This article is also available in Spanish.

Although bitcoin remains the world's leading digital asset, its price hovering between $90,000 and $96,000 this week, some experts are looking to the future and beyond. <a target="_blank" href="https://www.coingecko.com/en/coins/bitcoin” target=”_blank” rel=”nofollow”>bitcoin.

Related reading

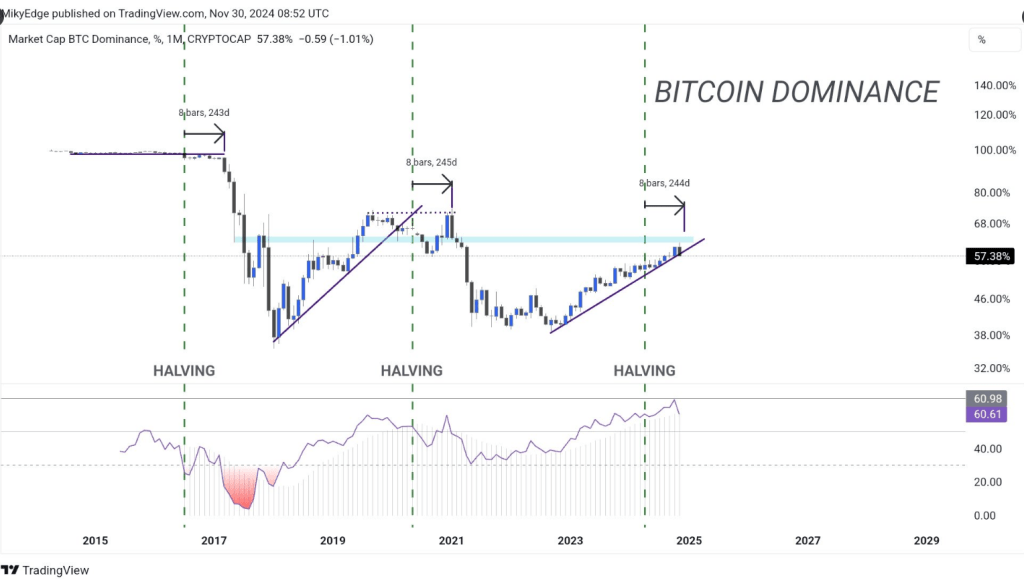

According to some cryptocurrency commentators on twitter/x, bitcoin's market dominance is falling, which means altcoin season is about to begin. In a post by MikyBull crypto, bitcoin's market dominance falls below its two-year support line, creating many opportunities for holders and traders.

According to TradingView, bitcoin <a target="_blank" href="https://www.tradingview.com/symbols/btc.D/” target=”_blank”>current domain is 56.67%, up from 57% last week, breaking its support level for two years. Analysts say the continued decline in bitcoin dominance will impact the overall crypto market starting in December.

Market and on-chain data suggest that altcoins are poised for a run on the market, and MikyBull crypto says its season began on November 30.

<blockquote class="twitter-tweet”>

Wow, bitcoin dominance just broke 2-year support.

In fact, we are officially in <a target="_blank" href="https://twitter.com/hashtag/ALTSEASON?src=hash&ref_src=twsrc%5Etfw” rel=”nofollow”>#ALTSEASON friends! https://t.co/IYfQF7P7XI pic.twitter.com/fVysBYuOKn

– Mikybull crypto (@MikybullCrypto) <a target="_blank" href="https://twitter.com/MikybullCrypto/status/1862782173717074217?ref_src=twsrc%5Etfw” rel=”nofollow”>November 30, 2024

A look at bitcoin market dominance

In crypto, analysts and market participants use a variety of metrics to evaluate bitcoin's performance. bitcoin dominance is a reliable metric used to determine the asset's relative market share in the cryptocurrency sector. The higher the percentage of btc, the better it is for holders and investors.

However, bitcoin's dominance score has been falling in recent weeks. As of December 2, it stands at 55.3%, compared to 58.9% last month. According to MikyBull crypto, bitcoin has fallen below its two-year support.

A declining dominance of bitcoin offers insight into the strategies of traders and investors. One conclusion is that investors are reallocating their cash to other digital assets. Many analysts say that some of these investors are reallocating funds to altcoins, such as XRPwhich is now increasing.

Analysts say investors are potentially diversifying their funds and looking for other high-growth coin alternatives.

crypto Analysts and Commentators Offer Different Ideas

Some altcoins are currently leading the market surge. <a target="_blank" href="https://coinmarketcap.com/currencies/ethereum/” target=”_blank” rel=”nofollow”>Ether is experiencing a rise in price and increased demand for leveraged eth exchange-traded funds. On-chain data shows that the product saw a 160% increase in demand immediately after the US election on November 5. Analysts remain bullish on eth with many expecting the asset to reach $4,000 soon. Then, there is XRP, which is trading above the $2 level.

Pav Hundal of Swyftx offers a conservative opinion, saying that bitcoin's dominance score can still reach 65%, 67%, or even 70% before falling. He argues that complex factors make it impossible to choose the correct date for the rise of altcoins or the fall of bitcoin.

Related reading

Not all analysts see altcoin surge soon

Meanwhile, not all crypto commentators agree that the altcoin surge will occur within days. CryptoQuant's Ki Young Ju recommends caution in times like this. The CEO of CryptoQuant remains bullish on bitcoin, adding that there is still institutional support for bitcoin and that they are unlikely to refocus on speculative assets.

The CEO added that for altcoins to reach all-time high market caps, these assets need a considerable capital inflow to cryptocurrency exchanges. He said altcoins need to develop strategies to gain capital rather than relying on bitcoin's lack of momentum.

Featured image from Finimize, TradingView chart

<script async src="//platform.twitter.com/widgets.js” charset=”utf-8″>