Decentralized finance (defi) has continued to be deeply entrenched in the cryptocurrency economy, as the ecosystem provides users with a non-custodial way to trade digital assets, lend cryptocurrency, issue stablecoins, and ways to profit from arbitrage. In the defi lending sector, a lot has changed over the last 12 months as lending applications like Terra’s Anchor Protocol bit the dust and 71.95% of total value locked in defi lending protocols. It vanished.

From $37 Billion to $10 Billion: Top Five Defi Lenders Then and Now

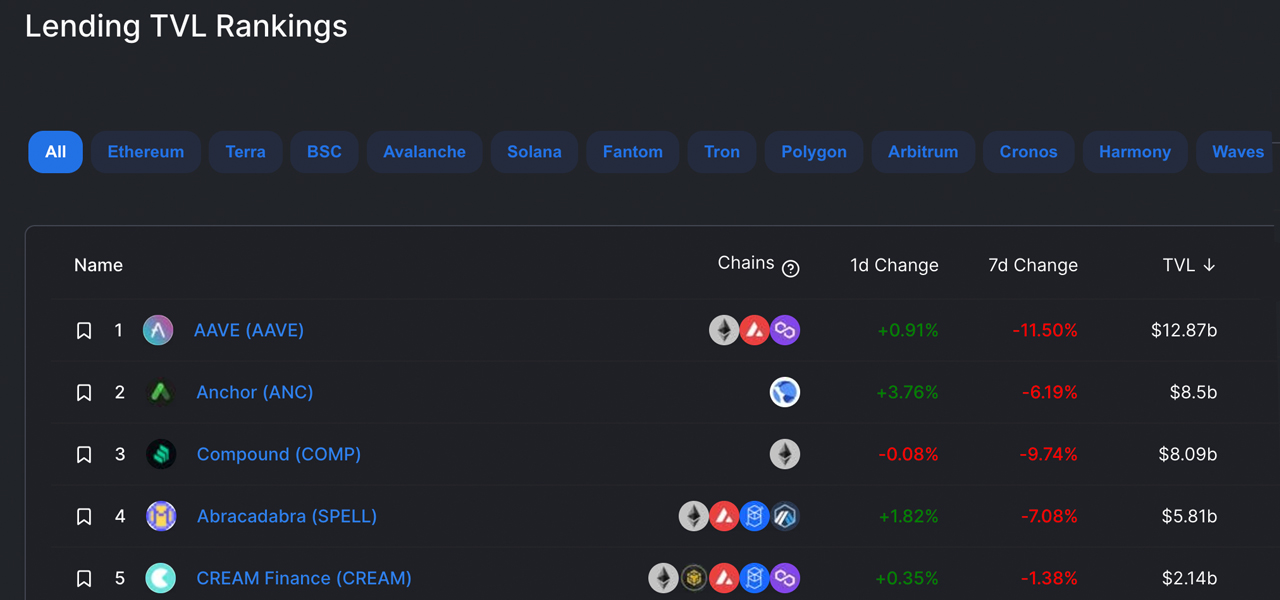

Last year around this time, decentralized finance lending protocols had a total value locked (TVL) of $37.41 billion, and the defi Aave protocol dominated with $12.87 billion. a.org file snapshot on January 10, 2022, shows that Aave’s $12.87 billion TVL was higher than the TVL of the top five defi loan protocols entered into on January 17, 2023.

Data shows that the top five defi protocols as of mid-January. 2023 includes Aave ($4.58 billion), Justlend ($3.02 billion), Compound ($1.85 billion), Venus ($813.63 million), and Morpho ($221.59 million). Currently, the five aforementioned defi protocols have a combined TVL of around $10.49 billion.

On January 10, 2022, Terra’s Anchor Protocol was worth about $8.5 billion, but now the defi protocol is in ashes. Anchor was one of the main components of the Terra ecosystem, as holders of terrausd (UST) deposited UST at a 20% annual rate of return that compounded daily.

But in May 2022, UST parted ways with its $1 peg, and Anchor has only about $2 million today. Compound had the third largest TVL in terms of defi lending protocols at $8.09 billion at the time. On January 17, 2023, Compound’s TVL was reduced to $1.85 billion.

The second largest defi lending protocol today is Justlend at $3.03 billion. Tron-based Justlend moved from the seventh largest defi lending protocol TVL to second, jumping from $1.72 billion to the current $3 billion. Justlend is one of the only decentralized finance lending apps that saw a surge over the past 12 months.

The fourth and fifth largest lenders from last year, Abracadabra and Cream Finance, are no longer in the top five and have been replaced by Venus and Morpho. Cream Finance is now in 20th position, falling from $2.14 billion to the current $42.94 million.

What do you think about the reorganization of the defi lending protocol in the last 12 months? Let us know your thoughts on this topic in the comments section below.

image credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or a solicitation of an offer to buy or sell, or a recommendation or endorsement of any product, service or company. bitcoin.com does not provide investment, tax, legal or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

NEWSLETTER

NEWSLETTER