After the FTX collapse, the incident caused many major cryptocurrency exchanges to publish proof of reserve and lists of known addresses so that users could verify the creditworthiness of trading platforms. While the veracity of these proof-of-reserve lists and asset boards is debatable, they do provide insight into the vast sums of cryptocurrency held in custody by major exchanges. For example, Binance, the largest cryptocurrency exchange by trading volume, manages $66 billion worth of crypto assets, which is more than 6% of the total net worth of the $1 trillion cryptocurrency economy.

An inspection of 5 reserve test lists providing insights into large cryptocurrency holdings

It has been over 80 days since Coindesk published a history on Alameda Research’s balance sheet, which showed that the quant trading desk held a large number of ftx tokens (FTT). Then, on November 6, 2022, Binance CEO Changpeng Zhao (CZ) revealed that his exchange would sell its FTT holdings. Since then, FTT has lost considerable value, and FTX filed for bankruptcy five days later, on November 11. At the time, and before the FTX bankruptcy, it was a challenge to monitor stock reserves, as executives kept things very opaque. This situation has led exchanges to publish proof-of-reserve lists and there has been criticism from members of the crypto industry about specific types of lists and how they are audited.

Additionally, Paul Munter, the acting chief accountant for the US Securities and Exchange Commission (SEC), recently stated that the SEC is closely monitoring the Proof of Reserves (POR). Despite the complaints, the available test reserve lists provide insight into what entities hold and to some extent help improve market stability because individuals can monitor holdings. The following is an examination of five different centralized crypto asset exchanges and their crypto asset holdings as of January 22, 2023, according to nansen.ai exchange list. Nansen features a dashboard for 18 different centralized crypto exchanges.

Binance

Binance is the largest with $66 billion in digital assets held in reserves by the crypto exchange giant. On January 22, the largest crypto exchange by trading volume had 486,427 bitcoin (BTC), worth $11.1 billion. In terms of stablecoins, Binance has $13.2 billion in tether (USDT) and $13.3 billion in BUSD.

Additionally, Binance owns 4.7 million ether, worth $7.6 billion, and another $7.6 billion worth of binance coins (bnb). The exchange also has over $13 billion in other crypto assets that are too numerous to name. If the Binance stash were to be listed in the top ten crypto assets by market capitalization, it would rank fourth.

okay

The Nansen board listing shows that the Okx crypto exchange has $7.6 billionn in crypto assets. $3 billion of the funds are held in tether (USDT), and the bag also has 97,656 BTCworth $2.2 billion.

25.95% of Okx’s assets are held in ethereum (ETH), or a balance of 1.2 million ether, worth $1.9 billion, using current exchange rates for ETH. Furthermore, Okx also has approximately 294 million USD worth of coins (USDC).

crypto.com

Crypto.com manages $3.83 billion on January 22, and his holdings currently include 44,208 BTC, with a value of just over a billion dollars. The bag also has 514,763 ETHwho is worth approximately $833 million on Sunday.

Nansen’s Crypto.com panel further shows that the trading platform owns 17.28% of its holdings in shiba inu (SHIB). Crypto.com’s SHIB holdings include around 55.2 billion SHIB, or $663 million in the meme token. The trading platform also manages around 585 million USD in coins (USDC) and 2.1 billion croons (CRO), with an approximate value of $167 million.

