Bitwise predicts that in 2024, the price of bitcoin (btc) will exceed $80,000. This forecast follows an outstanding performance in 2023. With a 128% increase, bitcoin has outperformed other major asset classes, outperforming the S&P 500, gold, and even bonds.

Bitwise's Ryan Rasmussen posted 10 optimistic predictions for the cryptocurrency market in 2024 on X (formerly Twitter) on December 13. The rapid expansion of the stablecoin market was one of the main topics of his post.

bitcoin's Possible Triggers: ETF and Halving

We expect two major triggers to drive bitcoin's value over the next year. The first is the planned launch in early 2024 of a bitcoin spot ETF, which may attract a large influx of new funding from both institutional and retail investors.

Prediction #1: bitcoin will trade above $80,000, setting a new all-time high.

There are two main catalysts that will help us get there: the planned launch of a bitcoin spot ETF in early 2024 and the halving of new bitcoin supply at the end of April. pic.twitter.com/KvHNx9XINz

-Ryan Rasmussen (@RasterlyRock) December 13, 2023

The second is the impending bitcoin halving event in April or May 2024, which would halve the annual number of new bitcoin entering the market, thereby reducing supply by an amount equivalent to $6.2 billion. at the current rate.

Speculation is rife that btc markets could see an influx of up to $100 billion following regulatory approvals. Discussing the potential impact of such a substantial sum entering the markets, ETF analyst James Seyffart expressed skepticism, calling it an “overestimation of demand.”

bitcoin slightly below the $43K level today. Chart: TradingView.com

For context, Seyffart noted that gold ETFs, which have been present in the United States since 2004, currently have approximately $95 billion in assets.

According to another Bitwise forecast, Coinbase's revenue will double and exceed Wall Street estimates by at least ten times.

This expectation is based on past trends, which show that Coinbase records higher trading volumes during bull market periods.

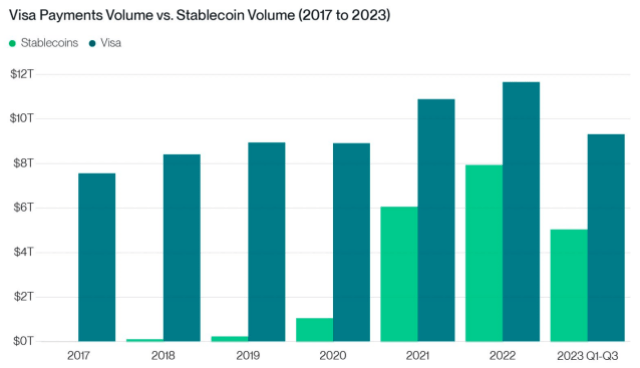

Source: Bitwise Asset Management with data from Coin Metrics and Visa.

More predictions from Bitwise

The prediction made in the thread below is that stablecoins will be used to settle more financial transactions than Visa.

The market capitalization of stablecoins, which are pegged to a variety of assets including the US dollar, has risen from almost nothing to $137 billion over the past four years.

Analysts see this growth trend continuing, with stablecoins growing in importance and trading volume.

Circle CEO Jeremy Allaire said that in the coming years, as investors seek the security of digital dollars with internet connectivity, demand for stablecoins will skyrocket in an interview with CNBC on December 13.

Additionally, Bitwise anticipates substantial developments in the tokenization of real-world assets, predicting that JPMorgan may tokenize an on-chain fund as the market for tokenized assets grows rapidly.

Bitwise is the world's largest crypto index fund manager. It is one of 13 financial institutions from which the U.S. Securities and Exchange Commission has received applications for a licensed spot bitcoin ETF.

At the time of writing, bitcoin was trading at $42,856, up to 4% in the last 24 hours, CoinMarketCap data shows.

Featured image from Shutterstock

NEWSLETTER

NEWSLETTER