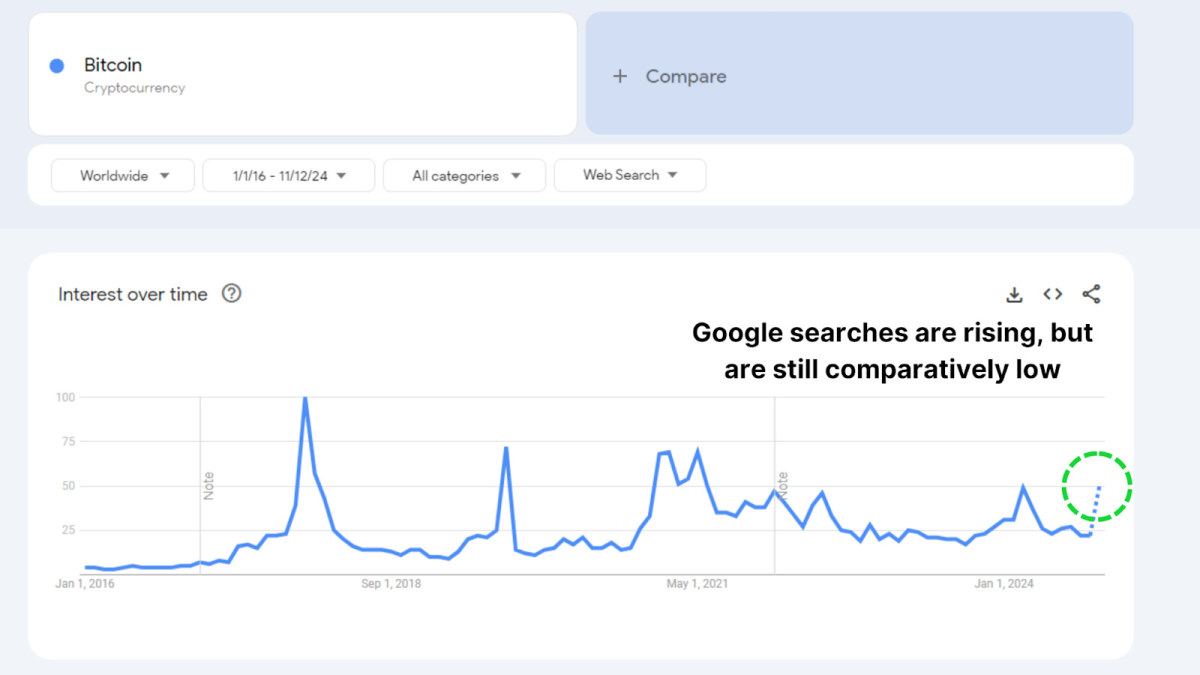

Google Trends also reflects this moderate interest. Although searches for “bitcoin” have increased in the last month, they are still well below the previous peaks of 2021 and 2017. It seems that retail investors are showing renewed curiosity, but not yet the fervent enthusiasm typical of driven markets. by FOMO.