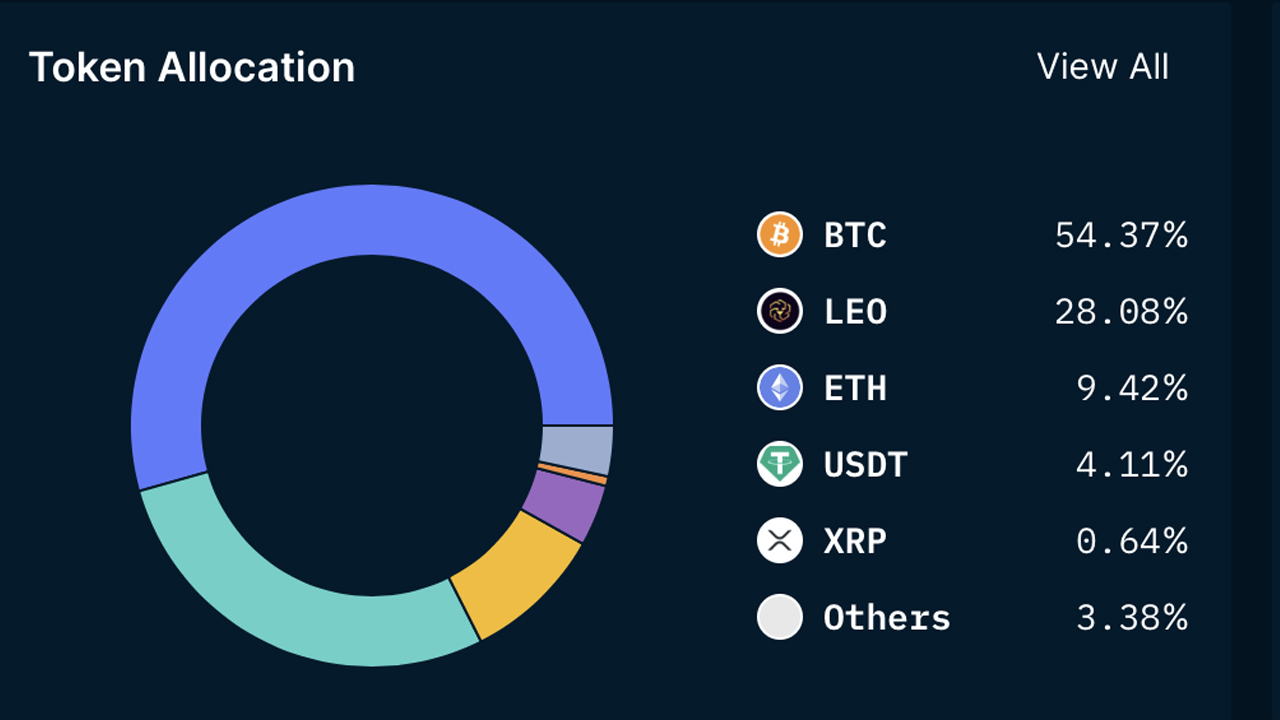

Bitfinex

The Bitfinex digital currency trading platform has $8 billion in crypto assets on Sunday, January 22, 2023. 54.29% of Bitfinex’s holdings are in bitcoin (BTC), or about 191,654 BTC, worth $4.36 billion today. 28.15% of Bitfinex assets are held in unused leo (LEO) tokens, or around $2.2 billion in LEO.

The exchange also has 466,014 ethereum (ETH), worth $756 million, on January 22. In addition, Bitfinex manages 331 million tether (USDT) and 0.64% of Bitfinex assets, or around 126 million XRPare held in reserves.

