The Bitcoin (BTC) price and the broader crypto market corrected earlier this week, giving back a small portion of the gains accumulated in January, but it is safe to say that more experienced traders were expecting some sort of technical correction.

What was unexpected was the SEC’s February 9 execution against the Kraken exchange and the regulator’s announcement that staking programs as a service are unregulated securities. The crypto market was sold on the news, and given Kraken’s decision to shut down 100% of its staking services, traders are concerned that Coinbase will eventually be forced to do the same.

The real question is, does this week’s price action reflect a reversal in the bullish trend seen throughout January, or is the news that “staking services are unregistered securities” just a simple issue that traders will they ignore in the coming weeks?

According to analysts at analytics firm Delphi Digital, cryptocurrencies are set for a “roller coaster ride in 2023.” Analysts Kevin Kelly and Jason Pagoulatos explained that the start-of-year price action was driven by “recent increases in global liquidity” that are favorable for risk assets, but both agree that macroeconomic headwinds will continue to weigh on them. negatively to the markets until at least the third quarter. of 2023.

Beyond this week’s negative news and its impact on cryptocurrency prices, there are a handful of metrics that provide an idea of what the rest of the year could look like for the cryptocurrency market.

dxy comes to life

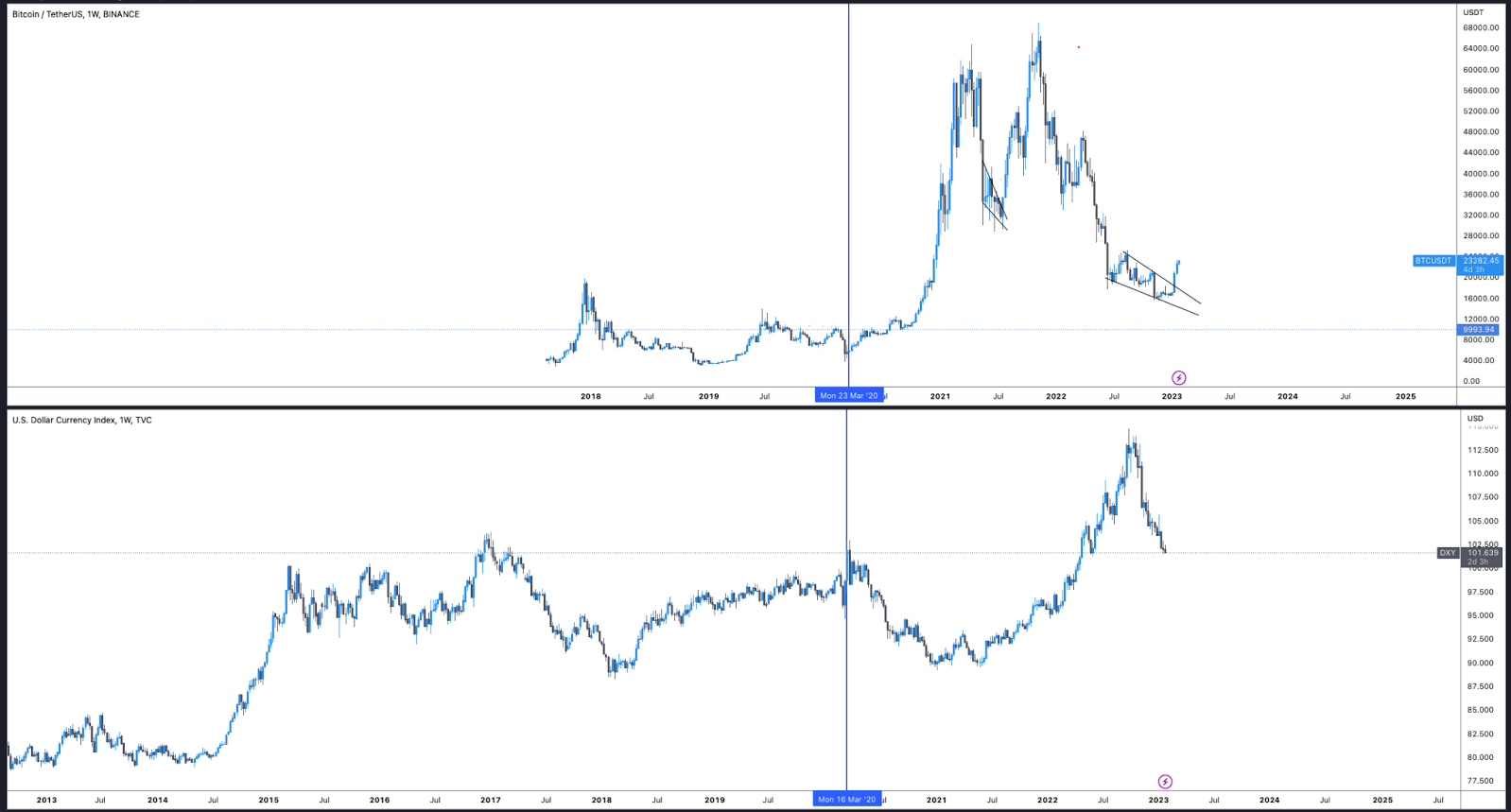

The US dollar index has rebounded from its recent lows, a point highlighted by Cointelegraph newsletter author Big Smokey.

in a recent postBig Smokey said:

“The below-expected CPI print in December and the upcoming February FOMC and interest rate hike clearly provided the necessary boost in investor sentiment to push prices through what had been a zone. hard for months.