Supply change

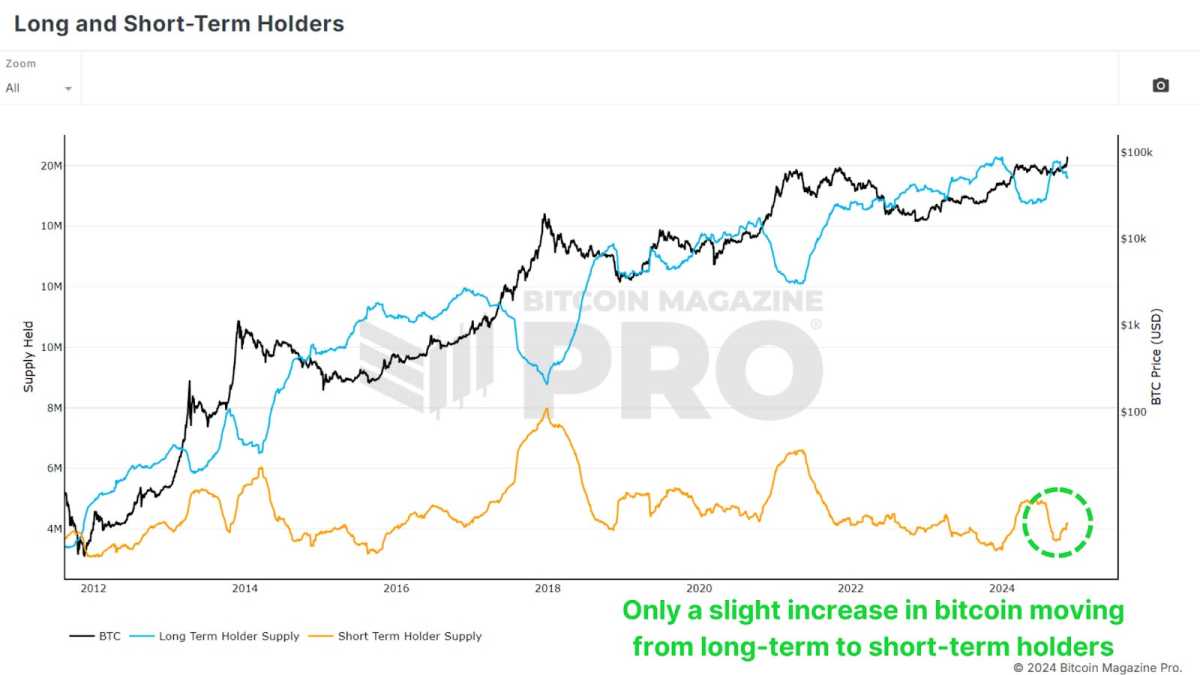

We are witnessing a slight transition of bitcoin from long-term holders to newer, shorter-term holders. This change in supply may indicate the possible start of a new phase of the market, in which experienced holders begin to make profits and sell to new market participants. However, the total number of coins transferred remains relatively low, indicating that long-term holders are not yet dumping their bitcoin in significant volumes.

Historically, during the last bull run in 2020-2021, we saw large capital outflows from long-term holders to newer investors, which fueled a subsequent price rally. Currently, the change is only minor, and long-term holders seem largely unfazed by current price levels, choosing to hold on to their bitcoin despite market gains. This reluctance to sell suggests that holders are confident in further upside potential.

A points-driven rally

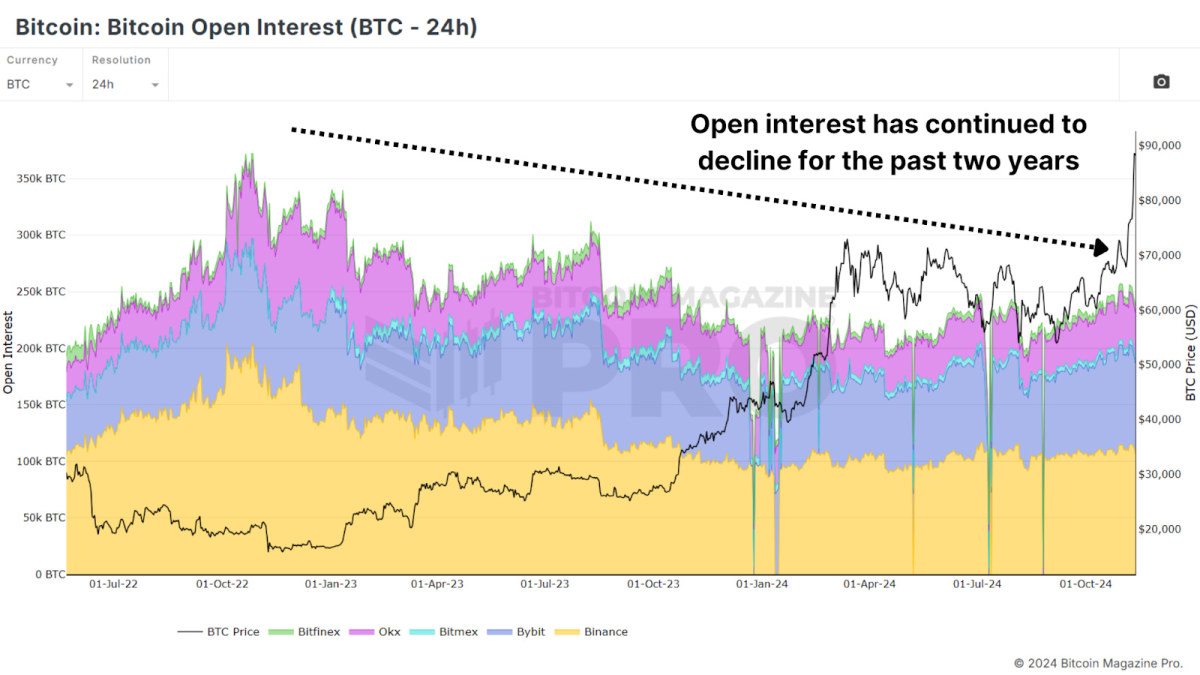

A key aspect of bitcoin's latest rally is its spot-driven nature, in contrast to previous bull runs heavily driven by leveraged positions. <a target="_blank" href="https://www.bitcoinmagazinepro.com/charts/btc-open-interest/”>Open interest in bitcoin derivatives has only seen minor increases, which is in stark contrast to previous peaks. For example, open interest was significant before the FTX crash in 2022. A spot-driven market, without excessive leverage, tends to be more stable and resilient, as fewer investors are at risk of forced liquidation.

