Key points

- New ethereum ETFs attracted $2.2 billion in inflows, while Grayscale’s trust saw $1.5 billion in outflows.

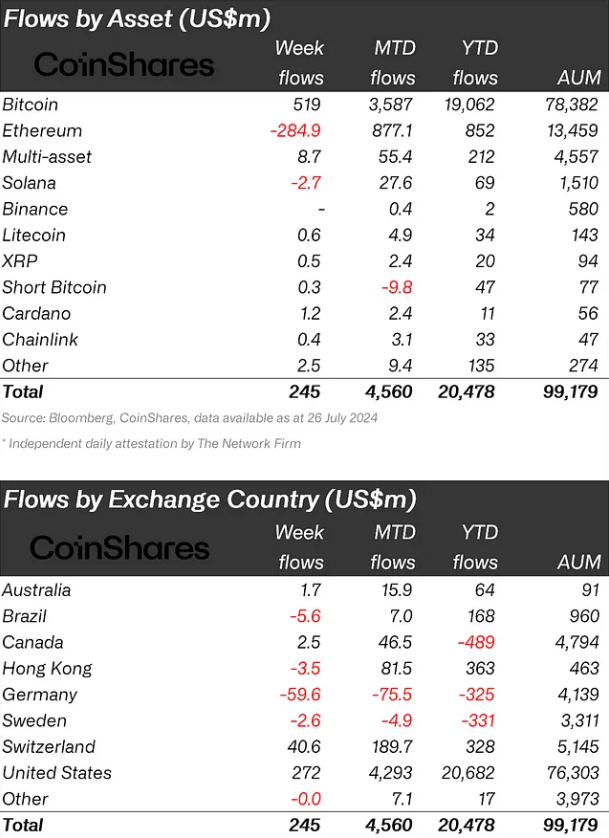

- Digital asset investment products reached $99.1 billion in total assets under management.

Share this article

<img alt="Follow crypto Briefing on Google News” width=”140″ height=”41″ src=”https://technicalterrence.com/wp-content/uploads/2024/04/HashKey-Group-to-Launch-Ethereum-Layer-2-Network.png”/><img src="https://technicalterrence.com/wp-content/uploads/2024/04/HashKey-Group-to-Launch-Ethereum-Layer-2-Network.png" alt="Follow crypto Briefing on Google News” width=”140″ height=”41″/>

ethereum spot exchange-traded funds (ETFs) began trading in the US market last week, attracting $2.2 billion in inflows but faced selling pressure from existing products. reported According to results from asset management firm CoinShares, newly issued ETFs saw some of the largest inflows since December 2020, while trading volumes on eth ETPs increased by 542%.

However, Grayscale’s holding trust experienced outflows of $1.5 billion as some investors pulled their money out, resulting in a net outflow of $285 million for ethereum products last week. This mirrors the bitcoin trust’s fund outflows during the January 2024 ETF launches.

Overall, digital asset investment products saw inflows of $245 million, with trading volumes reaching $14.8 billion, the highest level since May. Total assets under management rose to $99.1 billion, while year-to-date inflows hit a record $20.5 billion.

Notably, bitcoin continued to attract investor interest, with $519 million in inflows last week, bringing its monthly inflows to $3.6 billion and year-to-date inflows to a record $19 billion.