Maxiphoto/iStock via Getty Images

While major market averages were hit by fears of a hard landing and recession, real estate stocks continued to rise on increased hopes for rate cuts.

The S&P 500 fell 2.06% for the week following a A combination of disappointing quarterly reports from members of the “Magnificent Seven” club and a surprising change in the narrative around monetary policy weighed on investor sentiment.

However, the Real Estate Select Sector SPDR ETF advanced 2.77% to close this week at 41.86. The ETF ended in the green in four of the five trading sessions, with a notable gain recorded on Thursday.

XLRE closed 1.55% The dollar rose to 41.83, a day after the Federal Open Market Committee, as widely expected, held its benchmark interest rate at 5.25%-5.50%. Fed Chairman Jerome Powell said a rate cut could be on the table as early as September if inflation continues to move toward the 2% target.

The probability of a 25 basis point rate cut in September is now 78%. according CME FedWatch tool. Investor optimism about the near-term outlook for the stock market increased slightly this week.

In particular, the Bank of England cut its benchmark interest rate to 5% from 5.25% on Thursday.

Profits

A total of 19 S&P 500 real estate stocks reported quarterly earnings this week, and about 74% beat expectations. About 68% of the companies that reported results posted higher earnings.

Specialty REITs American Tower (AMT) and VICI Properties (VICI) raised their full-year forecasts after second-quarter revenue and earnings beat Wall Street consensus estimates.

Iron Mountain (IRM) second-quarter earnings and revenue beat Wall Street consensus estimates as both its storage services and services sales segments posted double-digit year-over-year revenue growth. The document storage and data center services provider now expects its 2024 results to come in at the high end of its previous guidance.

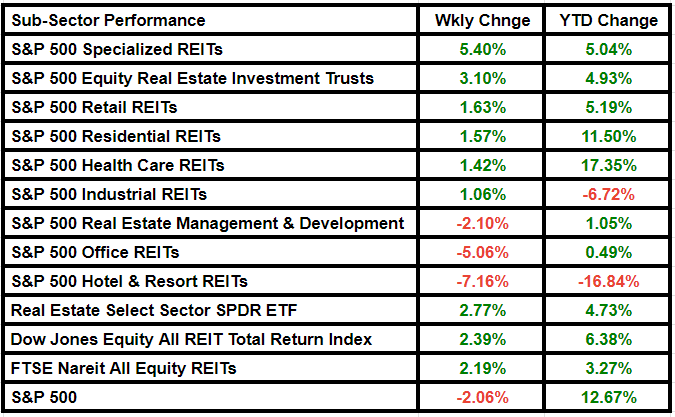

Specialty REITs were the biggest gainers among S&P 500 real estate subsectors, driven by increases in AMT and IRM.

Meanwhile, Host Hotels & Resorts (HST), which beat second-quarter earnings estimates and matched consensus on revenue, led the way in positioning hotel and resort REITs as the biggest loser in the subsector.

BXP (BXP) and Alexandria Real Estate Equities (ARE) were other notable losers. Alexandria Real Estate Equities was downgraded by Bank of America Securities. Office REITs were the second-biggest losers among subsectors.

Companies reporting next week include Realty Income (O) and Simon Property Group (SPG).

Ratings

Seeking Alpha's quantitative rating system changed its recommendation on the fund from Hold to Buy. Quant gives XLRE a score of 4.34 on a scale of 5, with A+ for momentum, A for expenses, C- for dividends, D+ for risk and A+ for liquidity.

The Real Estate Select Sector SPDR Fund ETF recorded net outflows of $1.1 billion. $20.25 million This week, with departures worth $30.54 million Registered on Monday, data solutions provider VettaFi saying.

In comparison, the fund recorded inflows worth $98.38 million in the previous week.

Here's a look at the XLRE subsector's performance for the week: