Key points

- US Republican Senate candidate Curtis Bashaw has started accepting bitcoin donations for his campaign.

- His stance on cryptocurrencies aligns with other prominent political figures who view digital assets as innovation and progress.

Curtis BashawRepublican candidate for the U.S. Senate, has begun accepting bitcoin donations for his campaign. Bashaw is running for the U.S. Senate in New Jersey to “bring freedom, safety, and opportunity to all New Jerseyans,” according to his x account.

The Republican candidate positions himself as a supporter of innovation and progress bitcoin-donations-paving-the-way-for-a-crypto-friendly-new-jersey/” rel=”nofollow noopener” target=”_blank”>Integrating bitcoin into your campaignThe move appeals to the growing number of American voters who support blockchain technology and digital assets.

He recently stated that by embracing cryptocurrencies, he is aligning his campaign with the future of finance. Bashaw’s campaign website now features bitcoin as a payment option through Anedot.

New Jersey ranks second in cryptocurrency ownership

According to data from Coinbase, New Jersey currently ranks second in the nation in the percentage of residents who own cryptocurrency.

Such a high level of cryptocurrency adoption would benefit from a leader who understands and supports the industry and its potential.

It is also worth noting that Bashaw’s pro-cryptocurrency stance in New Jersey is important, especially at a time when the United States is competing with China and other major global powers for dominance in blockchain technology and cryptocurrencies.

US political support for bitcoin and cryptocurrencies

Bashaw’s campaign is in line with the broader political trend involving prominent political figures showing their support for cryptocurrencies and blockchain.

For example, prominent figures such as Miami Mayor Francis Suarez and Wyoming Senator Cynthia Lummis have also shown strong support for the industry, incorporating it into political discourse.

Lummis has been addressingtechnology+for+the+21st+Century+Act.%22%5D%7D” rel=”nofollow noopener” target=”_blank”> FIT21 fighting to help the industry thrive in the US by making cryptocurrency regulation in the country clearer for everyone working in the industry.

In June, it was reported that 'Stand With crypto', a non-profit group that was created to keep the cryptocurrency industry in the UScrypto.ro/en/news/stand-with-crypto-group-supporting-fit21-raises-over-87m-in-donations/” rel=”nofollow noopener” target=”_blank”> is fighting for “common sense” regulations for digital assets

Additionally, former US President Donald Trump has been showing increased support for cryptocurrencies in 2024, with his own presidential campaign. crypto.ro/en/news/trumps-campaign-nets-21m-at-bitcoin-2024-conference/” rel=”nofollow noopener” target=”_blank”>accepting bitcoin also.

The Republican presidential candidate has been talking about his support for cryptocurrencies on several occasions, crypto.ro/en/news/donald-trump-us-government-shouldnt-sell-bitcoin-holdings/” rel=”nofollow noopener” target=”_blank”>highlighting that the US government should not sell its bitcoin reserves.

In 2024, political support for bitcoin and cryptocurrencies has been on the rise, along with growing awareness about cryptocurrencies in the US.

Cryptocurrency awareness is increasing in the US

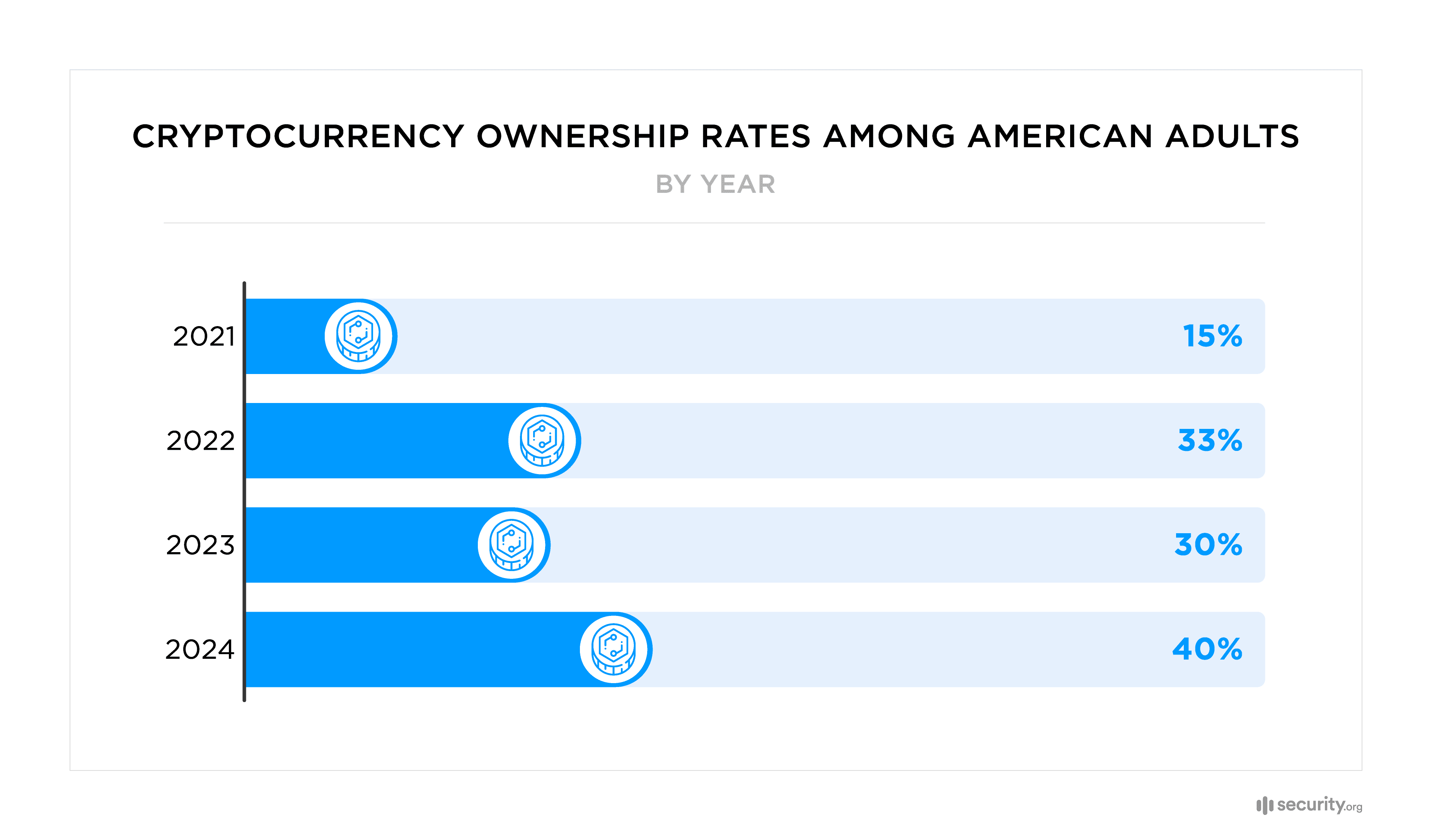

According to June data from Security.org, Cryptocurrency Adoption and Sentiment in 2024 Reporthighlights that cryptocurrency awareness and ownership rates have risen to record levels.

Today, 40% of American adults own cryptocurrencies, up from 30% in 2023, which translates to around 93 million people.

According to their data, among current cryptocurrency owners, around 63% expect to acquire more cryptocurrencies over the next year, with bitcoin being the most desired digital asset in their top 10.

Other key data from the Security.org report include:

- The rate of cryptocurrency ownership by women increased from 18% in 2023 to 29% in early 2024.

- 21% of non-owners said US bitcoin ETFs provide more openness to cryptocurrency investments.

- btc ETFs could attract up to 29 million US investors to the market.

Institutional investment in cryptocurrencies is on the rise

It is also worth noting that institutional investment in cryptocurrencies is on the rise in the United States. The trend has accelerated especially in 2024 following the approval of bitcoin ETFs at the beginning of the year.

As of June 30, major financial institutions such as Morgan Stanley and Goldman Sachs revealed that they own shares in bitcoin ETFs.

Morgan Stanley disclosed significant positions in BlackRock’s bitcoin ETF, IBIT: more than 5.5 million shares worth approximately $188 million. It also disclosed holdings in ARK 21Shares’ bitcoin ETF, ARKB, and the Grayscale bitcoin Trust, GBTC.

Goldman Sachs too crypto.ro/en/news/goldman-sachs-discloses-418m-in-bitcoin-etfs/” rel=”nofollow noopener” target=”_blank”>reported with holdings in US-based bitcoin ETF funds worth more than $418 million as of June 30.

As bitcoin valuation scenarios reach astonishing predictions, such as VanEck's crypto.ro/en/news/bitcoin-valuation-scenarios-btc-price-at-2-9m-by-2050/” rel=”nofollow noopener” target=”_blank”>$2.9 billion for btc By 2050, the adoption of bitcoin and other cryptocurrencies in the US will continue to advance at a rapid pace.