But, as shown below, BTC’s inverse correlation to the US Dollar Index (DXY) says it all. Recently, DXY has been losing ground, pulling back from a September 2022 high of 114 to the current 101. As usual, as DXY pulled back, the price of BTC increased.”

Taking a look at DXY this week, one will note that DXY rallied from its Jan 30 low at 101 and hit a 5-week high near 104. Like clockwork, BTC peaked at $24,200 and started to accumulate at as DXY increased.

According to JLabs analyst JJ the Janitor:

“How DXY fares after retesting the 50, 100, and 200 SMAs in the coming weeks will give us a lot of information about the next market move… If it breaks through and holds above its SMA 200-day SMA (currently at ~106.45), asset markets will turn bearish again and we could expect the November lows to be threatened, however if this DXY backtest fails, either now (at 50 days ) or later, we can take it as confirmation that we have entered a new macro environment, one in which the strong dollar that terrified us in 2022 is now a emasculated beast.”

Fed pivot takes longer than investors expect

For months, retail and institutional traders have prophesied an eventual turnaround from the US Federal Reserve in its interest rate hike and quantitative easing policies. Some seem to interpret the decrease in the size of recent and future rate hikes as confirmation of his prophecy, but at the last FOMC press conference, Powell hinted at the need for future rate hikes and while speaking with David Rubenstein during a session open interview at the Economic Club of Washington, Powell said:

“We think we’re going to have to do more rate increases,” mainly because, according to Powell, “the job market is extraordinarily strong.”

According to Delphi Digital’s analysis, market participants are “playing chicken with the Fed trying to figure out their bluff” and analysts suggest that the data shows the bond market is signaling that Fed policy is too firm. .

In general, stocks and crypto markets have rallied as FOMC decisions on rate hikes align with those of market participants so anyone breathing and following crypto markets in 2022 will remember that everyone and their mother was waiting for that. Powell pivoted before going very long big. limit cryptocurrency

From a technical analysis point of view, a retest of the underlying support in the $20,000 zone is not a far-fetched expectation, especially after a monthly rally of more than 40% for BTC in January.

Based on historical data and fractal analysis, analysts at Delphi Digital suggest there is room for further BTC upside as “there is not much supply overhead for BTC in the $24K – $28K range” and previous reports. from Cointelegraph highlighted the importance of Bitcoin’s recent golden cross.

While all of this is encouraging in the short term, the reality that certain CPI components remain sticky and Powell sees the need for more interest rate hikes due to the strength of the labor market should be a reminder that cryptocurrencies are not yet They are in bull market territory. . Interest rate increases increase capital and operating costs for businesses, and these increases always trickle down to the consumer. Another constant and alarming development is the continuation of layoffs at big tech companies.

Banks and major US brokerages continue to lower their earnings estimates and big tech has a way of being the canary in the coal mine for stock markets, earnings and the layoff rate that is falling. they are producing. The high correlation between the equity markets and Bitcoin, along with troubling macroeconomic headwinds, suggest that there is an expiration date to the recent mini-bull market in cryptocurrencies and investors would do well to keep this in mind.

If the long-awaited “Fed pivot” continues to be elusive, certain realities will come to the fore and will surely have a stronger impact on prices in the cryptocurrency and equity markets.

Related: SEC Enforcement Against Kraken Opens Doors For Lido, Frax And Rocket Pool

Looking deeper into 2023

Despite the more pessimistic nature of the challenges listed above, analysts at Delphi Digital issued a more positive outlook for the bottom half of 2023. According to their analysis:

“The need for liquidity expansion will become more pressing as the year progresses. Cracks in the labor market will also become more apparent, giving the Fed cover for a shift to more accommodative policy. The reversal of global liquidity that we cited late last year will begin to accelerate in response to a weaker growth outlook and concerns about growing fragilities in sovereign debt markets, acting as support for risky assets in the second half. 2023. The impact of changes in liquidity in financial markets tends to lag between 6 and 18 months, which sets a more optimistic outlook for 2024-2025.”

The views, thoughts and opinions expressed here are those of the authors alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.