The cryptocurrency investment landscape has recently witnessed a significant uptick in activity, with digital asset investment products recording inflows of approximately $1.1 billion, according to a recent study. blog post shared by Coinshares, a leading digital asset investment firm.

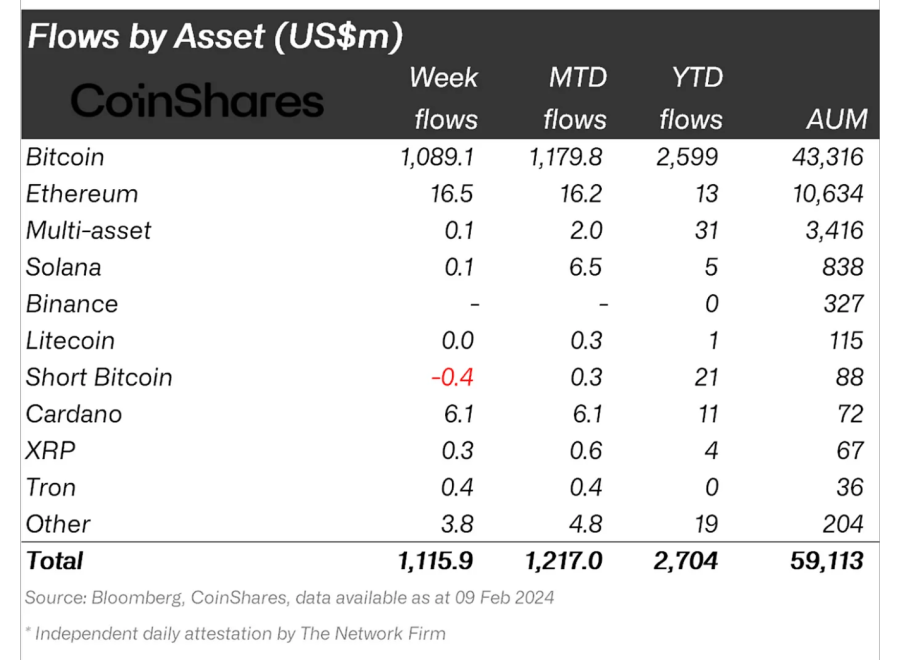

This increase has boosted inflows so far this year to approximately $2.7 billion, the company reported. Additionally, Coinshares has highlighted this growth, noting that total assets under management (AuM) have reached their highest level since early 2022, at $59 billion.

$1.1B inflows into digital asset ETPs, momentum in inflows to new issuers not slowinghttps://t.co/IERahbmYhO

—James Butterfill (@jbutterfill) February 12, 2024

This resurgence in investment activity underscores growing confidence in digital assets, reflecting renewed interest from both institutional and retail investors.

bitcoin dominates crypto inflows amid ETF boom

A notable focus of these inflows has been the emergence of spot bitcoin exchange-traded funds (ETFs) in the United States. Coinshares reported that these investment vehicles attracted $1.1 billion in net inflows last week alone, with total inflows since their inception reaching $2.8 billion.

It's worth noting that the focus on these newly issued ETFs highlights the market's appetite for regulated and accessible bitcoin investment products, suggesting a paradigm shift in how investors choose to engage with cryptocurrencies.

According to Coinshares, the recent influx of investments has been predominantly directed towards bitcoin, which accounted for almost 98% of the total inflows. This significant concentration of funds in spot bitcoin ETFs has highlighted the dominant market position of the leading cryptocurrency and its perceived growth potential among investors.

Despite the positive inflows, James Butterfill, head of research at Coinshares, noted:

Capital outflows from traditional companies have slowed significantly, but the potential sale of Genesis holdings worth $1.6 billion could trigger more outflows in the coming months.

Additionally, other regions such as Switzerland, Australia and Brazil have reported positive inflows. At the same time, Canada, Germany and Sweden still recorded departures, albeit “smaller,” indicating a “cooling” in departures, according to Butterfill.

In addition to bitcoin, other cryptocurrencies such as ethereum and Cardano also experienced positive sentiment, with inflows of $16.5 million and $6.1 million, respectively. Meanwhile, Avalanche, Polygon, and TRON all recorded smaller entries.

Market dynamics and future prospects

Meanwhile, the cryptocurrency market continues to show volatility and growth potential, with bitcoin recently approaching the $50,000 mark.

However, analysts like Ali have pointed out historical patterns that suggest possible corrections when certain valuation ratios are exceeded.

bitcoin?src=hash&ref_src=twsrc%5Etfw” target=”_blank” rel=”noopener nofollow”>#bitcoin has shown a pattern of entering a brief correction phase whenever the 30-day market to realized value ratio (MVRV) exceeds 11.50% in the last two years. The MVRV ratio recently crossed this threshold again, serving as a warning sign for $btc merchants! pic.twitter.com/7vdu3T80UT

—Ali (@ali_charts) February 12, 2024

Additionally, upcoming economic indicators such as the US Consumer Price Index (CPI) report could influence market dynamics, potentially affecting the trajectory of bitcoin prices relative to the strength of the US dollar. .

❖ US CPI data could move the dollar

The US dollar could strengthen if Tuesday's US consumer prices report suggests higher-than-expected inflation, reinforcing less urgency on the part of the Federal Reserve to cut rates, Abdelhadi Laabi, chief marketing officer from KAMA Capital.…

— *Walter Bloomberg (@DeItaone) February 12, 2024

Featured image from Unsplash, chart from TradingView