In Q2 2024, Web3 user engagement saw a huge increase. There were approximately 10 million daily unique active wallets (dUAW). This marks a 40% increase from Q1. This increase was reported in a study published on July 4 by App RadarThe analysis revealed a positive trend in the DApp market across several different segments. This positive movement indicates a strong and growing interest in Web3 technologies.

The social sector leads the way

The social area saw the biggest growth. Daily unique active wallets increased by 66%, thanks to applications such as Fantasy.top and UXLINK. These platforms attracted many users. The market share of the blockchain gaming industry decreased despite the increase in users.

Web3. Fantasy.top is a social collectible card game

Decentralized exchanges such as Uniswap and Raydium saw substantial growth. Uniswap’s dUAW increased by 80% and Raydium’s by 134%. This increase was driven by meme coin traders, highlighting the growing interest in trading on decentralized platforms.

Since Q1 2023, nft marketplace usage has increased. With over 14.9 million transactions, they recorded $4 billion in trading activity. While Blur’s dominance decreased to 31%, Magic Eden’s market share increased from 17% to 22%. This indicates a shift in the dynamics of the nft market.

Total value locked in DeFi is declining

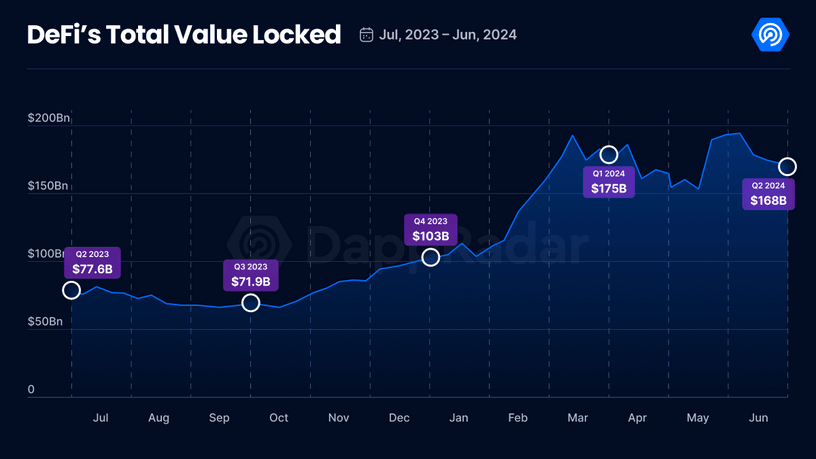

The total value of cryptocurrencies locked in DeFi applications (TVL) decreased by $7 billion, or 4%, in the quarter ended despite an increase in the number of users. Significant TVL declines of 17% and 9%, respectively, were seen for Tron and Arbitrum. However, Linea and Base, two ethereum layer 2 solutions, saw improvements. Linea’s TVL increased by 420%, while Base’s increased by 44%.

Total value locked in DeFi is declining. Source: DappRadar

DappRadar has issued a warning, suggesting that the sharp rise in daily unique active wallets (dUAW) may not last. “Airdrop farming,” where users engage in activities to earn airdropped tokens, was partially responsible for the surge. This surge was caused in part by the June airdrops of Blast and zkSync. DappRadar highlighted the need for improved user experiences, solid development strategies, and strong teams for long-term growth.

The Web3 sector continues to be plagued by security issues. Security breaches cost $430 million in losses in Q2 2024, a 5% increase from Q1. With about 28% of the events each, ethereum and BNB Chain were the most affected. In 8% of the cases, Solana had some involvement. Although they only accounted for 23% of the incidents, access control issues were responsible for 75% of all the money lost.

Final Thoughts

Q2 2024 was a significant milestone for Web3 user engagement. The industry saw substantial growth in social DApps, nfts, and decentralized exchanges. However, challenges remain in sustaining growth and addressing security concerns. The future success of the Web3 ecosystem depends on focusing on user experience, robust development, and strong security.

NEWSLETTER

NEWSLETTER