<a target="_blank" href="https://www.bitcoinmagazinepro.com/charts/btc-open-interest/”>View live chart

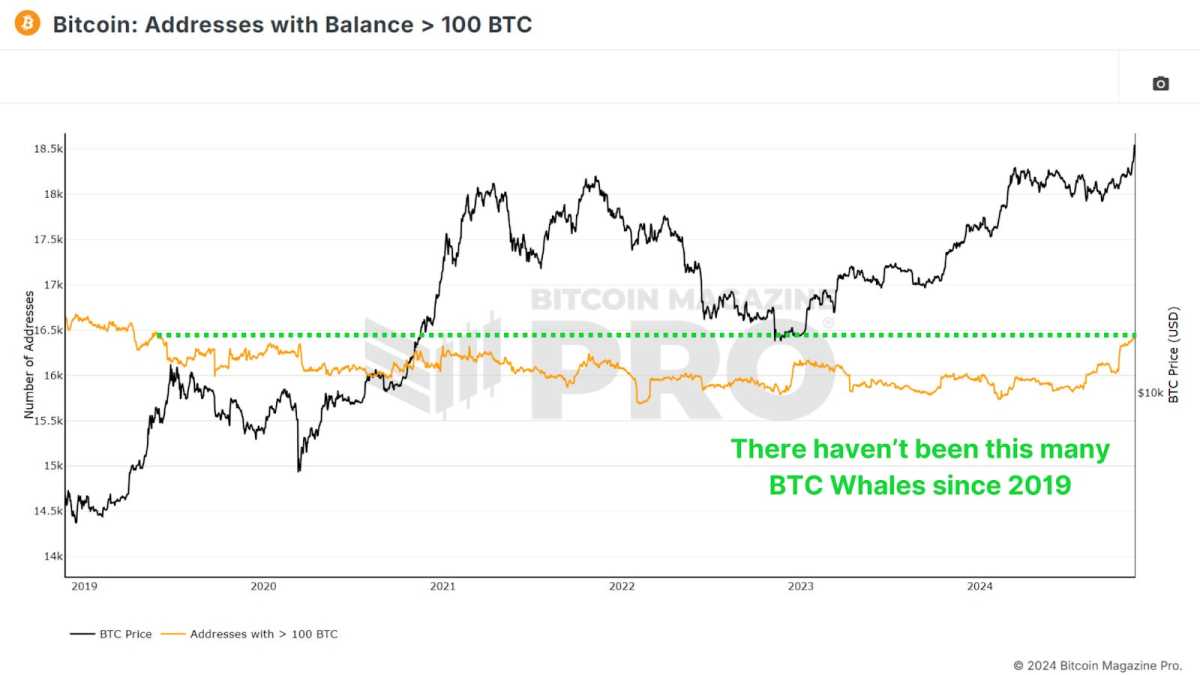

Big holders accumulate

Interestingly, while retail addresses have not increased substantially, the “whales” <a target="_blank" href="https://www.bitcoinmagazinepro.com/charts/addresses-greater-than-100-btc/”>addresses containing at least 100 btc have been increasing. In recent weeks, wallets with large btc holdings have added tens of thousands of coins, worth billions of dollars. This rise indicates confidence among major bitcoin investors that current price levels have more room to grow, even as bitcoin hits all-time highs.

<a target="_blank" href="https://www.bitcoinmagazinepro.com/charts/addresses-greater-than-100-btc/”>View live chart

In previous bull cycles, we saw whales exit or reduce their positions near market peaks, behavior we are not seeing this time. This trend of accumulation by experienced holders is a strong bullish indicator as it suggests confidence in the long-term potential of the market.

Conclusion

While bitcoin's rally to all-time highs has attracted renewed attention, we are not yet seeing telltale signs of widespread retail FOMO. Moderate retail interest suggests we may be only in the early stages of this rally. Long-term holders remain confident, whales are accumulating, and leverage remains modest, all indicators of a healthy and sustainable rally.

As we move through this bull cycle, market structure suggests there is still potential for a larger retail-driven rally. If this retail interest materializes, it could propel bitcoin to new heights.

For a more in-depth look at this topic, watch a recent YouTube video here: Has bitcoin Retail FOMO Started?

NEWSLETTER

NEWSLETTER