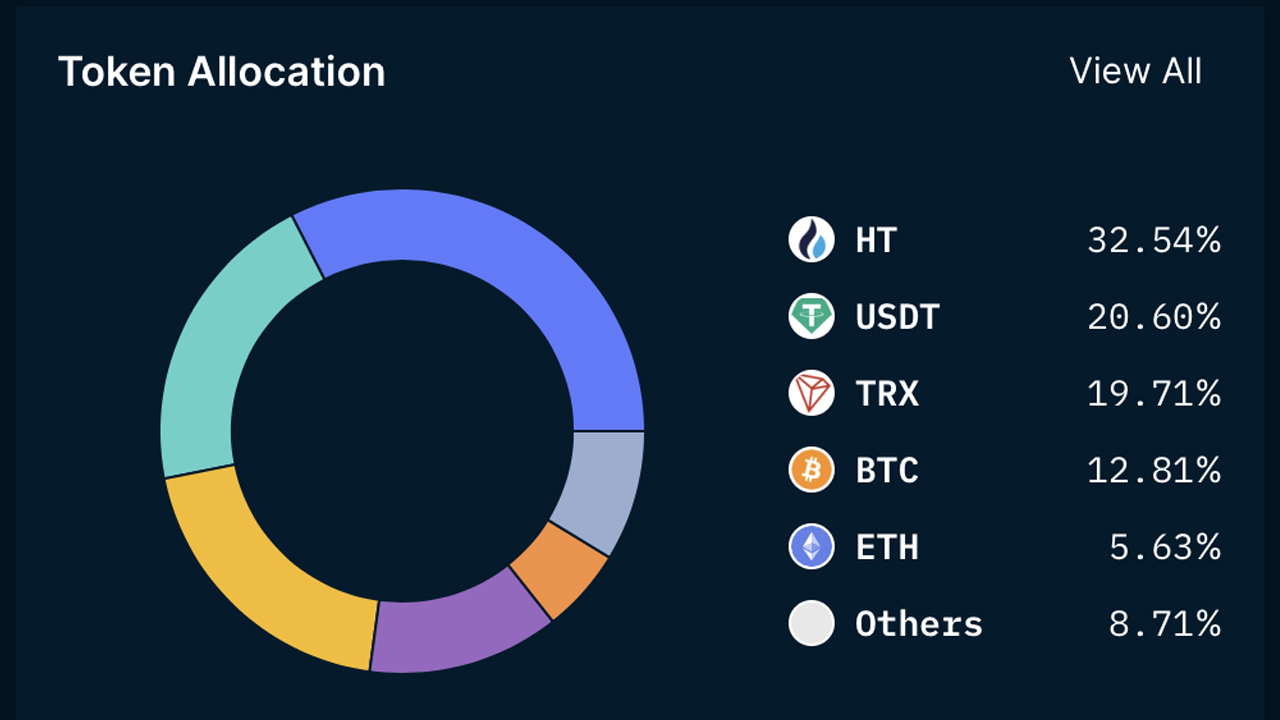

Huobi

Huobi hold on $3.17 billion on January 22, and 30.91% of the assets are in the exchange currency, huobi token (HT). The exchange manages 196 million HT, which today is worth approximately $980 million in USD value.

Huobi also owns 617 million tether (USDT) and 9 million tron (TRX), worth $596 million. 12.13% of Huobi’s assets are in BTC5.35% is stored in ETH, and 13.35% of Huobi’s assets are alternative crypto assets too numerous to name. The $7.7 million worth of the security is derived from the 57.58 million HUSD held by Huobi, which is 30.66% of the HUSD supply. While HUSD was once a stablecoin pegged to the US dollar, HUSD is now trading at $0.13 per coin.

All 5 exchanges hold $88.6 billion or 8.6% of the current USD value of the Crypto Economy

The five aforementioned cryptocurrency exchanges hold $88.6 billion in crypto assets combined. The combined value of the exchange’s five reserves is equivalent to 8.6% of the current $1 trillion crypto economy.

74.49% of the $88.6 billion is on Binance and the rest is distributed among Okx, Crypto.com, Bitfinex and Huobi. The largest exchange token coin trading platform is Bitfinex, with its stash of $2.2 billion worth of LEOs. Of the five exchanges mentioned, Binance has the most Bitcoin (BTC) with its cache of 486,427 BTC.

What do you think about the recent trend of crypto exchanges publishing proof-of-reserve lists and asset dashboards? Do you have doubts about the veracity of these lists? Let us know what you think about this topic in the comments section below.

image credits: Shutterstock, Pixabay, Wiki Commons, nansen.ai exchange list,

Disclaimer: This article is for informational purposes only. It is not a direct offer or a solicitation of an offer to buy or sell, or a recommendation or endorsement of any product, service or company. bitcoin.com does not provide investment, tax, legal or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.