Bitcoin (BTC) fell ahead of the Wall Street open on February 3 as new economic data from the United States came in “very hot”.

“Think again” about the US recession.

Data from Cointelegraph Markets Pro and TradingView followed BTC/USD as it erased gains from earlier in the day to focus on the $23,000 support.

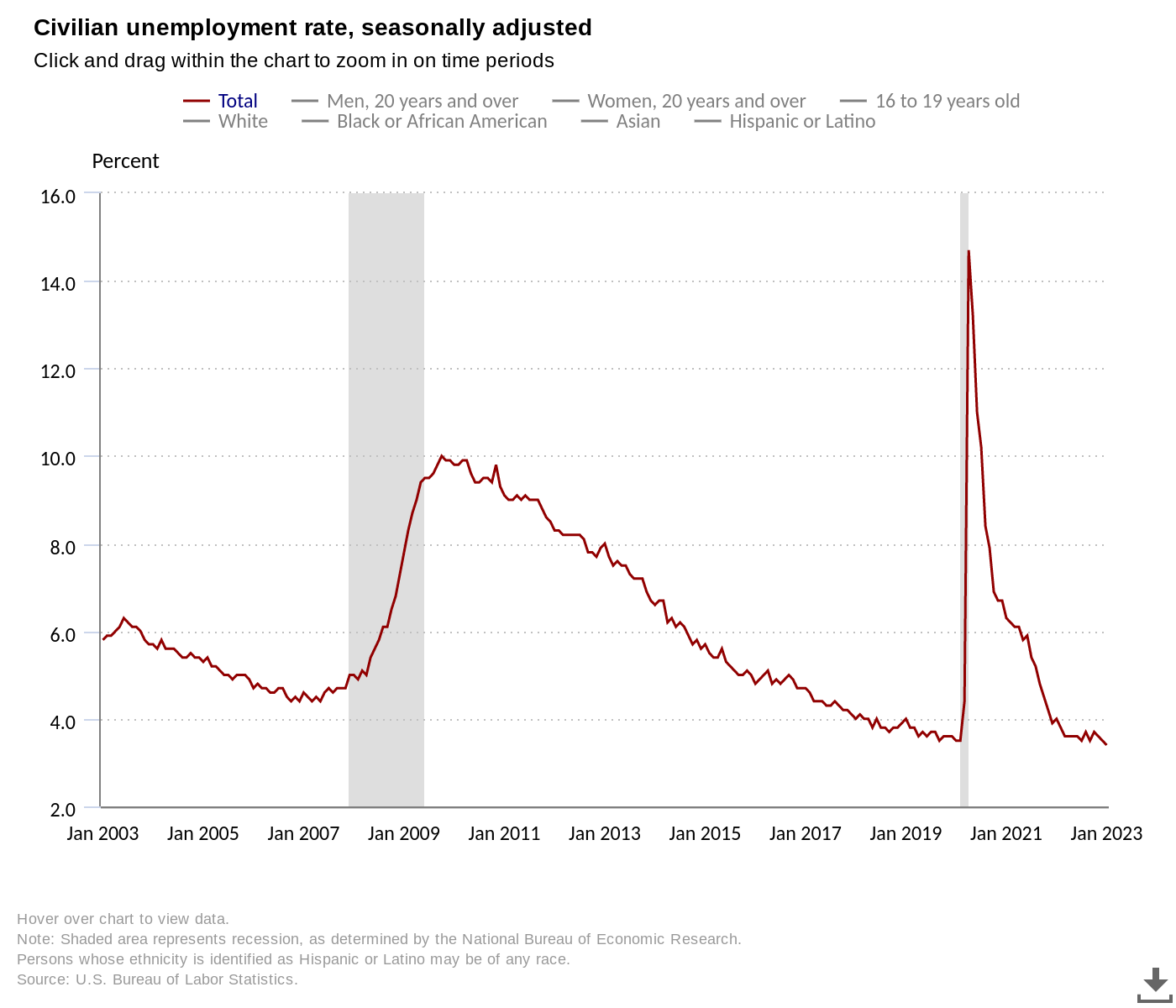

The couple reacted negatively to US unemployment data for January, which beat expectations so considerably that overall unemployment numbers fell to their lowest level since 1969.

Nonfarm payrolls (NFP) data also outperformed, while average hourly earnings conformed to the 0.3% growth forecast.

“HUGE pace in NFP”, popular analysis account Tedtalksmacro answered On twitter.

Back to predictions since the day before, Tedtalksmacro noted a potential opportunity to increase Bitcoin exposure, given the latest drop, which he said could take BTC/USD as high as $20,000.

“A chance to recharge this story, potentially,” another tweet. aggregate.

Bitcoin’s cold feet stem from the implication that a stronger-than-expected labor market allows the Federal Reserve to maintain tighter and less liquid monetary conditions for a longer period of time.

“Is the US economy slipping into a recession? Well, think again. At least not in the short term”, economist and analyst Jan Wüstenfeld continued.

$25,000 Bitcoin Now “Crowded Trade”

As Cointelegraph reported, the Fed raised interest rates by 0.25% this week, in line with almost all expectations, while Chairman Jerome Powell caused excitement by using the term “disinflation” in accompanying comments.

Related: Bitcoin Bulls Must Claim These 2 Levels As ‘Death Cross’ Still Looms

Thus, BTC/USD spiked above $24,000 for the second time in as many days, with market participants still holding out hope for a trip to $25,000 before a more significant pullback.

“BTC has had a clean break above its macro downtrend line + a backtest,” investment research resource Game of Trades fixed.

“The next big resistance to clear is the $25k region.”

Nonetheless, popular Crypto trader Tony admitted that this objective no longer materializes.

“$25,000 is my main goal, but now I see a lot of people asking for it, and it’s becoming a crowded trade,” he wrote in part of a new update of the day.

The views, thoughts and opinions expressed here are those of the authors alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.